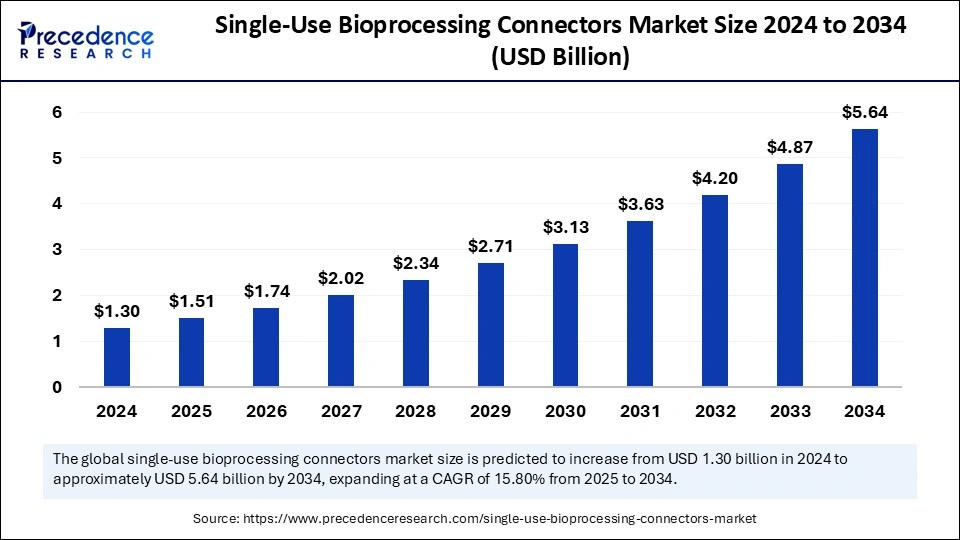

Single-Use Bioprocessing Connectors Market Set to Reach USD 5.64 Billion by 2034

The global single-use bioprocessing connectors market is expected to rise from USD 1.30 billion in 2024 to nearly USD 5.64 billion by 2034, reflecting a 15.80% CAGR.

Single-Use Bioprocessing Connectors Market Key Insights

- North America led the market by holding the largest market share of 48% in 2024.

- Asia Pacific is expected to grow at the fastest CAGR of 17% over the forecast period.

- By product, the aseptic connectors segment held a major market share of 66% in 2024.

- By product, the conventional connectors segment is anticipated to grow at the fastest rate over the forecast period.

- By application, the upstream bioprocessing segment contributed the highest market share of 46% in 2024.

- By end use, the biopharmaceutical and pharmaceutical companies segment held the largest market share of 45% in 2024.

- By end use, the CMOs and CROs segment is projected to grow at the fastest rate during the forecast period.

The global single-use bioprocessing connectors market is experiencing significant growth due to the increasing adoption of disposable bioprocessing systems in the pharmaceutical and biotechnology industries. Single-use bioprocessing connectors are essential components in biopharmaceutical manufacturing, enabling sterile connections and disconnections of fluid transfer systems. These connectors provide enhanced operational flexibility, reduce contamination risks, and minimize downtime compared to traditional stainless-steel systems. The rising demand for biologics, vaccines, and cell and gene therapies has further fueled the need for efficient and cost-effective single-use technologies. The market is projected to expand at a substantial rate, driven by advancements in bioprocessing techniques and increasing investments in biopharmaceutical production.

Sample Link: https://www.precedenceresearch.com/sample/5679

Market Drivers

One of the primary drivers of the single-use bioprocessing connectors market is the growing biopharmaceutical industry. With an increasing number of biologics and biosimilars being developed, pharmaceutical companies are shifting toward single-use technologies to enhance production efficiency and ensure product sterility. The need for faster production timelines and reduced cleaning and validation requirements further accelerate the adoption of single-use bioprocessing connectors. Additionally, the rise in personalized medicine and cell therapy research has increased the demand for modular and scalable manufacturing solutions, where single-use systems play a crucial role.

Regulatory support from agencies like the FDA and EMA for single-use technologies in biopharmaceutical manufacturing also strengthens market growth. Moreover, the emphasis on reducing manufacturing costs and operational complexities is pushing companies to invest in innovative single-use solutions.

Opportunities

The increasing adoption of automation and digitalization in bioprocessing presents a significant opportunity for the single-use bioprocessing connectors market. As biopharmaceutical manufacturers seek greater process control and efficiency, integrating automation into single-use systems enhances workflow standardization and reduces human errors. Emerging markets in Asia-Pacific, including China and India, offer immense growth potential due to expanding biopharmaceutical industries and government initiatives supporting local drug production. The demand for advanced single-use bioprocessing technologies in research institutions and contract manufacturing organizations (CMOs) is also creating new opportunities for market players.

Additionally, advancements in material science and the development of high-performance polymers for single-use connectors are expected to improve product durability and compatibility with various bioprocessing fluids. Companies investing in eco-friendly and recyclable single-use systems may also gain a competitive advantage as sustainability becomes a key focus in the industry.

Challenges

Despite its rapid growth, the single-use bioprocessing connectors market faces several challenges. One of the major concerns is the environmental impact of disposable bioprocessing systems. The accumulation of plastic waste from single-use components raises sustainability concerns, prompting companies to develop biodegradable alternatives. Additionally, the risk of extractable and leachable from single-use materials into biopharmaceutical products poses a challenge to product safety and regulatory compliance. Ensuring the compatibility of single-use connectors with different bioprocessing fluids and maintaining consistent quality across batches are other key challenges.

Supply chain disruptions, particularly during global crises such as the COVID-19 pandemic, have highlighted vulnerabilities in raw material sourcing and production continuity. Furthermore, the initial costs of transitioning from traditional stainless-steel systems to single-use technologies may deter smaller biopharmaceutical companies from adopting these solutions.

Regional Insights

North America dominates the single-use bioprocessing connectors market, driven by a well-established biopharmaceutical industry, strong research and development infrastructure, and high adoption rates of single-use technologies. The presence of major biopharma companies and contract manufacturers in the region further fuels market growth. The U.S. remains a key contributor, with regulatory bodies such as the FDA supporting advancements in single-use bioprocessing. Europe is also a significant market, with countries like Germany, France, and the U.K. investing in biotechnology and biomanufacturing capabilities. The increasing focus on biosimilar production and regulatory initiatives promoting single-use technologies are boosting market demand in the region.

The Asia-Pacific region is witnessing the fastest growth, supported by rising investments in biopharmaceutical production, government initiatives to strengthen local drug manufacturing, and increasing demand for cost-effective bioprocessing solutions. China and India are emerging as major hubs for biopharmaceutical manufacturing, with a growing presence of CMOs and CDMOs (Contract Development and Manufacturing Organizations) adopting single-use technologies. Additionally, Japan and South Korea are contributing to market expansion with advanced research facilities and strong regulatory frameworks.

Latin America and the Middle East & Africa are gradually embracing single-use bioprocessing, with increasing investments in healthcare infrastructure and biologics manufacturing. While market penetration in these regions remains lower than in North America and Europe, the growing demand for affordable and efficient bioprocessing solutions is expected to drive adoption.

Read Also: Healthcare Service Robots Market

Market Companies

The single-use bioprocessing connectors market has witnessed several significant developments in recent years. Leading bioprocessing companies are actively launching innovative products to meet the evolving needs of the biopharmaceutical industry. For instance, advancements in sterile connection technologies have led to the introduction of next-generation connectors with improved sealing properties and enhanced compatibility with various bioprocessing fluids. Collaborations and partnerships between biopharmaceutical manufacturers and single-use technology providers have also increased, aiming to streamline production workflows and improve scalability.

In 2023, several key players expanded their production capabilities to address the growing demand for single-use bioprocessing solutions. Companies like Sartorius, Thermo Fisher Scientific, and Merck KGaA have announced strategic investments in new manufacturing facilities and research centers dedicated to single-use technologies. Additionally, sustainability initiatives have gained momentum, with industry leaders exploring biodegradable materials and recycling programs to mitigate environmental concerns.

Regulatory agencies have been actively updating guidelines to ensure the safe and efficient use of single-use bioprocessing systems in drug manufacturing. The FDA and EMA have provided recommendations on the validation and qualification of single-use components, addressing concerns related to extractables, leachables, and sterility assurance.

Looking ahead, the market is expected to witness further innovations, including the integration of smart sensors and IoT-enabled single-use connectors for real-time process monitoring and quality control. As biopharmaceutical manufacturers continue to prioritize efficiency and flexibility, the adoption of single-use bioprocessing connectors is projected to remain on an upward trajectory.

Segments Covered in the Report

By Product

- Aseptic Connectors

- Conventional Connectors

By Application

- Upstream Bioprocessing

- Downstream Bioprocessing

- Fill-finish Operations

By End Use

- Biopharmaceutical & Pharmaceutical Companies

- CROs & CMOs

- Academic & Research Institutes

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa