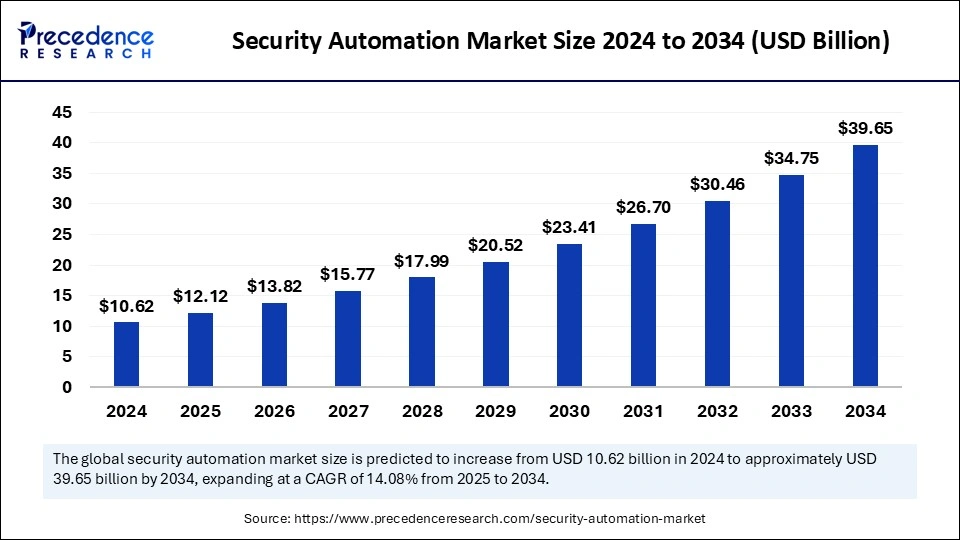

Security Automation Market is projected to reach USD 39.65 billion by 2034

The security automation market size is expected to grow from USD 10.62 billion in 2024 to nearly USD 39.65 billion by 2034, with a CAGR of 14.08%.

Security Automation Market Key Insights

- North America dominated the security automation market with the largest share of 36% in 2024.

- Asia Pacific is expected to grow at the fastest CAGR of 15% in the market during the forecast period.

- By offering, the solutions segment contributed the biggest market share of 65% in 2024.

- By offering, the services segment is likely to grow at the highest CAGR over the studied period.

- By deployment mode, the cloud segment held the largest share of the market in 2024.

- By deployment mode, the on-promise segment is anticipated to witness significant growth in the coming years.

- By application, the endpoint security segment led the security automation market in 2024.

- By application, the incident response management segment is expected to show significant growth throughout the forecast period.

- By code type, the full code segment led the market with the largest share in 2024.

- By code type, the no code segment is projected to expand at the highest CAGR over the studied period.

- By vertical, the BSFI segment held the largest market share in 2024.

- By vertical, the healthcare and life sciences segment is expected to expand rapidly during the forecast period.

- By technology, the AI & ML segment led the market in 2024.

- By technology, the UEBA (User Behavior & Entity Behavior Analytics) segment is anticipated to grow at a significant rate in the coming years.

The security automation market is experiencing rapid growth as organizations increasingly adopt automated security solutions to combat the evolving landscape of cyber threats. With the rise of cyberattacks, data breaches, and complex IT environments, businesses are integrating security automation tools to enhance threat detection, streamline incident response, and reduce human errors in cybersecurity operations. The growing reliance on cloud computing, artificial intelligence (AI), and machine learning (ML) in security frameworks is further fueling the market’s expansion.

As of 2024, the global security automation market is valued at USD 10.62 billion and is projected to reach approximately USD 39.65 billion by 2034, growing at a CAGR of 14.08%. The increasing adoption of security orchestration, automation, and response (SOAR) solutions, coupled with the demand for advanced threat intelligence, is driving investments in this sector. Organizations across various industries, including banking, healthcare, retail, and government agencies, are prioritizing security automation to strengthen their defense mechanisms against sophisticated cyber threats.

The need for compliance with stringent data security regulations, such as GDPR, CCPA, and ISO 27001, is pushing enterprises to automate security processes to ensure compliance and mitigate risks. Automation reduces response time to security incidents, enhances real-time threat detection, and minimizes operational costs, making it an essential component of modern cybersecurity strategies. With the rise in remote work, the proliferation of IoT devices, and the growing complexity of cyberattacks, security automation is becoming a critical investment for organizations worldwide.

Sample Link: https://www.precedenceresearch.com/sample/5713

Market Drivers

The increasing frequency and sophistication of cyber threats are major drivers of the security automation market. Cybercriminals are leveraging AI-driven attacks, ransomware, and phishing schemes to infiltrate networks, making traditional security measures inadequate. Organizations are turning to automated security solutions that provide real-time threat detection, automated response mechanisms, and proactive risk management to stay ahead of cyber adversaries.

Another key driver is the rising adoption of cloud-based security solutions. With enterprises shifting to cloud computing, there is a growing demand for security automation tools that can safeguard cloud environments, detect anomalies, and prevent data breaches. Cloud security automation helps organizations maintain security policies, enforce access controls, and monitor threats without manual intervention, improving efficiency and scalability.

Regulatory compliance is also playing a crucial role in market growth. Governments and regulatory bodies worldwide have imposed strict cybersecurity laws that require organizations to implement robust security frameworks. Compliance with HIPAA, PCI DSS, SOC 2, and other regulations has led to increased adoption of automated security monitoring, identity access management (IAM), and security analytics solutions.

The integration of AI and machine learning in security automation is revolutionizing the way organizations detect and respond to cyber threats. AI-driven security solutions can analyze vast amounts of data, identify patterns, and predict potential attacks, allowing organizations to take proactive measures. Machine learning algorithms help automate threat hunting, vulnerability assessment, and security patch management, reducing the workload on security teams.

Opportunities

The increasing adoption of zero-trust security architecture presents a significant growth opportunity for the security automation market. Organizations are shifting from traditional perimeter-based security models to zero-trust frameworks that require continuous authentication and verification of users and devices. Security automation plays a vital role in implementing zero-trust policies by enabling real-time monitoring, automated access controls, and policy enforcement.

The expansion of the Internet of Things (IoT) ecosystem is another promising opportunity. As businesses and consumers deploy more connected devices, the risk of cyberattacks targeting IoT networks is rising. Security automation solutions can help mitigate these risks by automatically detecting vulnerabilities, monitoring network traffic, and responding to suspicious activities in real-time. The increasing deployment of IoT in industries such as healthcare, manufacturing, and smart cities is driving demand for automated security solutions.

The rise of managed security services (MSS) is also creating new opportunities in the market. Small and medium-sized enterprises (SMEs) often lack the resources to maintain in-house security operations centers (SOCs). Managed security service providers (MSSPs) are offering security automation-as-a-service, allowing organizations to outsource security monitoring, threat intelligence, and incident response. This trend is expected to accelerate as more companies seek cost-effective security solutions.

Challenges

Despite its rapid growth, the security automation market faces several challenges, including integration complexities and high initial investment costs. Many organizations operate in hybrid IT environments with legacy systems that may not be compatible with modern security automation solutions. Integrating automation tools with existing security infrastructure can be time-consuming and costly, limiting adoption.

The shortage of skilled cybersecurity professionals is another major challenge. While security automation reduces the burden on security teams, it still requires expert oversight, fine-tuning, and continuous monitoring. Organizations struggle to find professionals with expertise in AI-driven security operations, threat intelligence, and automated incident response, hindering the full implementation of automation solutions.

Concerns regarding false positives and automated decision-making also pose challenges. Security automation tools rely on algorithms to detect and respond to threats, but they are not immune to errors. False positives can lead to unnecessary security alerts, while false negatives can result in undetected cyber threats. Ensuring the accuracy and reliability of automation tools remains a critical challenge for security vendors.

Regional Insights

North America dominates the security automation market, driven by the presence of leading cybersecurity vendors, high awareness of cyber threats, and strict regulatory frameworks. The United States, in particular, has seen a surge in cybersecurity investments across industries such as finance, healthcare, and government. The implementation of laws such as the Cybersecurity Maturity Model Certification (CMMC) for defense contractors has further fueled demand for automated security solutions.

Europe is another key market, with countries like Germany, the UK, and France prioritizing cybersecurity initiatives. The enforcement of the General Data Protection Regulation (GDPR) has compelled businesses to adopt security automation tools to ensure compliance and protect user data. The increasing frequency of cyberattacks targeting European enterprises is accelerating the adoption of automated threat detection and incident response solutions.

The Asia-Pacific region is witnessing significant growth, fueled by digital transformation, cloud adoption, and increasing cyber threats. Countries like China, India, Japan, and South Korea are investing heavily in cybersecurity infrastructure to combat the rising number of data breaches and ransomware attacks. The expansion of e-commerce, fintech, and smart city initiatives in the region is driving demand for security orchestration and AI-powered security automation tools.

Latin America and the Middle East & Africa are emerging markets with growing potential. Governments in these regions are strengthening cybersecurity regulations, leading to increased adoption of automated security platforms. The growing reliance on cloud services, the expansion of digital banking, and rising concerns over data privacy are contributing to market growth. While still in the early stages, investments in cybersecurity infrastructure and managed security services are expected to drive future expansion.

Read Also: Robotics Technology Market

Market Companies

- Cisco Systems, Inc.

- CrowdStrike

- CyberArk Software Ltd.

- IBM Corporation

- Palo Alto Networks

- Red Hat, Inc.

- Secureworks, Inc.

- Splunk Inc.

- Swimlane Inc.

- Tufin

Recent Developments

The security automation industry has witnessed several notable developments, including the rise of AI-driven security solutions. Cybersecurity vendors are leveraging artificial intelligence to enhance threat intelligence, automate incident response, and improve security analytics. The deployment of machine learning-based security information and event management (SIEM) systems is helping organizations detect and respond to threats more efficiently.

The increasing adoption of zero-trust security models is reshaping the market. Organizations are implementing security automation tools to enforce continuous authentication, identity verification, and real-time access controls. Companies like Microsoft, Google, and Palo Alto Networks are investing in zero-trust architecture to provide organizations with enhanced security solutions.

The merger and acquisition landscape in the security automation market is also evolving. Major cybersecurity firms are acquiring smaller startups specializing in security orchestration, AI-driven threat detection, and cloud security automation. Strategic partnerships between cybersecurity providers, cloud service providers, and enterprise IT vendors are fostering innovation and expanding market reach.

The security automation market is set for significant growth, driven by the rising sophistication of cyber threats, advancements in AI-powered security solutions, and increasing regulatory requirements. While challenges such as integration complexities and workforce shortages remain, the industry is evolving with zero-trust security models, managed security services, and IoT-driven automation. As organizations continue to prioritize cybersecurity, the demand for automated security solutions will continue to rise, shaping the future of digital defense strategies.

Segments Covered in the Report

By Offering

- Solutions

- SOAR

- XDR

- SIEM

- Services

- Professional Services

- Managed Services

By Deployment Mode

- Cloud

- On-premises

By Application

- Network Security

- Firewall Management

- Intrusion Detection & Prevention System

- Network Traffic Analysis

- Network Access Control

- Others

- Endpoint Security

- Threat Detection and Prevention

- Configuration Management

- Malware Detection and Protection

- Phishing and Email Protection

- Others

- Incident Response Management

- Incident Triage and Escalation

- Evidence Gathering

- Incident Categorization and Prioritization

- Workflow Orchestration

- Others

- Vulnerability Management

- Prioritization

- Vulnerability Scanning and Assessment

- Patch Management and Remediation

- Vulnerability Remediation and Ticketing

- Others

- Identity & Access Management

- Single Sign On (SSO)

- User Provisioning and Deprovisioning

- Access Policy Enforcement

- Multi-factor Authentication

- Others

- Compliance & Policy Management

- Automated Compliance Auditing

- Audit Trail Generation

- Regulatory Compliance Reporting

- Policy Enforcement Automation

- Others

- Data Protection & Encryption

- Encryption Key Management

- Data Loss Prevention

- File and Database Encryption

- Others

By Code Type

- No Code

- Low Code

- Full Code

By Vertical

- Manufacturing

- BFSI

- Healthcare & Life Sciences

- Media & Entertainment

- Energy & Utilities

- Retail & E-commerce

- Government & Defense

- IT & ITES

- Others

By Technology

- AI & ML

- Predictive Analytics

- Robotic Process Automation (RPA)

- User & Entity Behavior Analytics (UEBA)

- Others

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- MEA