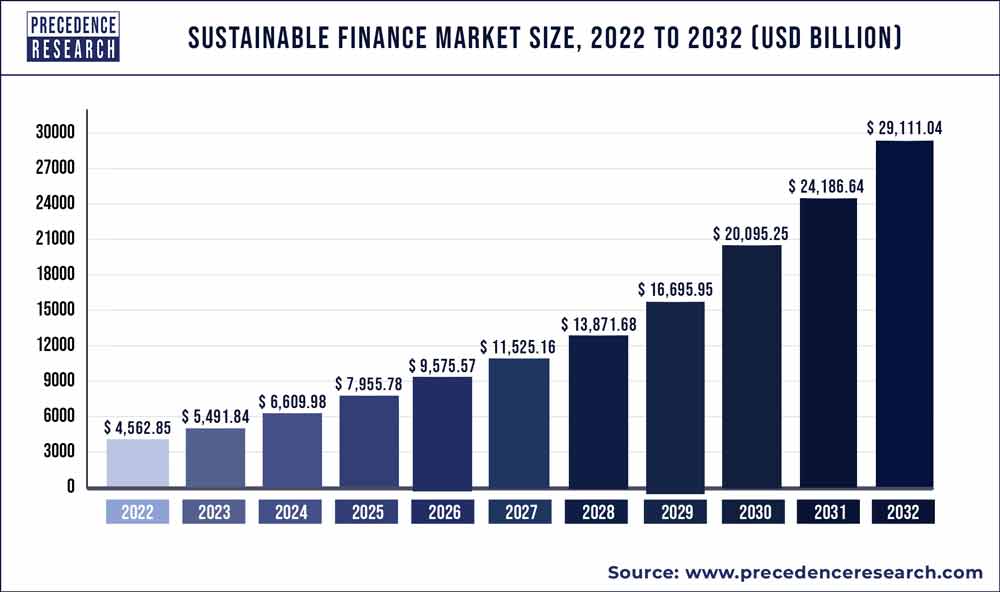

Sustainable Finance Market Size to Worth USD 29,111.04 Billion By 2032

The global sustainable finance market size is expected to be worth around USD 29,111.04 billion by 2032 from USD 4,562.85 billion in 2022, growing at a CAGR of 20.36% during the forecast period from 2022 to 2032.

Key Takeaways:

- North America led the global market in 2022.

- Asia-Pacific region is expected to expand at the fastest CAGR from 2023 to 2032.

- By Transaction Type, the green bond segment led the market in 2022.

- By Industry Verticals, the transport and logistics segment led the market in 2022.

Report Summary

The latest released research study on Global Printed and Sustainable finance Market, offers a detailed overview of the factors influencing the global business scope. The Printed and Sustainable finance Market research report shows the latest market insights, current situation analysis with upcoming trends and breakdown of the products and services. The report provides key statistics on the market status, size, share, growth factors of the Printed and Sustainable finance Market. The study also provides information on past and current market trends and developments, factors, capacities, technologies, and changes in market capital structure Printed and Sustainable finance Market. The study will assist market participants and market consultants to understand the continuing structure of the Printed and Sustainable finance Market. Our analysts monitoring the situation across the globe explain that the market will generate remunerative prospects for producers post COVID-19 crisis. The report aims to provide an additional illustration of the latest scenario, economic slowdown, and COVID-19 impact on the overall industry.

Download Access to a Free Copy of Our Latest Sample Report@ https://www.precedenceresearch.com/sample/3198

Sustainable Finance Market Report Scope

| Report Coverage | Details |

| Market Size in 2023 | USD 5,491.84 Billion |

| Market Size by 2032 | USD 29,111.04 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 20.36% |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Segments Covered | By Investment Type, By Transaction Type, and By Industry Verticals |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Read More: Geospatial Imagery Analytics Market Size To Cross USD 44.26 Bn By 2032

The report endeavors to offer a 360-degree analysis of the global Printed and Sustainable finance Market on the back of an insightful study of the prevailing demand and supply trends, important fiscal statistics of major players sustaining in the market, and the influence of latest economic advancements on the market. Developments in each geographical region is charted using authentic historical data with a view to help gauge the future trajectory of the market across the globe. SWOT analysis is conducted to identify the strengths, weaknesses, opportunities, and threats that these companies forecast to witness during the forecast period.

Market Size Estimation

Based on the provided information, it seems that the data you have is sourced from Precedence Research Reports. They have used both top-down and bottom-up approaches to estimate and validate the global market size for various parameters such as company, regional division, product type, and application (end users).

The sustainable finance market size estimations in the report are based on the selling price, excluding any discounts offered by manufacturers, distributors, wholesalers, or traders. The market share analysis for each segment and region is determined using the product utilization rate and average selling price.

To determine the revenues, percentage splits, market shares, growth rates, and breakdowns of the product markets for major manufacturers, the report relies on secondary sources and verifies the information through primary sources.

Major companies operating in this area

- Green Banks

- Sustainable Asset Management Firms

- Impact Investing Funds

- Green Energy Companies

- Social Enterprises

- Sustainable Technology Companies

- Green Real Estate Developers

- Corporate Green Bond Issuers

- Sustainable Agriculture and Food Companies

Sustainable Finance Market Segmentation

By Investment Type

- Equity, Fixed Income

- Mixed Allocation

By Transaction Type

- Green Bond

- Social Bond

- Mixed- sustainability Bond

By Industry Verticals

- Utilities

- Transport and Logistics

- Chemicals

- Food and Beverage

- Government

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Research Methodology

Secondary Research

It involves company databases such as Hoover’s: This assists us to recognize financial information, the structure of the market participants and industry’s competitive landscape.

The secondary research sources referred in the process are as follows:

- Governmental bodies, and organizations creating economic policies.

- National and international social welfare institutions

- Company websites, financial reports and SEC filings, broker and investor reports

- Related patent and regulatory databases

- Statistical databases and market reports

- Corporate Presentations, news, press release, and specification sheet of Manufacturers

Primary Research

Primary research includes face-to-face interviews, online surveys, and telephonic interviews.

- Means of primary research: Email interactions, telephonic discussions, and Questionnaire-based research etc.

- In order to validate our research findings and analysis, we conduct primary interviews of key industry participants. Insights from primary respondents help in validating the secondary research findings. It also develops the Research Team’s expertise and market understanding.

TABLE OF CONTENT

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology (Premium Insights)

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Sustainable Finance Market

5.1. COVID-19 Landscape: Sustainable Finance Industry Impact

5.2. COVID 19 – Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Sustainable Finance Market, By Investment Type

8.1. Sustainable Finance Market, by Investment Type, 2023-2032

8.1.1 Equity, Fixed Income

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Mixed Allocation

8.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Sustainable Finance Market, By Transaction Type

9.1. Sustainable Finance Market, by Transaction Type, 2023-2032

9.1.1. Green Bond

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Social Bond

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Mixed- sustainability Bond

9.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Sustainable Finance Market, By Industry Verticals

10.1. Sustainable Finance Market, by Industry Verticals, 2023-2032

10.1.1. Utilities

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Transport and Logistics

10.1.2.1. Market Revenue and Forecast (2020-2032)

10.1.3. Chemicals

10.1.3.1. Market Revenue and Forecast (2020-2032)

10.1.4. Food and Beverage

10.1.4.1. Market Revenue and Forecast (2020-2032)

10.1.5. Government

10.1.5.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Global Sustainable Finance Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Investment Type (2020-2032)

11.1.2. Market Revenue and Forecast, by Transaction Type (2020-2032)

11.1.3. Market Revenue and Forecast, by Industry Verticals (2020-2032)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Investment Type (2020-2032)

11.1.4.2. Market Revenue and Forecast, by Transaction Type (2020-2032)

11.1.4.3. Market Revenue and Forecast, by Industry Verticals (2020-2032)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Investment Type (2020-2032)

11.1.5.2. Market Revenue and Forecast, by Transaction Type (2020-2032)

11.1.5.3. Market Revenue and Forecast, by Industry Verticals (2020-2032)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Investment Type (2020-2032)

11.2.2. Market Revenue and Forecast, by Transaction Type (2020-2032)

11.2.3. Market Revenue and Forecast, by Industry Verticals (2020-2032)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Investment Type (2020-2032)

11.2.4.2. Market Revenue and Forecast, by Transaction Type (2020-2032)

11.2.4.3. Market Revenue and Forecast, by Industry Verticals (2020-2032)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Investment Type (2020-2032)

11.2.5.2. Market Revenue and Forecast, by Transaction Type (2020-2032)

11.2.5.3. Market Revenue and Forecast, by Industry Verticals (2020-2032)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Investment Type (2020-2032)

11.2.6.2. Market Revenue and Forecast, by Transaction Type (2020-2032)

11.2.6.3. Market Revenue and Forecast, by Industry Verticals (2020-2032)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Investment Type (2020-2032)

11.2.7.2. Market Revenue and Forecast, by Transaction Type (2020-2032)

11.2.7.3. Market Revenue and Forecast, by Industry Verticals (2020-2032)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Investment Type (2020-2032)

11.3.2. Market Revenue and Forecast, by Transaction Type (2020-2032)

11.3.3. Market Revenue and Forecast, by Industry Verticals (2020-2032)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Investment Type (2020-2032)

11.3.4.2. Market Revenue and Forecast, by Transaction Type (2020-2032)

11.3.4.3. Market Revenue and Forecast, by Industry Verticals (2020-2032)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Investment Type (2020-2032)

11.3.5.2. Market Revenue and Forecast, by Transaction Type (2020-2032)

11.3.5.3. Market Revenue and Forecast, by Industry Verticals (2020-2032)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Investment Type (2020-2032)

11.3.6.2. Market Revenue and Forecast, by Transaction Type (2020-2032)

11.3.6.3. Market Revenue and Forecast, by Industry Verticals (2020-2032)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Investment Type (2020-2032)

11.3.7.2. Market Revenue and Forecast, by Transaction Type (2020-2032)

11.3.7.3. Market Revenue and Forecast, by Industry Verticals (2020-2032)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Investment Type (2020-2032)

11.4.2. Market Revenue and Forecast, by Transaction Type (2020-2032)

11.4.3. Market Revenue and Forecast, by Industry Verticals (2020-2032)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Investment Type (2020-2032)

11.4.4.2. Market Revenue and Forecast, by Transaction Type (2020-2032)

11.4.4.3. Market Revenue and Forecast, by Industry Verticals (2020-2032)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Investment Type (2020-2032)

11.4.5.2. Market Revenue and Forecast, by Transaction Type (2020-2032)

11.4.5.3. Market Revenue and Forecast, by Industry Verticals (2020-2032)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Investment Type (2020-2032)

11.4.6.2. Market Revenue and Forecast, by Transaction Type (2020-2032)

11.4.6.3. Market Revenue and Forecast, by Industry Verticals (2020-2032)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Investment Type (2020-2032)

11.4.7.2. Market Revenue and Forecast, by Transaction Type (2020-2032)

11.4.7.3. Market Revenue and Forecast, by Industry Verticals (2020-2032)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Investment Type (2020-2032)

11.5.2. Market Revenue and Forecast, by Transaction Type (2020-2032)

11.5.3. Market Revenue and Forecast, by Industry Verticals (2020-2032)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Investment Type (2020-2032)

11.5.4.2. Market Revenue and Forecast, by Transaction Type (2020-2032)

11.5.4.3. Market Revenue and Forecast, by Industry Verticals (2020-2032)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Investment Type (2020-2032)

11.5.5.2. Market Revenue and Forecast, by Transaction Type (2020-2032)

11.5.5.3. Market Revenue and Forecast, by Industry Verticals (2020-2032)

Chapter 12. Company Profiles

12.1. Green Banks

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Sustainable Asset Management Firms

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Impact Investing Funds

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Green Energy Companies

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Social Enterprises

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Sustainable Technology Companies

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Green Real Estate Developers

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Corporate Green Bond Issuers

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Sustainable Agriculture and Food Companies

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Thanks for reading you can also get individual chapter-wise sections or region-wise report versions such as North America, Europe, or Asia Pacific.

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com