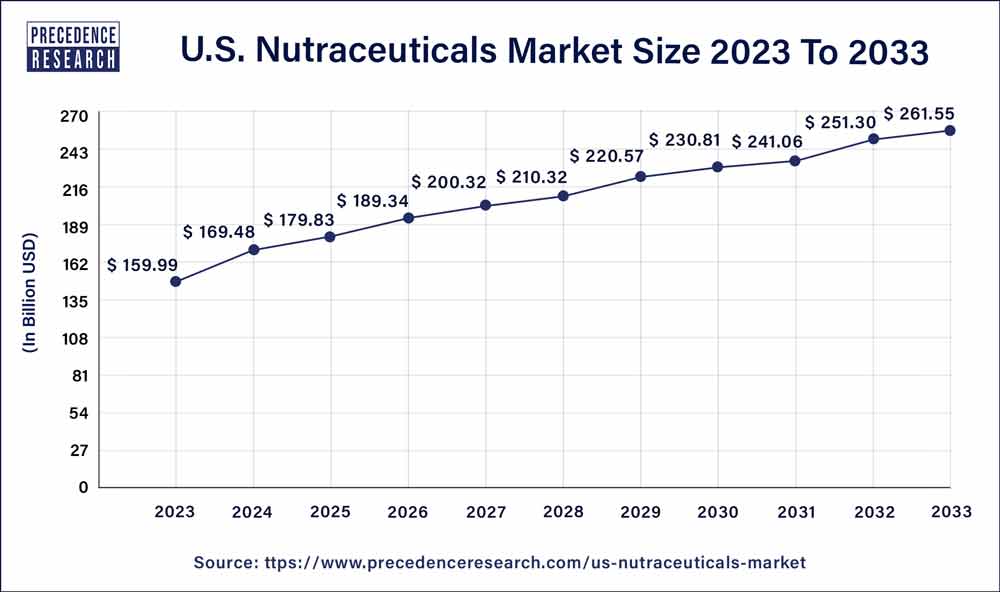

U.S. Nutraceuticals Market Size to Rise USD 261.55 Bn by 2033

The U.S. nutraceuticals market size reached USD 159.99 billion in 2023 and is expected to surpass around USD 261.55 billion by 2033 with a CAGR of 4.94% from 2024 to 2033.

Key Points

- By type, the functional food segment dominated the market in 2023.

- By type, the dietary supplements segment is observed to grow at a faster rate during the forecast period.

- By form, the tablets & soft gels segment dominated the U.S. nutraceuticals market in 2023.

- By sales channel, the offline segment dominated the market in 2023.

- By sales channel, the online segment is expected to witness the fastest rate of expansion during the forecast period.

The U.S. nutraceuticals market is a thriving sector encompassing a wide range of products aimed at promoting health and wellness. Nutraceuticals, which include dietary supplements, functional foods, and beverages fortified with beneficial ingredients, have gained significant popularity among consumers seeking proactive approaches to maintaining their well-being. This market segment is characterized by a diverse array of products catering to various health concerns, ranging from immunity support to weight management and beyond.

Get a Sample: https://www.precedenceresearch.com/sample/3768

Growth Factors:

List of Contents

ToggleSeveral factors contribute to the robust growth of the U.S. nutraceuticals market. One key driver is the increasing consumer awareness and interest in preventive healthcare, driven by a growing emphasis on healthy lifestyles and disease prevention. Additionally, advancements in nutritional science and research have led to the development of innovative nutraceutical products with enhanced efficacy and safety profiles. The expanding aging population and rising prevalence of chronic diseases further fuel demand for nutraceuticals, as individuals seek natural and holistic approaches to address health issues and improve overall quality of life.

U.S. Nutraceuticals Market Scope

| Report Coverage | Details |

| U.S. Market Size in 2023 | USD 159.99 Billion |

| U.S. Market Size by 2033 | USD 261.55 Billion |

| Growth Rate from 2024 to 2033 | CAGR of 4.94% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Type, By Form, and By Sales Channel |

U.S. Nutraceuticals Market Dynamics

Drivers:

The U.S. nutraceuticals market is propelled by various drivers that shape its growth trajectory. A significant driver is the rising adoption of wellness trends and holistic approaches to health management among consumers. Moreover, the convenience and accessibility of nutraceutical products through multiple distribution channels, including retail outlets, e-commerce platforms, and direct selling networks, contribute to market expansion. Furthermore, endorsements from healthcare professionals, celebrities, and social media influencers play a pivotal role in influencing consumer purchasing decisions, fostering trust and credibility in nutraceutical brands.

Restraints:

Despite its promising growth prospects, the U.S. nutraceuticals market faces certain challenges and restraints. Regulatory complexities and evolving legal frameworks pose hurdles for market participants in terms of product registration, labeling requirements, and claims substantiation. Moreover, concerns regarding product safety, quality, and efficacy necessitate stringent quality control measures and transparency in manufacturing processes. Additionally, consumer skepticism and misinformation surrounding nutraceuticals’ effectiveness and potential side effects may impede market penetration and consumer acceptance.

Opportunities:

The U.S. nutraceuticals market presents abundant opportunities for innovation, diversification, and market expansion. Rapid advancements in biotechnology, nanotechnology, and ingredient delivery systems offer avenues for developing next-generation nutraceutical formulations with improved bioavailability and targeted health benefits. Furthermore, strategic collaborations between nutraceutical companies and healthcare providers, research institutions, and government agencies can facilitate evidence-based research, product development, and market access. Additionally, tapping into niche segments such as personalized nutrition, sports nutrition, and beauty-from-within products can unlock new growth opportunities and cater to evolving consumer preferences and lifestyle trends.

Read Also: Composable Applications Market Size Reach USD 27.71 Bn by 2033

Recent Developments

- In December 2023, USV Pvt Ltd and Biogenomics launched Insuquick, a biosimilar Insulin Aspart intended for Indian patients with diabetes.

- In May 2022, Unilever announced an agreement to purchase a majority stake in Nutrafol, a well-known supplier of hair wellness products. Through Unilever Ventures, Unilever now has a minority share (13.2%) in Nutrafol.

U.S. Nutraceuticals Market Companies

- DSM

- Amway

- Pfizer Inc.

- Nestle

- Nature’s Bounty

- General Mills Inc.

- Danone

- The Kraft Heinz Company

- The Hain Celestial Group, Inc.

- Tyson Foods

Segments Covered in the Report

By Type

- Dietary Supplements

- Vitamins

- Botanicals

- Minerals

- Proteins & Amino Acids

- Fibers & Specialty Carbohydrates

- Omega Fatty Acids

- Others

- Functional Beverages

- Energy Drinks

- Sports Drinks

- Functional Juices

- Others

- Functional Food

- Carotenoids

- Dietary Fibers

- Fatty Acids

- Minerals

- Prebiotics & Probiotics

- Vitamins

- Others

- Personal Care

By Form

- Capsules

- Liquid & Gummies

- Tablets & Soft Gels

- Powder

- Others

By Sales Channel

- Offline

- Specialty Stores

- Supermarkets/Hypermarkets

- Convenience Stores

- Drug Stores/Pharmacies

- Online Retail Stores

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/