U.S. Off-road Vehicles Market Size to Surpass USD 19.09 Bn by 2033

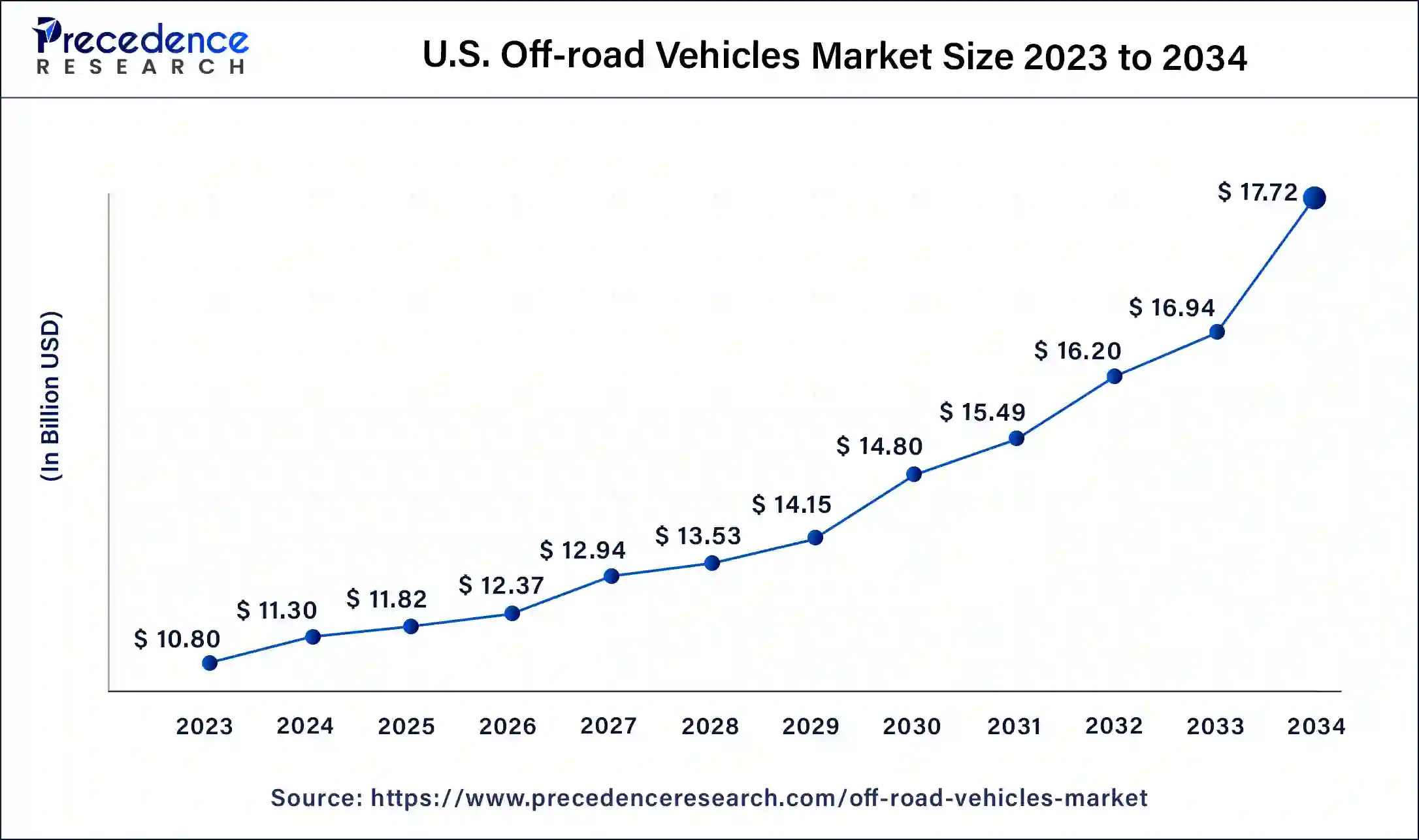

The U.S. off-road vehicles market size surpassed USD 12.63 billion in 2023 and is anticipated to exceed around USD 19.09 billion by 2033, growing at a CAGR of 4.40% from 2024 to 2033.

Key Points

- By product type, the three-wheeler segment held the largest market share of 46% in 2023.

- By product type, the service segment is anticipated to grow at a remarkable CAGR of 8.4% between 2024 and 2033.

- By propulsion type, the diesel segment generated over 47% of market share in 2023.

- By propulsion type, the gasoline segment is expected to expand at the fastest CAGR over the projected period.

- By application, the sports segment generated over 38% of the market share in 2023.

- By application, the military segment is expected to expand at the fastest CAGR over the projected period.

The U.S. off-road vehicles market is a significant and growing sector of the automotive industry. It encompasses a range of vehicles designed for off-road driving, including all-terrain vehicles (ATVs), side-by-side vehicles (SxS), dirt bikes, and other specialized vehicles. These vehicles are used for recreational activities such as trail riding, racing, and hunting, as well as for agricultural and industrial purposes. The market has been expanding due to rising interest in outdoor sports and adventures.

Get a Sample: https://www.precedenceresearch.com/sample/4099

Growth Factors:

The U.S. off-road vehicles market is experiencing growth due to several factors. Increasing disposable incomes and a growing interest in outdoor recreational activities are driving demand. Additionally, advancements in vehicle technology, such as enhanced safety features and fuel efficiency, have made off-road vehicles more appealing to a broader audience. The availability of financing options and after-sales services also contributes to market growth.

U.S. Off-road Vehicles Market Data and Statistics

- In August 2022, Polaris introduced its latest flagship RZR Pro R Sport ATV model in India, boasting a robust 1997 cc 4-stroke DOHC inline four-cylinder engine that generates a formidable 225 bhp of maximum power.

- Also in 2022, Arctic Cat debuted the new Alterra 600 ATV, available in four distinct trim levels.

- In April 2021, Arctic Cat unveiled a new addition to its 2022 model year lineup, the Alterra 600 EPS, featuring a redesigned engine, drivetrain, and chassis, promising enhanced power, improved handling, and simplified servicing. Dealerships began stocking this model in July.

- February 2022 marked the entry of American Landmaster into the electric UTV market, offering electric-powered UTVs with a towing capacity of 1,200 lbs in both 2-door and 4-door configurations, operating in 4X2 driving mode.

- Also in February 2022, Segway Powersports expanded the availability of its Fugleman side-by-side vehicle to over 40 dealerships across the United States.

- Back in June 2020, Kawasaki unveiled its 2020 lineup of MULE and ATV vehicles, encompassing the Brute Force ATV series, MULE PRO lineup, and SX series.

Region Insights:

The off-road vehicles market is strong across various regions in the U.S., with notable market activity in states like California, Texas, and Florida due to their favorable climates and abundant off-road trails. The Midwest and Southeast also have a significant market presence, supported by a culture of outdoor activities and agriculture.

U.S. Off-road Vehicles Market Scope

| Report Coverage | Details |

| U.S. Market Size in 2023 | USD 12.63 Billion |

| U.S. Market Size in 2024 | USD 13.16 Billion |

| U.S. Market Size by 2033 | USD 19.09 Billion |

| Growth Rate from 2024 to 2033 | CAGR of 4.40% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Product Type, By Propulsion Type, and By Application |

U.S. Off-road Vehicles Market Dynamics

Drivers:

Key drivers for the U.S. off-road vehicles market include the growing popularity of outdoor and adventure sports, particularly among younger generations. There is also increased demand for off-road vehicles for commercial use, such as in farming and construction. Technological innovations in off-road vehicle design, including electric and hybrid models, are further fueling market expansion.

Opportunities:

Opportunities in the market include the development of electric off-road vehicles, which offer an environmentally friendly alternative to traditional gas-powered models. Manufacturers can also capitalize on the customization trend by offering personalized features and accessories. Additionally, expanding into new regions and markets, both domestically and internationally, presents further growth potential.

Challenges:

Challenges facing the U.S. off-road vehicles market include regulatory and environmental concerns, such as emissions standards and land-use restrictions that may limit access to off-road areas. Market players must also navigate competition from other types of recreational vehicles, such as snowmobiles and watercraft, which can impact sales. Ensuring safety and reliability while managing production costs is another hurdle that manufacturers must overcome.

Read Also: Oral Rinse Market Size to Surpass USD 13.70 Billion by 2033

Recent Developments

- In June 2023, Polaris Inc. revealed that it had secured a $700,000 grant aimed at facilitating the development of an electric vehicle (EV) charging infrastructure designed specifically for off-road vehicles. This initiative will be implemented within a public off-road trail system located in Michigan’s Upper Peninsula. The grant originates from the Mobility Public-Private Partnership & Programming (MP4) Grant, which is part of the Michigan Office of Future Mobility & Electrification’s efforts to strengthen the state’s mobility sector, including the outdoor recreation industry, through the adoption of electric and technologically enhanced vehicles.

- Also in June 2023, Kawasaki Motors Corp., U.S.A., announced the continuation of its partnership with TrueTimber. Commencing from the 2024 model year, TrueTimber will exclusively provide camouflage patterns for a range of Kawasaki models, including the newly introduced Kawasaki MULE PRO-FXT™ 1000.

U.S. Off-road Vehicles Market Companies

- Polaris Inc.

- Arctic Cat Inc.

- Yamaha Motor Corporation

- Honda Motor Co., Ltd.

- Kawasaki Motors Corp., U.S.A.

- Can-Am (BRP)

- Suzuki Motor Corporation

- John Deere

- Textron Inc.

- Kubota Corporation

- Kymco

- CFMOTO

- Mahindra & Mahindra Limited

- Massimo Motor

- American Landmaster

Segments Covered in the Report

By Product Type

- All-Terrain Vehicle

- Utility Terrain Vehicle

- Snowmobile

- Three-Wheeler

By Propulsion Type

- Gasoline

- Diesel

- Electric

By Application

- Utility

- Sports

- Recreation

- Military

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/