Space Technology Market Size to Surpass USD 916.85 Bn by 2033

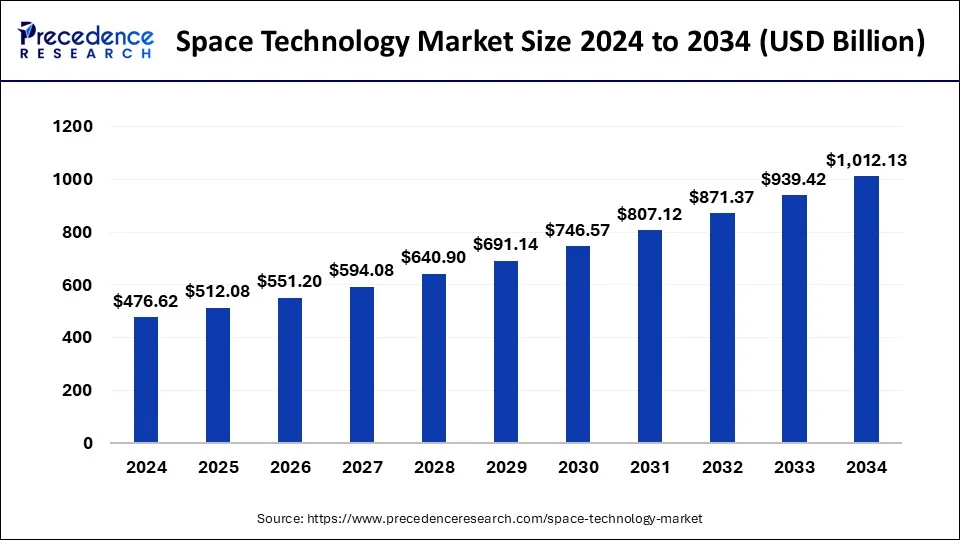

The global space technology market size surpassed USD 443.20 billion in 2023 and is anticipated to be worth around USD 916.85 billion by 2033, growing at a CAGR of 7.54% from 2024 to 2033.

Key Points

- North America accounted more than 55% of the market share in 2023.

- Asia Pacific is expected to expand at the fastest CAGR of 9.05% between 2024 and 2033.

- By type, the space vehicles segment has held the major market share of 67% in 2023.

- By end use, in 2023, the commercial segment dominated the market with the largest market share of 62% in 2023.

- By application, the navigation and mapping segment led the market with the maximum market share of 21% in 2023.

The global space technology market encompasses a wide range of technologies and services related to space exploration, satellite communication, remote sensing, space transportation, and space tourism. In recent years, the space industry has experienced significant growth driven by increasing government and private sector investments, technological advancements, and expanding commercial applications of space technology. With the emergence of new players, such as private space companies and startups, the space technology market is undergoing rapid transformation, offering opportunities for innovation and collaboration across various sectors.

Get a Sample: https://www.precedenceresearch.com/sample/4052

Growth Factors:

Several key factors are driving the growth of the global space technology market. Firstly, growing government initiatives and investments in space exploration, satellite launches, and national security applications are fueling demand for space technology solutions. Governments worldwide are allocating substantial budgets to space programs aimed at advancing scientific research, enhancing national security, and fostering international cooperation in space exploration. Additionally, the emergence of commercial space ventures, such as satellite internet constellations, space tourism initiatives, and lunar exploration missions, is expanding the market opportunities for space technology companies. Moreover, technological advancements in areas such as reusable launch vehicles, miniaturized satellites, 3D printing, and artificial intelligence are driving innovation and reducing the costs associated with space missions, making space more accessible to both government agencies and private enterprises.

Region Insights:

The global space technology market exhibits significant regional variations in terms of government spending, industry capabilities, and market dynamics. The United States remains a dominant player in the space industry, with NASA leading major space exploration missions and private companies like SpaceX, Blue Origin, and Boeing driving innovation in space transportation, satellite deployment, and human spaceflight. Europe, represented by agencies such as the European Space Agency (ESA) and commercial entities like Airbus Defence and Space, plays a key role in satellite manufacturing, Earth observation, and international space collaboration. China has emerged as a major player in the space sector, with ambitious plans for lunar exploration, satellite launches, and the development of its space station. Other regions, including Russia, India, Japan, and emerging spacefaring nations in Asia and the Middle East, are also making significant strides in space technology development and exploration.

Trends:

Several trends are shaping the evolution of the global space technology market. One notable trend is the increasing commercialization of space activities, driven by the emergence of private space companies offering launch services, satellite imagery, communications, and space tourism experiences. Commercial satellite constellations for broadband internet, led by companies like SpaceX’s Starlink and OneWeb, are poised to revolutionize global connectivity and create new opportunities for digital inclusion. Another trend is the miniaturization of satellites and the proliferation of small satellite launches, enabling cost-effective solutions for Earth observation, communication, and scientific research. Furthermore, advancements in reusable launch vehicle technology, exemplified by SpaceX’s Falcon 9 rocket, are driving down the cost of access to space and facilitating more frequent and affordable space missions.

Space Technology Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 7.54% |

| Global Market Size in 2023 | USD 443.20 Billion |

| Global Market Size in 2024 | USD 476.62 Billion |

| Global Market Size by 2033 | USD 916.85 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Type, By End-use, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Space Technology Market Dynamics

Drivers:

Several factors are driving the demand for space technology solutions worldwide. Firstly, the increasing reliance on satellite-based services for communication, navigation, weather forecasting, disaster management, and environmental monitoring is driving demand for satellite manufacturing, launch services, and satellite imagery. Governments and private enterprises are investing in satellite constellations for broadband internet, Earth observation, and remote sensing applications to address various societal challenges and commercial opportunities. Additionally, advancements in space exploration, including missions to the Moon, Mars, and beyond, are fueling demand for spacecraft development, propulsion systems, and life support technologies. Moreover, the growing interest in space tourism and commercial spaceflight experiences is driving investments in space tourism infrastructure, spacecraft design, and spaceport development.

Opportunities

The space technology market presents numerous opportunities for stakeholders across the value chain. Satellite manufacturers have the opportunity to capitalize on the growing demand for satellite constellations, Earth observation satellites, and small satellites for various applications. Launch service providers can expand their capabilities to meet the increasing demand for satellite launches, including rideshare opportunities and dedicated missions for commercial and government customers. Space tourism companies have the opportunity to develop innovative spacecraft, space habitats, and experiences for space travelers seeking unique and immersive spaceflight experiences. Furthermore, technology companies specializing in areas such as propulsion, robotics, materials science, and artificial intelligence can leverage their expertise to develop cutting-edge solutions for space exploration, satellite operations, and in-space manufacturing.

Challenges:

Despite the opportunities presented by the growing space technology market, several challenges remain that could hinder its growth and development. One of the primary challenges is the high cost and complexity of space missions, including satellite launches, spacecraft development, and space exploration missions, which can pose barriers to entry for smaller companies and emerging spacefaring nations. Additionally, regulatory and legal challenges, including spectrum allocation, space debris mitigation, intellectual property rights, and export controls, can create hurdles for companies operating in the space industry. Moreover, geopolitical tensions and international competition in space activities, including concerns over space militarization and weaponization, could impact collaboration and cooperation among nations and hinder progress in space exploration and technology development. Addressing these challenges will require collaboration among governments, industry stakeholders, and international organizations to ensure the sustainable and responsible use of space for the benefit of humanity.

Read Also: Precious Metal Market Size to Cross USD 514.06 Billion by 2033

Recent Developments

- In September 2023, the Polar Satellite Launch Vehicle (PSLV-C57) successfully launched the Aditya-L1 spacecraft from the Second Launch Pad of Satish Dhawan Space Centre (SDSC), Sriharikota under the space mission of ISRO.

- In December 2023, Qualcomm Technologies, Inc., in collaboration with the Indian Space Research Organisation (ISRO), developed and tested select chipset platforms that support NavIC L1 signals. The initiative will help accelerate the adoption of NavIC and enhance the geo-location capabilities of mobile, automotive, and the Internet of Things (IoT) solutions in the region.

- In December 2023, NASA launched the James Webb Space Telescope. The telescope is designed to study the universe in infrared light, which allows us to see objects that are too faint or distant to be seen by other telescopes.

- In January 2023, SpaceX’s most spacecraft launched into space on a single mission, with 143 satellites. 3.

- SpaceX raised about USD2 billion with an ambitious plan for 2023, which includes 87 rocket launches, a sustained moon exploration project, and expansion of Starlink internet service.

Space Technology Market Companies

- Airbus SE

- Astra Space Inc.

- Ball Corporation

- Beijing Commsat Technology Development Co. Ltd.

- Blue Origin LLC

- Boeing

- China Aerospace Science and Technology Corporation

- General Dynamics Corporation

- Hedron

- Hindustan Aeronautics Limited

- Honeywell International Inc.

- ICEYE

- Lockheed Martin Corporation

- Maxar Technologies

- Northrop Grumman Corporation

- OHB System AB

- Rocket Lab USA

- Safran S.A.

- Sierra Nevada Corporation

- SpaceX

- Thales Group

- Virgin Galactic

List of Space Agencies in the Space Technology Market

- National Aeronautics and Space Administration (NASA)

- European Space Agency

- China National Space Administration

- Indian Space Research Organization

- Japan Aerospace Exploration Agency

- Canadian Space Agency

- Italian Space Agency

- National Centre for Space Studies – France

- United Kingdom Space Agency

- Israel Space Agency

Segments Covered in the Report

By Type

- Space Vehicles

- Spacecraft

- Flyby Spacecraft

- Orbiter Spacecraft

- Atmospheric Spacecraft

- Lander Spacecraft

- Rover Spacecraft

- Others (Observatory Spacecraft, Penetrator Spacecraft, etc.)

- Satellites

- Weather Satellite

- Communication Satellite

- Navigation Satellites

- Earth Observation Satellite

- Astronomical Satellites

- Miniaturized Satellites

- Spacecraft

- Space Stations

- Orbital Launch Vehicles

- Deep-space communication

- In-space Propulsion

- Others (Support Infrastructure, Procedures, etc.)

By End-use

- Government

- Military

- Commercial

By Application

- Navigation & Mapping

- Meteorology

- Disaster Management

- Satellite Communication

- Satellite Television

- Remote Sensing

- Science & Engineering

- Earth Observation

- Military and National Security

- Data & Analytics

- Information Technology

- Internet Services

- Manufacturing

- Others (Space Medicine, Tele-Education, etc.)

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/