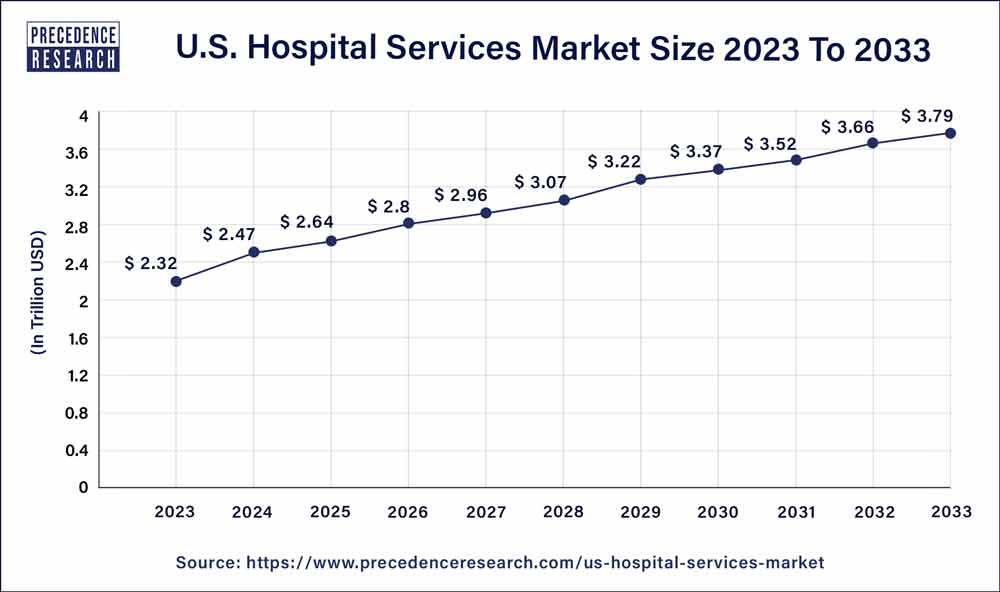

U.S. Hospital Services Market Size to Cross USD 3.79 Trn By 2033

The U.S. hospital services market size was valued at USD 2.32 trillion in 2023 and is expected to hit around USD 3.79 trillion by 2033, growing at a CAGR of 4.85% from 2024 to 2033.

Key Takeaways

List of Contents

Toggle- By hospital type, the public/community hospital segment held the largest market share of 53% in 2023.

- By service type, the outpatient services segment held the largest share of 52% in 2023.

- By service area, the cardiovascular segment held the largest share of 22% in 2023.

- By service area, the cancer care segment is expected to witness the fastest rate of growth during the forecast period of 2024-2033.

Introduction:

The U.S. Hospital Services Market is a vital component of the nation’s healthcare system, encompassing a wide range of medical facilities, services, and resources dedicated to patient care. With a diverse landscape of public, private, and non-profit institutions, the sector plays a pivotal role in providing essential healthcare services to individuals across the country. From primary care to specialized treatments, hospitals serve as crucial hubs for diagnosis, treatment, and rehabilitation, catering to the diverse needs of patients of all ages and backgrounds.

Get a Sample: https://www.precedenceresearch.com/sample/3708

Growth Factors

Several key factors contribute to the growth of the U.S. Hospital Services Market. Technological advancements in medical equipment and procedures continually enhance the quality and efficacy of healthcare delivery, driving demand for hospital services. Additionally, demographic trends such as an aging population and increasing prevalence of chronic diseases fuel the need for specialized care and long-term medical services. Moreover, expansions in healthcare coverage and government initiatives to improve access to care further stimulate market growth by increasing patient volumes and healthcare utilization rates.

U.S. Hospital Services Market Scope

| Report Coverage | Details |

| U.S. Market Size in 2023 | USD 2.32 Trillion |

| U.S. Market Size by 2033 | USD 3.79 Trillion |

| Growth Rate from 2024 to 2033 | CAGR of 4.85% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Hospital Type, By Service Type, and By Service Areas |

U.S. Hospital Services Market Dynamics

Drivers:

Several drivers propel the growth and evolution of the U.S. Hospital Services Market. One significant driver is the increasing focus on preventive care and population health management, leading hospitals to invest in wellness programs, screenings, and community outreach initiatives. Furthermore, advancements in data analytics and electronic health records enable hospitals to optimize operations, enhance clinical decision-making, and improve patient outcomes. Additionally, strategic collaborations between hospitals, insurers, and other healthcare stakeholders facilitate care coordination, cost containment, and value-based care delivery models, driving efficiency and quality improvement efforts across the sector.

Restraints:

Despite its growth prospects, the U.S. Hospital Services Market faces certain constraints and challenges. One major restraint is the escalating cost of healthcare, driven by factors such as rising drug prices, labor expenses, and regulatory compliance burdens. These cost pressures strain hospital budgets, limit investment capacity, and challenge financial sustainability, particularly for smaller, independent institutions. Additionally, workforce shortages, particularly in specialized fields such as nursing and primary care, pose operational challenges and hinder capacity expansion efforts, impacting patient access and quality of care.

Opportunities:

Despite the challenges, the U.S. Hospital Services Market presents significant opportunities for innovation, collaboration, and growth. Technological advancements such as telemedicine, artificial intelligence, and remote monitoring hold promise for expanding access to care, improving patient engagement, and reducing healthcare disparities. Furthermore, shifts towards value-based care reimbursement models incentivize hospitals to prioritize quality, efficiency, and patient satisfaction, fostering opportunities for care delivery redesign and performance improvement initiatives. Moreover, strategic investments in infrastructure, workforce development, and population health management enable hospitals to enhance competitiveness, expand service offerings, and position themselves for long-term success in a rapidly evolving healthcare landscape.

Read Also: Coenzyme Q10 Market Size to Attain USD 1,700.46 Million By 2033

Recent Developments

- In November 2023, to better serve patients, regulators, and healthcare professionals, AstraZeneca developed Evinova, which is poised to become a prominent supplier of digital health solutions. Evinova provides globally-scaled digital solutions and services to the life sciences and healthcare industry, with long-term support from AstraZeneca and key partnerships with Parexel and Fortrea.

- In March 2023, Health systems, providers, payers, and employer groups can now more effectively motivate and establish deep connections with patients virtually from anywhere with the launch of Philips Virtual Care Management, a comprehensive portfolio of flexible solutions and services from Royal Philips, a global leader in health technology. By lowering emergency room visits and improving the treatment of chronic diseases, Philips Virtual Care treatment can help reduce the burden on hospital staff and save healthcare costs.

U.S. Hospital Services Market Companies

- Mayo clinic

- HCA Healthcare

- Cleveland clinic

- Ascension Health

- Community Health Systems, Inc.

- Tenet Healthcare

- MIT Health

- Universal Health Services

- Trinity Health

- Lifepoint Health, Inc.

Segments Covered in the Report

By Hospital Type

- State-owned Hospital

- Private Hospital

- Public/ Community Hospital

By Service Type

- Outpatient Services

- Inpatient Service

By Service Areas

- Cardiovascular

- Acute Care

- Cancer Care

- Diagnostics, and Imaging

- Neurorehabilitation & Psychiatry Services

- Gynecology

- Others

TABLE OF CONTENT

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology (Premium Insights)

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Hospital Services Market

5.1. COVID-19 Landscape: U.S. Hospital Services Industry Impact

5.2. COVID 19 – Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Hospital Services Market, By Hospital Type

8.1. U.S. Hospital Services Market, by Hospital Type, 2024-2033

8.1.1 State-owned Hospital

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Private Hospital

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Public/Community Hospital

8.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 9. U.S. Hospital Services Market, By Service Type

9.1. U.S. Hospital Services Market, by Service Type, 2024-2033

9.1.1. Outpatient Services

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Inpatient Service

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. U.S. Hospital Services Market, By Service Areas

10.1. U.S. Hospital Services Market, by Service Areas, 2024-2033

10.1.1. Cardiovascular

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Acute Care

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Cancer Care

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. Diagnostics, and Imaging

10.1.4.1. Market Revenue and Forecast (2021-2033)

10.1.5. Neurorehabilitation & Psychiatry Services

10.1.5.1. Market Revenue and Forecast (2021-2033)

10.1.6. Gynecology

10.1.6.1. Market Revenue and Forecast (2021-2033)

10.1.7. Others

10.1.7.1. Market Revenue and Forecast (2021-2033)

Chapter 11. U.S. Hospital Services Market and Trend Forecast

11.1. U.S.

11.1.1. Market Revenue and Forecast, by Hospital Type (2021-2033)

11.1.2. Market Revenue and Forecast, by Service Type (2021-2033)

11.1.3. Market Revenue and Forecast, by Service Areas (2021-2033)

Chapter 12. Company Profiles

12.1. Mayo clinic

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. HCA Healthcare

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Cleveland clinic

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Ascension Health

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Community Health Systems, Inc.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Tenet Healthcare

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. MIT Health

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Universal Health Services

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Trinity Health

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Lifepoint Health, Inc.

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/