Returnable Packaging Market Size to Worth USD 208.56 Bn by 2033

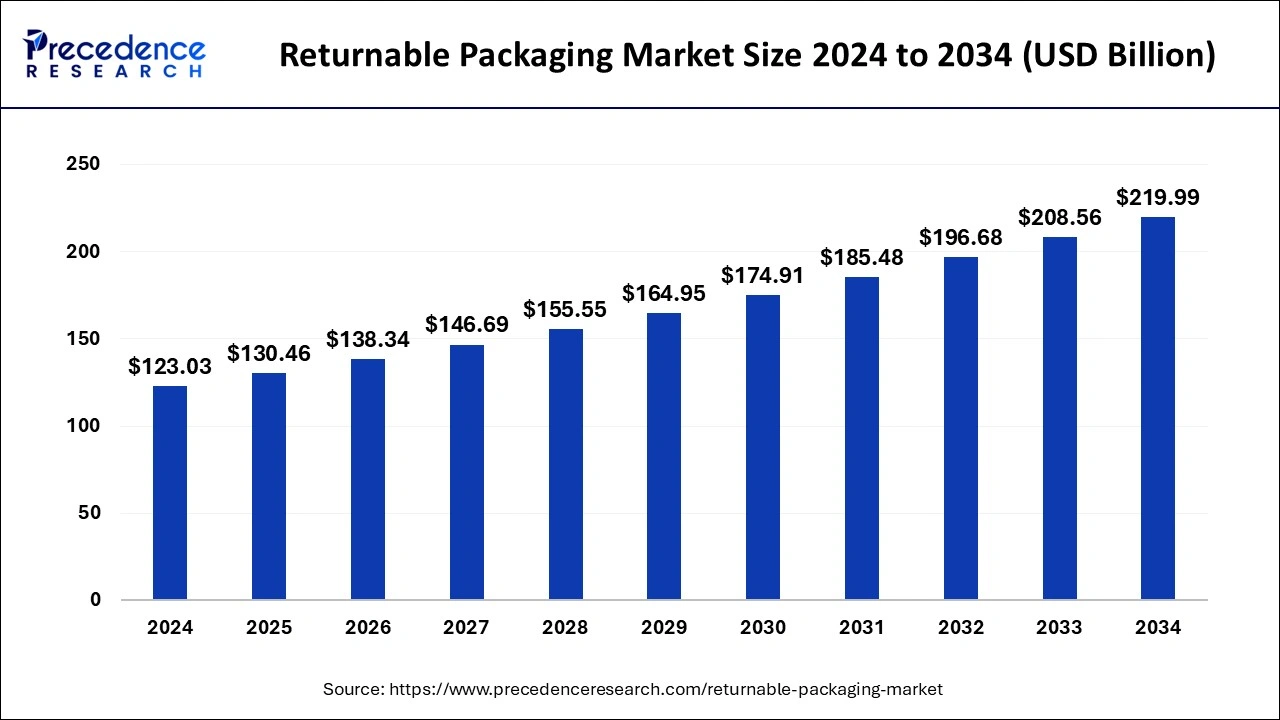

The global returnable packaging market size is expected to increase USD 208.56 billion by 2033 from USD 116.02 billion in 2023 with a CAGR of 6.04% between 2024 and 2033.

Key Points

- Asia Pacific dominated the returnable packaging market with the largest revenue share of 38% in 2023.

- By material, the plastic segment has contributed more than 64% of revenue share in 2023.

- By material, the metal segment is expected to grow at the highest CAGR of 6.71% during the forecast period.

- By product, the pallets segment accounted for the major revenue share of 58% in 2023.

- By product, the IBC segment is projected to grow at the highest CAGR of 7.15% during the forecast period.

- By end-use, the food & beverage segment has held the biggest revenue share of 36% in 2023.

- By end-use, the healthcare segment is expected to expand at the solid CAGR of 6.92% during the forecast period.

Returnable packaging, also known as reusable packaging, refers to packaging solutions that are designed for multiple uses and extended life cycles. These packaging solutions are constructed from durable materials such as plastic, metal, or wood, enabling them to withstand repeated use. Returnable packaging is primarily used in various industries, including automotive, food and beverages, pharmaceuticals, and consumer goods, among others. The market for returnable packaging is growing due to the increasing emphasis on sustainability and cost efficiency.

The global returnable packaging market has witnessed significant growth over the past decade, driven by the increasing demand for sustainable packaging solutions that reduce environmental impact. As businesses and consumers alike become more environmentally conscious, the adoption of returnable packaging solutions has surged. The market encompasses a wide range of products, including pallets, crates, drums, racks, and intermediate bulk containers (IBCs), each tailored to meet the specific needs of different industries.

Get a Sample: https://www.precedenceresearch.com/sample/4601

Growth Factors

Environmental Sustainability

One of the primary growth factors for the returnable packaging market is the increasing emphasis on environmental sustainability. Returnable packaging significantly reduces waste generation compared to single-use packaging, making it an attractive option for businesses looking to minimize their environmental footprint. Governments and regulatory bodies worldwide are also promoting sustainable packaging practices, further driving the adoption of returnable packaging solutions.

Cost Efficiency

Returnable packaging offers substantial cost savings over time. Although the initial investment in durable packaging materials may be higher, the long-term savings from reduced material and disposal costs make returnable packaging a cost-effective solution. Companies can reuse the packaging multiple times, leading to a lower total cost of ownership. Additionally, returnable packaging can help reduce the costs associated with waste management and disposal.

Increasing Industrialization and Global Trade

The growth of industrialization and global trade has also contributed to the expansion of the returnable packaging market. As industries expand and supply chains become more complex, the need for efficient and reliable packaging solutions increases. Returnable packaging provides a robust and durable option for transporting goods, ensuring that products reach their destinations in optimal condition.

Technological Advancements

Technological advancements in packaging materials and design have further fueled the growth of the returnable packaging market. Innovations in materials such as high-density polyethylene (HDPE) and polypropylene have enhanced the durability and performance of returnable packaging solutions. Additionally, advancements in tracking and tracing technologies, such as RFID and IoT, have improved the management and monitoring of returnable packaging assets, making them more attractive to businesses.

Regional Insights

North America is a significant market for returnable packaging, driven by the presence of major industries such as automotive, food and beverages, and pharmaceuticals. The region’s focus on sustainability and stringent regulatory frameworks have encouraged the adoption of returnable packaging solutions. Additionally, the well-established logistics and transportation infrastructure in North America supports the efficient movement and management of returnable packaging assets.

Europe is another prominent market for returnable packaging, characterized by a strong emphasis on environmental sustainability and circular economy principles. The European Union’s regulations and directives aimed at reducing packaging waste and promoting recycling have spurred the adoption of returnable packaging solutions. Countries such as Germany, France, and the UK are leading the way in implementing sustainable packaging practices.

The Asia-Pacific region is experiencing rapid growth in the returnable packaging market, driven by increasing industrialization, urbanization, and rising consumer awareness about sustainability. Countries like China, India, and Japan are witnessing significant investments in manufacturing and logistics infrastructure, which is boosting the demand for returnable packaging. Additionally, the growing e-commerce sector in the region is driving the need for efficient and sustainable packaging solutions.

Returnable Packaging Market Scope

| Report Coverage | Details |

| Market Size by 2033 | USD 208.56 Billion |

| Market Size in 2023 | USD 116.02 Billion |

| Market Size in 2024 | USD 123.03 Billion |

| Market Growth Rate from 2024 to 2033 | CAGR of 6.04% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Material, Product, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Returnable Packaging Market Dynamics

Drivers

Growing Awareness of Environmental Issues

The increasing awareness of environmental issues among consumers and businesses is a significant driver for the returnable packaging market. As concerns about plastic pollution and waste generation continue to rise, companies are seeking sustainable packaging solutions that align with their environmental goals. Returnable packaging offers a viable alternative to single-use packaging, reducing the amount of waste generated and promoting a circular economy.

Regulatory Support

Government regulations and policies aimed at reducing packaging waste and promoting recycling are driving the adoption of returnable packaging solutions. Regulatory bodies in various regions are implementing stringent guidelines to minimize the environmental impact of packaging materials. These regulations are encouraging businesses to adopt sustainable packaging practices, including the use of returnable packaging.

Opportunities

Expansion into New Industries

The returnable packaging market has significant opportunities for expansion into new industries. While the automotive, food and beverages, and pharmaceuticals sectors are the primary users of returnable packaging, other industries such as electronics, retail, and agriculture are also exploring the benefits of reusable packaging solutions. Expanding the adoption of returnable packaging across various industries can drive market growth and create new revenue streams.

Technological Advancements

Advancements in technology present opportunities for the returnable packaging market. Innovations in materials, such as biodegradable and compostable polymers, can enhance the sustainability and performance of returnable packaging solutions. Additionally, the integration of smart technologies, such as RFID and IoT, can improve the tracking and management of returnable packaging assets, providing real-time visibility and enhancing supply chain efficiency.

Customization and Branding

The ability to customize returnable packaging solutions to meet specific customer requirements presents significant opportunities for market growth. Companies can tailor the design, size, and features of returnable packaging to align with their unique needs and branding strategies. Customizable returnable packaging not only enhances the functionality and efficiency of packaging but also serves as a powerful branding tool, reinforcing brand identity and increasing customer loyalty.

Challenges

Initial Investment Costs

One of the primary challenges for the returnable packaging market is the initial investment cost. The upfront costs associated with purchasing durable and reusable packaging materials can be higher compared to single-use packaging. This initial investment can be a barrier for small and medium-sized enterprises (SMEs) with limited budgets. However, it is important to note that the long-term cost savings and environmental benefits of returnable packaging can outweigh the initial investment.

Management and Logistics

Managing and coordinating the return of empty packaging can be a logistical challenge for businesses. Efficient reverse logistics systems are required to ensure the timely return of packaging assets, minimize the risk of loss or damage, and optimize the reuse cycle. Implementing effective tracking and tracing technologies, such as RFID and IoT, can help address these challenges by providing real-time visibility and enhancing asset management.

Read Also: Premium Bottled Water Market Size to Worth USD 40.89 Bn by 2033

Returnable Packaging Market Companies

- ORBIS Corporation

- NEFAB GROUP

- PPS Midlands Limited

- Tri-pack Packaging Systems Ltd.

- Amatech, Inc.

- CHEP

- Celina

- UBEECO Packaging Solutions

- RPR Inc.

- RPP Containers

- IPL, Inc.

- Schoeller Allibert

Recent Developments

- In April 2024, a returnable six-pack of beer was created by Carrefour Belgium, Cornet Beer, and DW Reusables. The pack, which was introduced with the help of Living Lab and VLAIO, is fully brandable and returnable using TOMRA’s reverse vending machines. The six-bottle packs are stated to provide the same level of shopping ease as single-use packs, with fewer product handling, quick replenishment, and optimal shelf space, all kept on merchant shelves.

- In January 2024, a major step towards a circular economy was taken with the opening of the National Wash Network’s extensive infrastructure to support the reusable food packaging scheme across Canada. The goal of this program is to enable food service companies, both domestic and international, to switch from single-use to reusable packaging.

- In October 2023, the European Packaging and Packaging Waste Regulation that prioritizes the development of a circular economy, with returnable bottles at its core demanded returnable packaging and refillable manufacturing lines over a food-grade bottle-to-bottle process is rising as a result of the goal of 25% of bottles being reused by 2040.

Segment Covered in the Report

By Material

- Plastic

- Metal

- Wood

By Product

- Pallets

- Crates

- IBCs

- Drums & Barrels

- Dunnage

- Others

By End-use

- Food & Beverage

- Automotive

- Consumer Durables

- Healthcare

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/