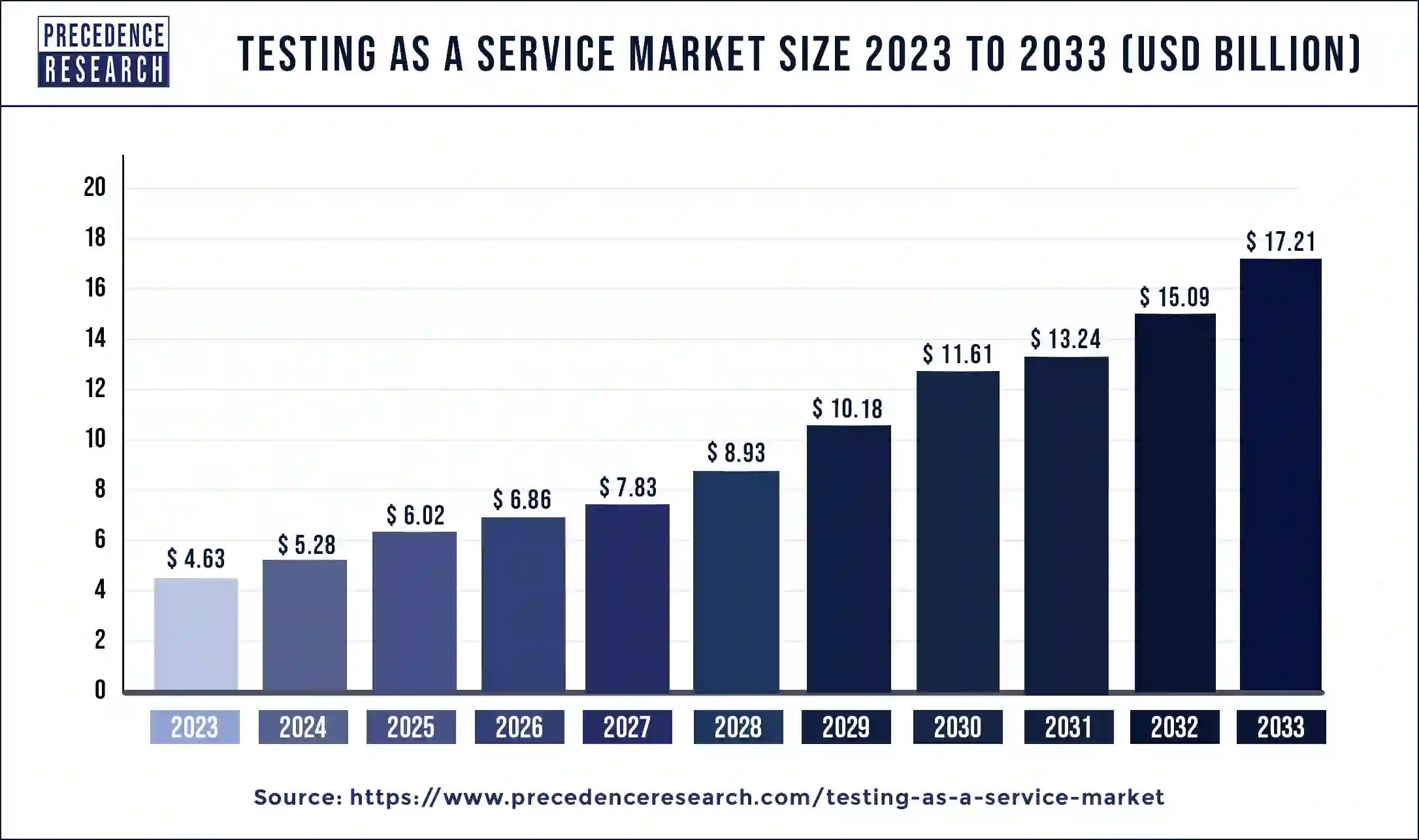

Testing as a Service Market Size to Surpass USD 17.21 Bn by 2033

The global testing as a service market size surpassed USD 4.63 billion in 2023 and is projected to attain around USD 17.21 billion by 2033, growing at a CAGR of 14.03% from 2024 to 2033.

Key Points

- North America led the market with holding a 40% of market share in 2023.

- Asia Pacific is expected to witness significant growth during the forecast period.

- By test type, the functionality segment has generated more than 28% of market share in 2023.

- By test type, the security segment is expected to grow the fastest during the forecast period.

- By deployment type, the public segment held a significant share of the market in 2023.

- By deployment type, the private segment is poised to grow at a significant rate during the forecast period.

- By end use, in 2023, the IT & telecommunication segment led the market.

- By end use, the healthcare segment is expected to grow the fastest during the forecast period.

The Testing as a Service (TaaS) market has witnessed significant growth in recent years, propelled by the increasing adoption of cloud computing, agile methodologies, and DevOps practices across various industries. TaaS refers to outsourcing software testing activities to third-party service providers who offer testing services on a subscription or pay-per-use basis. This model enables organizations to reduce capital expenditure on testing infrastructure and resources while ensuring high-quality software delivery. The TaaS market encompasses a wide range of testing services, including functional testing, performance testing, security testing, and compatibility testing, among others. As organizations strive to accelerate their software development cycles and enhance product quality, the demand for TaaS solutions continues to rise.

Get a Sample: https://www.precedenceresearch.com/sample/4043

Growth Factors

Several key factors are driving the growth of the Testing as a Service market. Firstly, the increasing complexity of software applications and the need for comprehensive testing solutions are driving organizations to seek specialized testing expertise from external service providers. TaaS vendors offer a diverse range of testing services, tools, and frameworks tailored to meet the specific requirements of different industries and applications.

Secondly, the proliferation of digital transformation initiatives across industries is fueling the demand for TaaS solutions. As businesses digitize their operations and launch digital products and services, the importance of rigorous testing to ensure functionality, performance, and security becomes paramount. TaaS providers offer scalable and flexible testing solutions that align with the agile and DevOps practices adopted by many organizations, enabling them to achieve faster time-to-market and better customer experiences.

Furthermore, the increasing adoption of cloud computing and virtualization technologies is driving the growth of the TaaS market. Cloud-based testing platforms offer advantages such as scalability, cost-effectiveness, and accessibility, making them an attractive option for organizations looking to optimize their testing processes. TaaS vendors leverage cloud infrastructure to deliver on-demand testing services globally, catering to the needs of geographically dispersed teams and distributed development environments.

Region Insights

The demand for Testing as a Service varies across different regions, influenced by factors such as technological advancement, industry verticals, regulatory environment, and economic conditions. North America holds a significant share of the TaaS market, driven by the presence of a large number of technology companies, early adopters of agile and DevOps practices, and stringent quality standards in industries such as healthcare, finance, and aerospace.

Europe is also a prominent market for TaaS, characterized by the adoption of advanced testing methodologies, strong emphasis on quality assurance, and regulatory compliance requirements such as GDPR (General Data Protection Regulation). Countries like the UK, Germany, and France are key contributors to the growth of the TaaS market in Europe, with industries like automotive, manufacturing, and telecommunications driving demand for testing services.

In the Asia Pacific region, rapid industrialization, increasing investments in IT infrastructure, and the emergence of startups and SMEs (Small and Medium Enterprises) are driving the demand for TaaS solutions. Countries like India, China, and Japan are witnessing significant growth in the TaaS market, fueled by the expansion of the IT and BFSI (Banking, Financial Services, and Insurance) sectors and the adoption of digital technologies.

Testing as a Service Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 14.03% |

| Global Market Size in 2023 | USD 4.63 Billion |

| Global Market Size by 2024 | USD 5.28 Billion |

| Global Market Size by 2033 | USD 17.21 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Test Type, By End-use, and By Deployment Type |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Testing as a Service Market Dynamics

Drivers

Several drivers are propelling the growth of the Testing as a Service market. Firstly, the growing complexity of software applications, fueled by trends such as IoT (Internet of Things), AI (Artificial Intelligence), and blockchain, is increasing the demand for comprehensive testing solutions. TaaS providers offer specialized expertise and advanced testing tools to address the unique challenges posed by these emerging technologies.

Secondly, the shift towards agile and DevOps practices is driving the adoption of TaaS solutions. Organizations are embracing agile methodologies to accelerate their software development cycles and DevOps principles to integrate development and operations seamlessly. TaaS providers offer testing services that align with agile and DevOps workflows, enabling organizations to achieve continuous testing and delivery while maintaining high levels of quality.

Furthermore, the increasing focus on cost optimization and resource efficiency is driving organizations to adopt TaaS models. By outsourcing testing activities to third-party service providers, organizations can reduce capital expenditure on testing infrastructure, tools, and resources, while gaining access to specialized expertise and scalable testing solutions. TaaS also offers flexibility in terms of resource allocation, allowing organizations to scale testing efforts based on project requirements and timelines.

Opportunities

The Testing as a Service market presents several opportunities for growth and innovation. Firstly, there is a growing demand for specialized testing services tailored to specific industry verticals and use cases. TaaS providers can capitalize on this opportunity by offering domain-specific testing solutions for industries such as healthcare, automotive, e-commerce, and fintech, addressing the unique testing challenges and regulatory requirements of each sector.

Secondly, there is an opportunity for TaaS providers to expand their service offerings beyond traditional functional testing to encompass emerging areas such as AI-driven testing, cybersecurity testing, and IoT testing. By investing in research and development and partnering with technology vendors, TaaS providers can develop innovative testing solutions that address the evolving needs of modern software development.

Furthermore, there is a growing trend towards the adoption of TaaS solutions by small and medium-sized enterprises (SMEs) and startups. These organizations often lack the resources and expertise to establish in-house testing capabilities and are increasingly turning to TaaS providers for cost-effective and scalable testing solutions. TaaS providers can capitalize on this market segment by offering tailored packages and flexible pricing models that cater to the needs of SMEs and startups.

Challenges

Despite the promising growth prospects, the Testing as a Service market faces several challenges that need to be addressed. Firstly, concerns related to data security and privacy pose a significant challenge for TaaS providers, particularly in industries such as healthcare, finance, and government, where sensitive data is involved. TaaS providers need to implement robust security measures and comply with relevant regulations to ensure the confidentiality, integrity, and availability of client data.

Secondly, the lack of awareness and understanding of TaaS among organizations and stakeholders can hinder market growth. Many organizations are still skeptical about outsourcing testing activities and may perceive TaaS as a risk to quality and control. TaaS providers need to educate potential clients about the benefits of TaaS models, demonstrate their expertise and track record, and address concerns related to quality assurance and governance.

Furthermore, the competitive landscape of the TaaS market is intensifying, with the entry of new players and the consolidation of existing vendors. TaaS providers need to differentiate themselves by offering unique value propositions, such as industry-specific expertise, advanced testing methodologies, and innovative technologies. Building strong partnerships with technology vendors, system integrators, and industry associations can also help TaaS providers enhance their market presence and competitiveness.

Read Also: Nutraceutical Packaging Market Size to Cross USD 5.86 Bn by 2033

Recent Developments

- In January 2024, Capgemini SE introduced the “CLOUD DE CONFIANCE” platform. This platform provides the specific cloud needs of the French State, public agencies, hospitals, regional authorities, Vital Importance Operators (OIVs), and Essential Service Operators (OSEs), enabling them to use Microsoft 365 and Microsoft Azure services.

- In December 2023, IBM Corporation took over Software AG, a German multinational software corporation. Through this acquisition, IBM would enhance its business portfolio by creating hybrid cloud and cutting-edge AI solutions for enterprises with a distinct and compelling appeal.

- In November 2023, Accenture PLC came into partnership with Vodafone Group Plc, a British multinational telecommunications company. Through this partnership, Accenture PLC would enhance its technology and transformation services business.

- In November 2023, DXC Technology Company entered into a partnership with Amazon Web Services, Inc., an IT Services and IT Consulting company. Through this partnership, DXC Technology Company would expedite the transfer of its fundamental enterprise systems to cloud infrastructure.

Testing as a Service Market Companies

- Accenture

- Atos SE

- Capgemini

- DeviQA Solutions

- Deloitte Touche Tohmatsu Limited

- DXC Technology Company

- IBM Corporation

- Infosys Limited

- TATA Consultancy Services Limited

- Qualitest Group

Segments Covered in the Report

By Test Type

- Functionality

- Performance

- Compatibility

- Security

- Compliance

- Others

By End-use

- IT & telecommunication

- Healthcare

- BFSI

- Automotive

- Manufacturing

- Retail & Consumer Goods

- Energy & Utilities

- Others

By Deployment Type

- Public

- Private

- Hybrid

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/