U.S. Concierge Medicine Market Size, Trends, Report By 2032

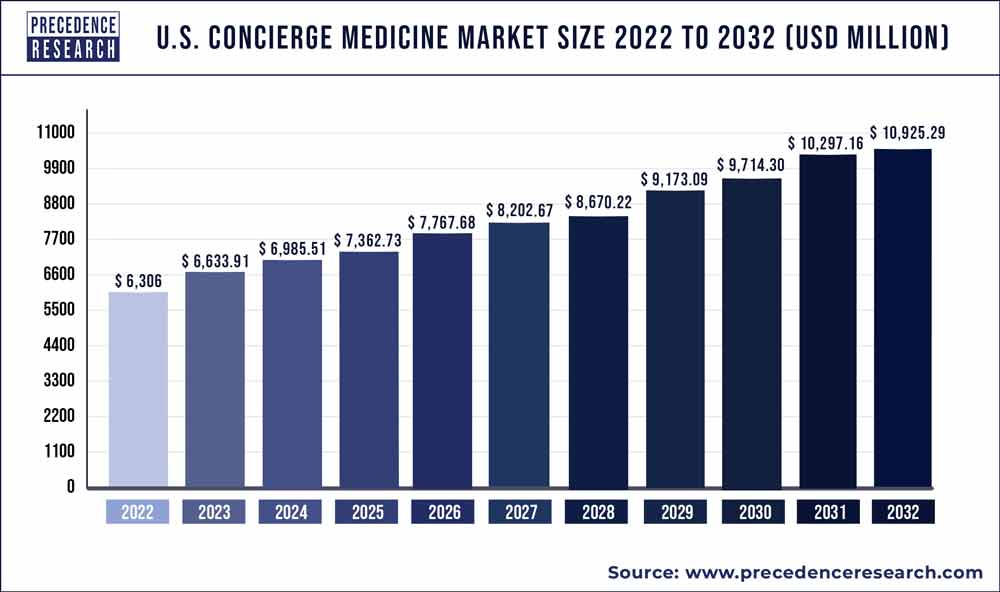

The U.S. concierge medicine market size is estimated at USD 6,633.91 million in 2023 and is predicted to reach around USD 10,925.29 million by 2032 with a notable CAGR of 5.70% from 2023 to 2032.

The global concierge medicine market size reached USD 19.12 billion in 2023 and is predicted to surpass around USD 34.27 billion by 2032 with a CAGR of 6.7% during the forecast period 2023 to 2032.

Concierge medicine in the U.S. has gained significant traction as a personalized healthcare model offering enhanced access and services to patients willing to pay out-of-pocket or through subscription-based models. This market segment focuses on providing more personalized, timely, and convenient medical care compared to traditional healthcare settings. Physicians in concierge medicine typically limit their patient panels to ensure longer appointment times, 24/7 availability, and often include services such as same-day appointments, virtual consultations, and preventive care management. The market has seen growth driven by increasing patient demand for individualized healthcare experiences and the desire for more direct relationships with healthcare providers, although it remains a niche within the broader healthcare industry.

Download the Sample Report ( Including Full TOC, List of Table & Figures, Chart): https://www.precedenceresearch.com/sample/2170

Key Points

- By application, the others segment dominated the U.S. concierge medicine market with the largest share in 2022.

- By application, the primary care segment is observed sustain as a second largest segment throughout the forecast period.

- By ownership, in 2022, the group segment held the dominating position in the market.

Application Insights

Concierge medicine in the U.S. is primarily driven by its application in various healthcare services. The market prominently features primary care services, which form the cornerstone of most concierge practices. These services encompass comprehensive healthcare management, offering patients personalized care plans, routine check-ups, preventive screenings, and management of chronic conditions. The demand for primary care in concierge settings is fueled by increasing patient preferences for personalized healthcare experiences and enhanced access to physicians. Additionally, specialty care services play a significant role, providing access to specialized medical disciplines such as cardiology, dermatology, and orthopedics. These services cater to specific healthcare needs beyond primary care, offering patients continuity of care and specialized treatment options tailored to their medical conditions. Moreover, wellness and preventive health programs are integral to concierge medicine, emphasizing proactive health management through fitness assessments, nutritional counseling, stress management techniques, and personalized wellness plans. These programs aim to improve overall well-being and prevent disease, aligning with growing consumer interest in preventive healthcare strategies.

Ownership Insights

Ownership structures within the U.S. concierge medicine market vary, reflecting different strategic approaches and operational models. Physician-owned practices constitute a significant portion of the market, where individual physicians or small groups of healthcare providers directly own and operate concierge practices. This ownership model allows physicians to maintain autonomy over patient care decisions, practice operations, and service delivery, fostering personalized patient-physician relationships and flexibility in healthcare management. In contrast, hospital or healthcare system-owned practices integrate concierge medicine services into larger institutional frameworks. These practices leverage institutional resources, infrastructure, and healthcare networks to enhance patient access to specialized medical services and integrate premium healthcare offerings within broader hospital services. Furthermore, corporate-owned practices are emerging as a notable trend, with corporate entities or investment groups acquiring existing concierge practices or establishing new ones. This ownership model focuses on scalability, operational efficiencies, and geographic expansion opportunities to capitalize on the growing market demand for personalized healthcare experiences. Corporate ownership may bring professional management practices, financial backing, and strategic growth initiatives to optimize practice performance and market presence.

Market Dynamics and Future Outlook

The U.S. concierge medicine market is poised for continued growth driven by evolving consumer preferences, advancements in medical technology, and shifting healthcare delivery models. Key market dynamics include the integration of telemedicine, artificial intelligence (AI), and digital health platforms to enhance patient engagement, care coordination, and operational efficiencies within concierge practices. Regulatory considerations, including state-level regulations impacting ownership structures, billing practices, and service scope, also influence market dynamics. Looking ahead, the market is expected to witness further innovation in healthcare delivery, with concierge medicine playing a pivotal role in delivering personalized, patient-centric care. The future outlook emphasizes opportunities for market expansion, strategic partnerships, and technological advancements to meet the growing demand for high-quality, accessible healthcare services in the U.S.

U.S. Concierge Medicine Market Scope

| Report Coverage | Details |

| Growth Rate from 2023 to 2032 | CAGR of 5.70% |

| U.S. Market Size in 2022 | USD 6,306 Million |

| U.S. Market Size in 2023 | USD 6,633.91 Million |

| U.S. Market Size by 2032 | USD 10,925.29 Million |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Segments Covered | By Application and By Ownership |

U.S. Concierge Medicine Market Trends

- Rise in Popularity: There has been a growing preference among patients for personalized healthcare services, leading to increased interest in concierge medicine. Patients value the direct access to physicians, longer appointment times, and personalized care plans offered by concierge practices.

- Expansion of Services: Concierge practices are expanding beyond primary care to offer a wider range of services, including specialty care, wellness programs, and preventive health screenings. This expansion aims to cater to comprehensive healthcare needs under a personalized approach.

- Technology Integration: There’s a notable trend towards integrating technology in concierge medicine practices. This includes telemedicine for remote consultations, mobile health apps for patient communication and monitoring, and electronic health records (EHR) systems for efficient data management.

- Diverse Business Models: Concierge medicine practices are adopting diverse business models to accommodate different patient demographics and healthcare needs. This includes tiered membership plans, hybrid models combining concierge and traditional care, and corporate partnerships to offer services to employees.

- Growing Physician Interest: Physicians are increasingly drawn to concierge medicine due to benefits such as reduced administrative burden, improved work-life balance, and the ability to provide higher-quality care with fewer patient volume pressures.

U.S. Concierge Medicine Market Dynamics

Driver

Concierge medicine, also known as boutique or personalized medicine, has been steadily growing in the U.S. healthcare landscape. This model offers patients enhanced access to primary care physicians, often through a subscription-based or fee-for-service approach. Several key drivers fueling the growth of the U.S. concierge medicine market include increasing patient demand for personalized healthcare services. Patients are seeking more personalized attention, shorter wait times, and longer appointment durations than traditional healthcare settings typically offer. Concierge medicine meets these expectations by providing more time for comprehensive consultations and a focus on preventive care, which resonates well with patients aiming for proactive health management.

Restraint

Opportunities within the U.S. concierge medicine market are expanding as healthcare consumers prioritize convenience and quality. The model appeals to individuals and families who value direct access to physicians, timely appointments, and a higher level of service. Additionally, advancements in technology enable concierge practices to offer telemedicine services, enhancing accessibility for patients regardless of location. This flexibility not only attracts busy professionals and those seeking specialized care but also supports the aging population looking for comprehensive healthcare solutions tailored to their specific needs.

Opportunity

Despite these opportunities, the concierge medicine market also faces several challenges. One significant hurdle is the perception of exclusivity and affordability. Critics argue that the model may exacerbate healthcare disparities by catering primarily to affluent patients who can afford subscription fees or out-of-pocket expenses not covered by insurance. Moreover, transitioning to a concierge practice can be financially risky for physicians, requiring careful management of patient retention and practice growth. Regulatory complexities, including state-specific laws governing direct primary care and insurance reimbursement, also pose challenges for practitioners navigating the legal landscape while delivering personalized care.

Read Also: Cosmetic Ingredients Market Size, Trends, Report By 2032

Recent Developments

- In May 2023, the women-led telemedicine startup FemGevity has formally started, with the goal of providing women with menopause symptoms with individualised, cost-effective, and continuous care. Unlike the “one size fits all” approach that has been the standard for far too long, this digital platform provides women a comprehensive and holistic approach to menopause care. FemGevity aims to create advanced precision medicine services for women at affordable prices, by levelling the high-quality healthcare services accessible to more people.

- In December 2022, Tampa General Hospital announced the launch of concierge medicine facility for its patients in Florida. The initiative will focus on preventive care and metabolic health in adolescents.

U.S. Concierge Medicine Market Players

- Priority Physicians, Inc

- Castle Connolly Private Health Partners

- Partner MD

- Concierge Consultants and Cardiology

Segments Covered in the Report

By Application

- Primary Care

- Cardiology

- Pediatrics

- Psychiatry

- Internal Care

- Others

By Ownership

- Independent

- Group