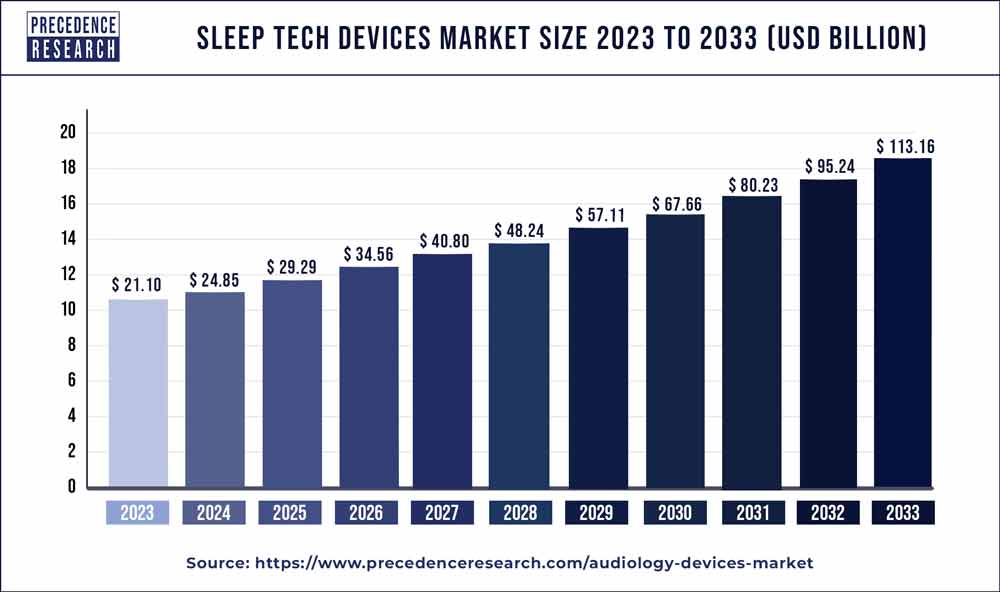

Sleep Tech Devices Market Size to Worth USD 113.16 Bn by 2033

The global sleep tech devices market size was valued at USD 21.10 billion in 2023 and is projected to rake around USD 113.16 billion by 2033, growing at a CAGR of 18.23% from 2024 to 2033.

Key Points

- North America has held a revenue share of around 42.7% in 2023.

- By product, the wearables segment held the largest share of around 76% in 2023. The segment is observed to sustain the dominance throughout the forecast period.

- By application, the insomnia segment dominated the sleep tech devices market with revenue share of 48% in 2023.

- By distribution channel, the sleep centers and fitness centers segment stood as a dominating share of the market in 2023.

The Sleep Tech Devices Market has witnessed significant growth in recent years, driven by increasing awareness about the importance of sleep for overall health and well-being. Sleep technology devices encompass a wide range of products designed to monitor, analyze, and improve sleep quality, including wearable devices, smart mattresses, sleep trackers, and smart sleep lights. These devices offer users insights into their sleep patterns, helping them identify factors affecting their sleep and make necessary adjustments for better rest.

The market for sleep tech devices is fueled by several factors, including rising prevalence of sleep disorders such as insomnia, sleep apnea, and restless leg syndrome. Additionally, growing adoption of digital health technologies and increasing emphasis on preventive healthcare measures have contributed to the expanding demand for sleep tech devices. Moreover, advancements in sensor technology, artificial intelligence, and machine learning algorithms have enhanced the capabilities of these devices, making them more accurate and user-friendly.

Get a Sample: https://www.precedenceresearch.com/sample/3911

Growth Factors

Several factors are driving the growth of the sleep tech devices market. Firstly, the growing awareness about the importance of sleep in maintaining overall health and well-being has led to increased consumer interest in monitoring and improving sleep quality. Furthermore, the rising prevalence of sleep disorders, coupled with the growing elderly population, has created a significant demand for innovative solutions to address sleep-related issues.

Moreover, the integration of sleep tracking features into wearable devices such as smartwatches and fitness trackers has expanded the reach of sleep tech devices among consumers. These devices offer convenience and real-time monitoring, allowing users to track their sleep patterns without the need for additional equipment. Additionally, the emergence of smart home technology has led to the development of connected sleep solutions, enabling users to control their sleep environment for optimal comfort and rest.

Sleep Tech Devices Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 18.23% |

| Global Market Size in 2023 | USD 21.10 Billion |

| Global Market Size by 2033 | USD 113.16 Billion |

| U.S. Market Size in 2023 | USD 8.65 Billion |

| U.S. Market Size by 2033 | USD 38.46 Billion |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Product, By Application, and By Distribution Channel |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Region Insight

The sleep tech devices market is witnessing robust growth across various regions, with North America leading the market share due to high adoption rates of digital health technologies and increasing awareness about sleep disorders. The region is home to several key players in the sleep tech industry, driving innovation and technological advancements.

Europe is also a significant market for sleep tech devices, fueled by growing healthcare expenditure and rising prevalence of sleep disorders. Countries such as Germany, the UK, and France are witnessing increasing demand for sleep monitoring and management solutions, driving market growth in the region.

Asia Pacific is expected to emerge as a lucrative market for sleep tech devices, driven by rapid urbanization, changing lifestyles, and increasing disposable income. Countries like China, Japan, and India are witnessing growing awareness about sleep health, creating opportunities for market expansion in the region.

Trends:

The sleep tech devices market is witnessing several trends that are shaping the industry landscape. One notable trend is the integration of artificial intelligence (AI) and machine learning algorithms into sleep tracking devices. These technologies enable more accurate sleep analysis and personalized recommendations for improving sleep quality.

Another trend is the emphasis on user experience and design aesthetics in sleep tech devices. Manufacturers are focusing on developing sleek, minimalist designs that blend seamlessly into the bedroom environment, enhancing user satisfaction and adoption.

Furthermore, there is a growing trend towards wearable sleep tech devices that offer comprehensive health monitoring capabilities beyond sleep tracking. These devices incorporate features such as heart rate monitoring, activity tracking, and stress management, providing users with holistic insights into their overall health and wellness.

Read Also: Audiology Devices Market Size to Hit USD 18.71 Bn by 2033

Recent Developments

- In January 2024, the National Sleep Foundation (NSF) created the SleepTech® Network, a new community platform for stakeholders in the sleep technology business. The news comes from the CES® trade exhibition in Las Vegas, which shows the whole technology environment. NSF is located in Booth 8604 in Tech East’s North Hall. The inaugural members of the SleepTech® Network range from high-profile start-ups to Fortune Global 500 representatives, representing key segments such as consumer electronics, digital therapeutics, mobility, consumer home products, and sleep-monitoring AI software. Asleep, Pocket Kado, PureCare, Samsung Health, Variowell, and Waymo are among the companies that participate.

- In December 2022, ASLEEP, a sleep technology firm, announced that it would reveal the blueprint for an individually personalized sleep environment based on its unequaled AI-based sleep monitoring technology at CES 2023. ASLEEP offers a wide range of sleep-related services using AI technology that analyzes sleep phases based on breathing sounds. ASLEEP’s technology can identify sleep phases in any setting by utilizing microphone-equipped devices such as smartphones, smart TVs, and speakers. ASLEEP’s sleep detection technology provides the most accurate results without the need for wearable devices such as smartwatches. It detects REM sleep, non-REM sleep, and wake state with an average 15% higher accuracy than industry-leading smartwatches.

- In January 2023, Earable® Neuroscience conducted a global launch ceremony for its FRENZ™ Brainband at CES 2023. During the occasion, the business talked about the breakthroughs behind the award-winning gadget, its potential to disrupt sleep technology, a special discount pricing, and its 88 Pioneer project. Earable® Neuroscience, a deep tech firm creating scalable, human-centric solutions that improve everyday experiences, had a global launch event for the FRENZ™ Brainband at the 2023 Consumer Electric Show (CES 2023) on Jan 6, revealing the breakthroughs that power the award-winning gadget.

Competitive Landscape:

The sleep tech devices market is highly competitive, with numerous players vying for market share through product innovation, strategic partnerships, and expansion into new markets. Key players in the market include companies such as Fitbit, Garmin, ResMed, Philips, and Withings, among others.

These companies are focusing on developing advanced sleep tracking algorithms, improving sensor accuracy, and enhancing user experience to gain a competitive edge in the market. Additionally, partnerships with healthcare providers, insurance companies, and technology firms are enabling companies to broaden their reach and tap into new customer segments.

Sleep Tech Devices Market Companies

- Philips

- Fitbit

- Eight Sleep

- Dodow

- Rhythm

- Casper

- Xiaomi

- Oura Health

- Nokia

- Sleepace

Segments Covered in the Report

By Product

- Wearables

- Non-wearables

By Application

- Obstructive Sleep Apnea

- Insomnia

- Narcolepsy

- Others

By Distribution Channel

- Hypermarkets and Supermarkets

- Sleep Centers and Fitness Centers

- Pharmacy and Retail Stores

- E-commerce

- Others

`By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/