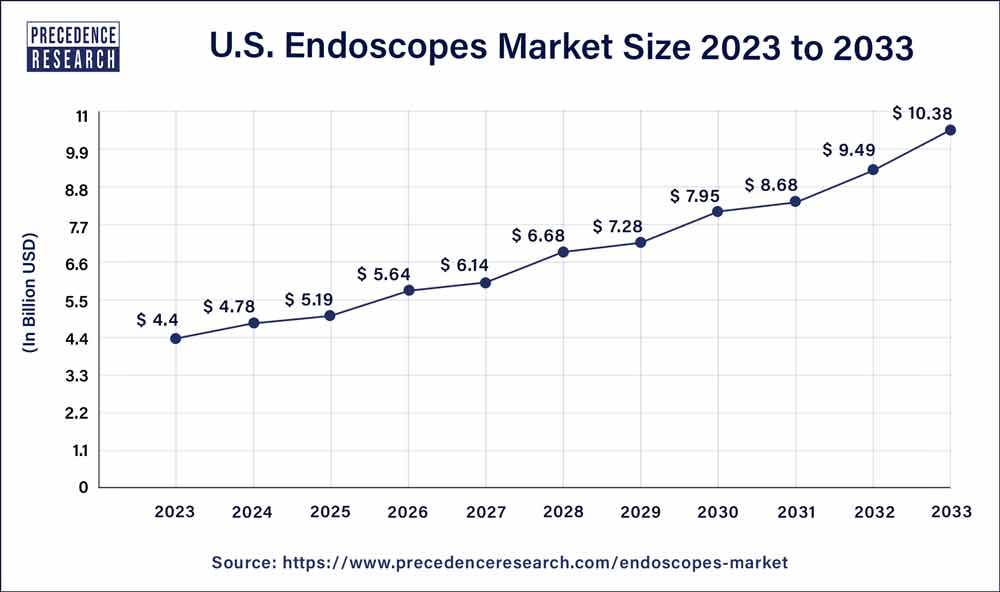

U.S. Endoscopes Market Size to Hit USD 10.38 Bn by 2033

Key Takeaways

- By product, the flexible endoscopes segment held the largest share of the market in 2023.

- By product, the disposable endoscopes segment is observed to witness the fastest rate of expansion during the forecast period.

- By application, the gastrointestinal (GI) endoscopy segment dominated the market with the largest share in 2023.

- By end-use, the hospitals segment held the largest share of the market in 2023.

Introduction:

The U.S. endoscopes market is a critical component of the healthcare industry, facilitating minimally invasive diagnostic and therapeutic procedures across various medical specialties. Endoscopes, equipped with advanced imaging technologies and flexible insertion capabilities, enable healthcare professionals to visualize internal organs and tissues, diagnose diseases, and perform minimally invasive surgeries with precision. This analysis delves into the multifaceted landscape of the U.S. endoscopes market, exploring growth drivers, technological advancements, regulatory considerations, competitive dynamics, and emerging opportunities shaping the industry.

Get a Sample: https://www.precedenceresearch.com/sample/3724

Growth Factors:

The U.S. endoscopes market is experiencing robust growth driven by several factors. One significant factor is the increasing prevalence of gastrointestinal disorders, such as colorectal cancer, gastrointestinal bleeding, and inflammatory bowel disease, necessitating frequent endoscopic examinations and interventions. Moreover, the aging population, with a higher incidence of age-related diseases and conditions, contributes to the growing demand for endoscopic procedures. Additionally, advancements in endoscopic imaging technologies, including high-definition (HD), ultra-high-definition (UHD), and three-dimensional (3D) imaging, enhance visualization and diagnostic accuracy, driving adoption among healthcare providers.

U.S. Endoscopes Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 9% |

| U.S. Market Size in 2023 | USD 4.40 Billion |

| U.S. Market Size by 2033 | USD 10.38 Billion |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Product, By Application, and By End-Use |

U.S. Endoscopes Market Dynamics

Drivers:

Numerous drivers propel the expansion of the U.S. endoscopes market. Key among these is the shift towards minimally invasive surgical techniques, driven by patient preference for shorter recovery times, reduced postoperative pain, and improved cosmetic outcomes. Endoscopic procedures offer significant advantages over traditional open surgeries, including smaller incisions, reduced risk of complications, and shorter hospital stays. Furthermore, the increasing emphasis on early disease detection and preventive healthcare encourages the adoption of endoscopic screening programs for conditions such as colorectal cancer and Barrett’s esophagus. Additionally, reimbursement reforms and healthcare policy initiatives aimed at promoting value-based care incentivize healthcare providers to invest in advanced endoscopic technologies and procedures.

Restraints:

Despite its growth trajectory, the U.S. endoscopes market faces certain restraints and challenges. One notable restraint is the high cost associated with acquiring and maintaining advanced endoscopic equipment, particularly for smaller healthcare facilities and outpatient clinics. Additionally, concerns regarding infection control and the risk of cross-contamination associated with reusable endoscopes have prompted stringent regulatory oversight and increased scrutiny from healthcare regulatory agencies. Moreover, the shortage of skilled endoscopists and the learning curve associated with mastering advanced endoscopic techniques pose challenges to widespread adoption and utilization of endoscopic procedures.

Opportunity:

The U.S. endoscopes market presents significant opportunities for innovation, expansion, and collaboration. Technological advancements, such as miniaturization, robotic-assisted endoscopy, and artificial intelligence (AI) integration, hold promise for enhancing procedural efficiency, diagnostic accuracy, and patient outcomes. Furthermore, the rising demand for non-invasive diagnostic and therapeutic options, coupled with the increasing prevalence of chronic diseases, creates opportunities for the development of novel endoscopic devices and procedures. Collaborations between industry players, healthcare providers, and academic institutions can accelerate research and development efforts, facilitate technology transfer, and drive the adoption of cutting-edge endoscopic solutions.

Region Insights

The United States boasts a mature and highly competitive endoscopes market, characterized by the presence of leading medical device manufacturers, healthcare facilities, and research institutions. Major metropolitan areas, such as New York, Los Angeles, and Chicago, serve as hubs for medical innovation and attract top talent in the field of gastroenterology, pulmonology, and minimally invasive surgery. Academic medical centers and teaching hospitals play a pivotal role in advancing endoscopic techniques, training the next generation of endoscopists, and conducting clinical research trials. Furthermore, the consolidation of healthcare facilities and the emergence of integrated healthcare delivery networks drive demand for comprehensive endoscopic services, including diagnostic imaging, therapeutic interventions, and post-procedural care.

Read Also: Push-to-talk Market Size to Attain USD 89.73 Billion by 2033

Recent Developments

- In October 2023, the next-generation EVIS X1TM endoscopy system from Olympus Corporation, a global medical technology company dedicated to making people’s lives healthier, safer, and more fulfilling, officially entered the market in the United States. It will be on display and available for demonstration from October 22–24 during the American College of Gastroenterology (ACG) annual meeting in Vancouver, Canada.

- In October 2023, two of the most recent breakthroughs from PENTAX Medical America Inc., a part of HOYA Group, are the i20c video endoscope series and the PENTAX Medical INSPIRATM, a top-tier 4K video processor.

- In July 2023, the 4K video processor and endoscope series obtained 510(k) approval and is being stocked for retail.

U.S. Endoscopes Market Companies

- Olympus Corporation

- Stryker Corporation

- Ethicon Endo-Surgery, Inc

- Boston Scientific

- Arthrex, Inc.

- ConMed

- Medtronic

- Johnson & Johnson

- Cook Medical

- Richard Wolf GmbH

Segments Covered in the Report

By Product

- Flexible Endoscopes

- Bronchoscopes

- Laryngoscopes

- Sigmoidoscopes

- Upper Gastrointestinal Endoscopes

- Duodenoscopes

- Colonoscopes

- Pharyngoscopes

- Nasopharyngoscopes

- Others

- Capsule Endoscopes

- Robot Assisted Endoscopes

- Rigid Endoscopes

- Urology Endoscopes

- Laparoscopes

- Arthroscopes

- Cystoscopes

- Neuroendoscopes

- Others

- Disposable Endoscopes

By Application

- Arthroscopy

- Urology Endoscopy

- Laparoscopy

- Gastrointestinal (GI) Endoscopy

- Bronchoscopy

- Mediastinoscopy

- Gynecology Endoscopy

- Otoscopy

- Laryngoscopy

- Others

By End-Use

- Ambulatory Surgery Centers

- Hospitals

- Others

TABLE OF CONTENT

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Endoscopes Market

5.1. COVID-19 Landscape: U.S. Endoscopes Industry Impact

5.2. COVID 19 – Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global U.S. Endoscopes Market, By Product

8.1. U.S. Endoscopes Market Revenue and Volume, by Product, 2024-2033

8.1.1 Flexible Endoscopes

8.1.1.1. Market Revenue and Volume Forecast (2021-2033)

8.1.2. Capsule Endoscopes

8.1.2.1. Market Revenue and Volume Forecast (2021-2033)

8.1.3. Robot Assisted Endoscopes

8.1.3.1. Market Revenue and Volume Forecast (2021-2033)

8.1.4. Rigid Endoscopes

8.1.4.1. Market Revenue and Volume Forecast (2021-2033)

8.1.5. Disposable Endoscopes

8.1.5.1. Market Revenue and Volume Forecast (2021-2033)

Chapter 9. Global U.S. Endoscopes Market, By Application

9.1. U.S. Endoscopes Market Revenue and Volume, by Application, 2024-2033

9.1.1. Arthroscopy

9.1.1.1. Market Revenue and Volume Forecast (2021-2033)

9.1.2. Urology Endoscopy

9.1.2.1. Market Revenue and Volume Forecast (2021-2033)

9.1.3. Laparoscopy

9.1.3.1. Market Revenue and Volume Forecast (2021-2033)

9.1.4. Gastrointestinal (GI) Endoscopy

9.1.4.1. Market Revenue and Volume Forecast (2021-2033)

9.1.5. Bronchoscopy

9.1.5.1. Market Revenue and Volume Forecast (2021-2033)

9.1.6. Mediastinoscopy

9.1.6.1. Market Revenue and Volume Forecast (2021-2033)

9.1.7. Gynecology Endoscopy

9.1.7.1. Market Revenue and Volume Forecast (2021-2033)

9.1.8. Otoscopy

9.1.8.1. Market Revenue and Volume Forecast (2021-2033)

9.1.9. Laryngoscopy

9.1.9.1. Market Revenue and Volume Forecast (2021-2033)

9.1.10. Others

9.1.10.1. Market Revenue and Volume Forecast (2021-2033)

Chapter 10. Global U.S. Endoscopes Market, By End-Use

10.1. U.S. Endoscopes Market Revenue and Volume, by End-Use, 2024-2033

10.1.1. Ambulatory Surgery Centers

10.1.1.1. Market Revenue and Volume Forecast (2021-2033)

10.1.2. Hospitals

10.1.2.1. Market Revenue and Volume Forecast (2021-2033)

10.1.3. Others

10.1.3.1. Market Revenue and Volume Forecast (2021-2033)

Chapter 11. Global U.S. Endoscopes Market, Regional Estimates and Trend Forecast

11.1. U.S.

11.1.1. Market Revenue and Volume Forecast, by Product (2021-2033)

11.1.2. Market Revenue and Volume Forecast, by Application (2021-2033)

11.1.3. Market Revenue and Volume Forecast, by End-Use (2021-2033)

Chapter 12. Company Profiles

12.1. Olympus Corporation

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Stryker Corporation

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Ethicon Endo-Surgery, Inc

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Boston Scientific

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Arthrex, Inc.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. ConMed

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Medtronic

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Johnson & Johnson

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Cook Medical

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Richard Wolf GmbH

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/