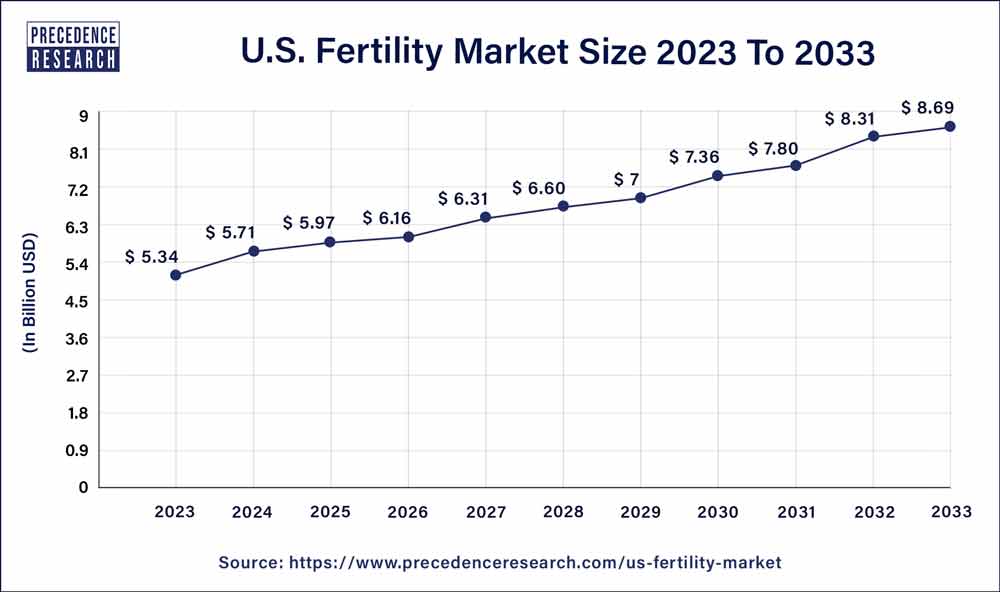

The U.S. fertility market size accouted for USD 5.34 billion in 2023 and is projected to reach around USD 8.69 billion by 2033, growing at a CAGR of 4.78% from 2024 to 2033.

Key Takeaways

- By offering, the assisted reproductive technology segment dominated the market in 2023.

- By end-user, the fertility clinics segment dominated the U.S. fertility market in 2023 and the segment is observed to sustain the dominance throughout the forecast period.

The U.S. fertility market is a dynamic and rapidly evolving sector within the healthcare industry. It encompasses a wide range of services, including fertility treatments, assisted reproductive technologies (ART), fertility drugs, and related diagnostic procedures. With changing societal trends such as delayed childbearing and increasing awareness about fertility issues, the demand for fertility services in the United States has been steadily growing. This market caters to individuals and couples facing infertility challenges, as well as those seeking options for family planning and reproductive health.

Get a Sample: https://www.precedenceresearch.com/sample/3751

Growth Factors:

List of Contents

ToggleSeveral factors contribute to the growth of the fertility market in the United States. One key driver is the rising prevalence of infertility, which is influenced by factors such as advanced maternal age, lifestyle changes, and medical conditions like polycystic ovary syndrome (PCOS). Additionally, advancements in reproductive medicine and technologies have expanded the range of treatment options available to individuals and couples, driving demand for fertility services. Furthermore, increasing societal acceptance of non-traditional family structures, including single parenthood and same-sex parenting, has widened the customer base for fertility clinics and providers.

U.S. Fertility Market Scope

| Report Coverage | Details |

| U.S. Market Size in 2023 | USD 5.34 Billion |

| U.S. Market Size by 2033 | USD 8.69 Billion |

| Growth Rate from 2024 to 2033 | CAGR of 4.78% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Offering and By End User |

U.S. Fertility Market Dynamics

Drivers:

The availability of insurance coverage for fertility treatments is a significant driver of market growth in the United States. As more insurance plans include coverage for infertility diagnosis and treatments, individuals and couples are more likely to seek professional assistance, thereby boosting demand for fertility services. Moreover, the growing trend of medical tourism for fertility treatments has contributed to market expansion, with patients traveling to the United States from countries with limited access to advanced reproductive technologies or restrictive regulations.

Restraints:

Despite the growth opportunities, the U.S. fertility market also faces several challenges and restraints. One major barrier is the high cost of fertility treatments, which can be prohibitive for many individuals and families, particularly those without insurance coverage. This financial burden often leads to disparities in access to fertility services, with lower-income individuals and marginalized communities facing barriers to care. Additionally, ethical and regulatory concerns surrounding emerging technologies like mitochondrial replacement therapy (MRT) and genome editing pose regulatory hurdles and public scrutiny, potentially limiting the adoption of these innovative treatments.

Opportunity:

The U.S. fertility market presents significant opportunities for expansion and innovation. As advancements in technology continue to improve success rates and reduce the cost of fertility treatments, there is a growing emphasis on personalized medicine and tailored treatment approaches. Genetic testing and screening services offer opportunities for early detection of fertility issues and informed decision-making regarding treatment options. Moreover, the integration of telemedicine and digital health platforms into fertility care delivery has the potential to enhance access, convenience, and patient engagement, particularly in underserved rural areas.

Read Also: Pharmaceutical Contract Manufacturing Market Size, Trend, Growth Report 2033

Recent Developments

- In January 2024, the creative co-branding venture between Ivy Reproductive, an international center for family-building services, and SMP Pharmacy Solutions, a reproductive specialist pharmacy, aims to improve the patient experience at all 13 of Ivy’s fertility centers.

- In June 2023, Prominent ovarian biology-focused biotechnology company Celmatix Inc. has discovered encouraging early leads in its most recent therapeutic development, which aims to create the first oral FSH receptor (FSHR) agonist medication ever. The cutting-edge experimental product has the power to change infertility therapies completely.

U.S. Fertility Market Companies

- Boston IVF Fertility Clinic

- INVO Bioscience

- San Diego Fertility Center

- Celmatix

- FUJIFILM IRVINE SCIENTIFIC

- Carolinas Fertility Institute

- Progyny Inc.

- Cook Medical

Segments Covered in the Report

By Offering

- Assisted Reproductive Technology

- IVF

- Artificial Insemination

- Surrogacy

- Others

- Fertility Drugs

- Gonadotropin

- Anti-estrogen

- Others

- Others

By End User

- Fertility Clinics

- Hospitals

- Clinical Research Institutes

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/