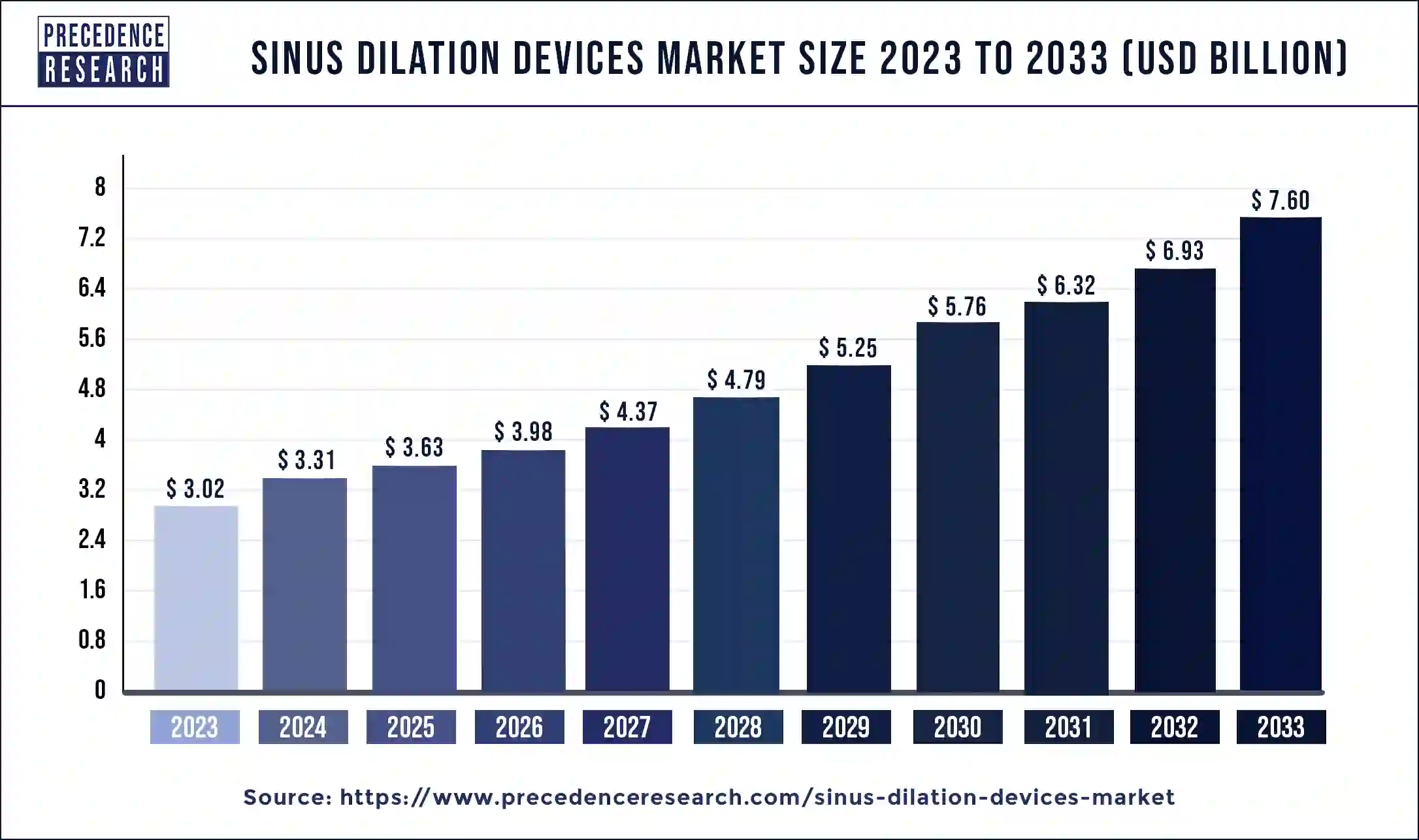

Sinus Dilation Devices Market Size to Worth USD 7.60 Bn by 2033

The global sinus dilation devices market size is expected to increase USD 7.60 billion by 2033 from USD 3.02 billion in 2023, with a CAGR of 9.67% between 2024 and 2033.

Key Points

- The North America sinus dilation devices market size accounted for USD 1.27 billion in 2023 and is expected to attain around USD 3.23 billion by 2033, poised to grow at a CAGR of 9.78% between 2024 and 2033.

- North America dominated the market with the largest revenue share of 42% in 2023.

- Asia Pacific is expected to expand at the fastest CAGR of 10.42% over the forecast period.

- By product, the balloon sinus dilation devices segment has held a major revenue share of 47% in 2023.

- By product, the functional endoscopic sinus surgery (FESS) instruments set segment is expected to grow at a notable rate in the market during the forecast period.

- By type, the sinuscopes segment dominated the market with the largest revenue share of 62% in 2023.

- By procedure, the standalone segment has held a major revenue share of 67% in 2023.

- By procedure, the hybrid segment is expected to grow at a highest CAGR of 10.52% during the forecast period.

- By patient, the adult segment has contributed more than 68% of revenue share in 2023.

- By patient, the pediatric segment is expected to grow at a solid CAGR of 10.23% during the forecast period.

- By end-use, the hospitals segment has recorded more than 52% of revenue share in 2023.

- By end-use, the ambulatory surgical centers segment is expected to grow at the highest rate in the market during the forecast period.

The sinus dilation devices market is experiencing significant growth due to several key factors. One major factor is the increasing prevalence of chronic sinusitis and other sinus-related conditions globally. Additionally, advancements in technology have led to the development of more effective and minimally invasive sinus dilation devices, driving adoption rates among patients and healthcare providers. Moreover, rising awareness about the benefits of minimally invasive procedures and the growing demand for outpatient treatments further contribute to market growth.

Get a Sample: https://www.precedenceresearch.com/sample/4411

Region Insights

The sinus dilation devices market exhibits variations in growth and adoption rates across different regions. Developed regions such as North America and Europe tend to have higher adoption rates due to well-established healthcare infrastructure, higher healthcare spending, and greater awareness about sinus-related conditions. In contrast, emerging economies in Asia-Pacific and Latin America are witnessing rapid growth in the sinus dilation devices market, driven by improving healthcare infrastructure, rising disposable incomes, and increasing access to healthcare services.

Sinus Dilation Devices Market Scope

| Report Coverage | Details |

| Sinus Dilation Devices Market Size in 2023 | USD 3.02 Billion |

| Sinus Dilation Devices Market Size in 2024 | USD 3.31 Billion |

| Sinus Dilation Devices Market Size by 2033 | USD 7.60 Billion |

| Sinus Dilation Devices Market Growth Rate | CAGR of 9.67% from 2024 to 2033 |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Product, Type, Procedure, Patient, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Sinus Dilation Devices Market Dynamics

Drivers:

Several factors are driving the growth of the sinus dilation devices market. One of the primary drivers is the increasing prevalence of chronic sinusitis and other sinus-related conditions, fueled by factors such as air pollution, allergies, and anatomical factors. Additionally, the growing preference for minimally invasive procedures over traditional surgeries, owing to shorter recovery times and reduced risks, is driving the adoption of sinus dilation devices. Moreover, technological advancements leading to the development of more efficient and user-friendly devices are further propelling market growth.

Opportunities:

The sinus dilation devices market presents several opportunities for growth and expansion. One key opportunity lies in expanding market penetration in emerging economies where there is a growing demand for minimally invasive treatment options. Moreover, strategic collaborations and partnerships between medical device manufacturers and healthcare providers can help enhance product development and distribution networks, tapping into new market segments. Furthermore, ongoing research and development efforts aimed at improving the efficacy and safety of sinus dilation devices present opportunities for innovation and market differentiation.

Challenges:

Despite the promising growth prospects, the sinus dilation devices market faces certain challenges. One significant challenge is the high cost associated with these devices, which may limit access for patients in certain regions or socio-economic groups. Regulatory hurdles and stringent approval processes for new devices also pose challenges for market players, delaying product launches and market entry. Additionally, limited reimbursement policies for sinus dilation procedures in some healthcare systems may hinder market growth. Moreover, competition from alternative treatment options such as medication and traditional sinus surgeries adds to the challenges faced by market players.

Read Also: Rare Diseases Treatment Market Size to Worth USD 488.76 Bn by 2033

Sinus Dilation Devices Market Recent Developments

- In March 2024, University Medical Devices Raised $1.6M to Launch the MicroWash Device for Nasal Specimen Collection. University Medical Devices (UMD) closed a $1.6M round of seed funding to bring its first product, MicroWash, to market. The device provides a more effective method of nasal specimen collection compared to nasal swabs to diagnose respiratory illness, including COVID-19.

- In December 2022, DKSH Business Unit Healthcare, an organization that helps healthcare companies seeking to grow their business in Asia, has agreed to bring Nuance Pharma’s Bentrio nasal spray to Hong Kong and Macau (the Macao Special Administrative Region of the People’s Republic of China).

- In February 2022, Medtronic plc (NYSE: MDT), a global leader in healthcare technology, launched the NuVent™ Eustachian tube dilation balloon, which has been cleared by the U.S. Food and Drug Administration (FDA) for the treatment of chronic, obstructive Eustachian Tube Dysfunction.

Sinus Dilation Devices Market Companies

- Smith+Nephew

- Stryker

- Intersect ENT, Inc

- Olympus Corporation

- SinuSys Corporation

- Johnson & Johnson Services, Inc.

- TE Connectivity

- InnAccel Technologies Pvt Ltd

Segment Covered in the Report

By Product

- Balloon Sinus Dilation Devices

- Endoscopes

- Sinus Stents/Implants

- Functional Endoscopic Sinus Surgery (FESS) Instruments Set

- Others

By Type

- Sinuscopes

- Rhinoscopes

By Procedure

- Standalone

- Hybrid

By Patient

- Adult

- Pediatric

By End-use

- Hospitals

- Ambulatory Surgical Centers

- Ent Clinics/in Office

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/