U.S. Payment Integrity Market Size to Surpass USD 10.27 Bn by 2033

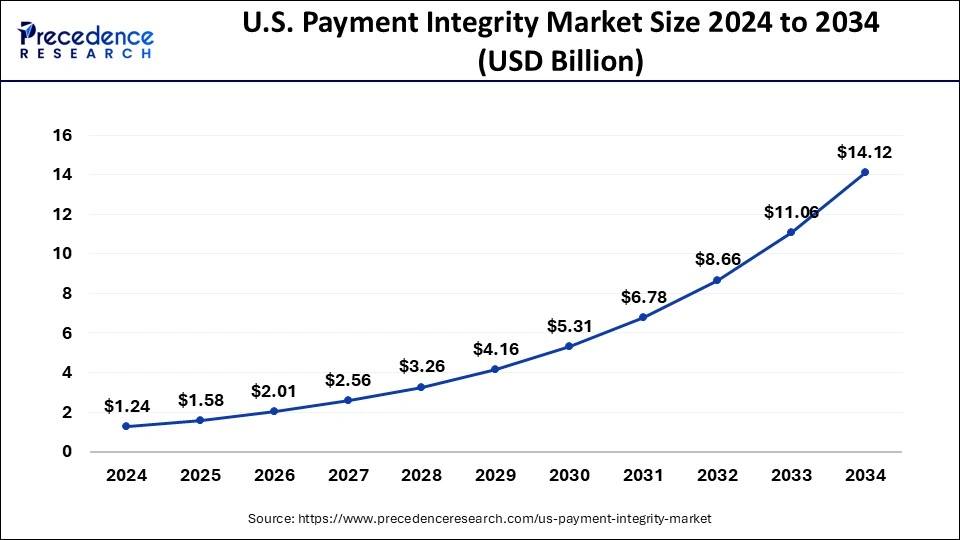

The U.S. payment integrity market size is calculated at USD 1.24 billion in 2024 and is projected to surpass around USD 10.27 billion by 2033, at a significant CAGR of 26% from 2024 to 2033.

U.S. Payment Integrity Market Statistics

- By Component, the software segment contributed more than 63.10% of revenue share in 2023.

- By Function, the OLAP & visualization segment dominated the market and registered more than 40.10% revenue share in 2023.

- By Application, the post-payment segment accounted for more than 49.80% of revenue share in 2023.

- By Mode of Delivery, the on-premises segment dominated the market and captured more than 55.95% revenue share in 2023.

- By End Use, the healthcare providers segment led the market and contributed more than 64.75% of revenue share in 2023.

The U.S. Payment Integrity market encompasses a range of technologies and solutions aimed at reducing improper payments across various sectors, including healthcare, government, and financial services. It focuses on preventing fraud, waste, and abuse, thereby optimizing financial transactions and ensuring compliance with regulatory standards.

Get a Sample: https://www.precedenceresearch.com/sample/3060

U.S. Payment Integrity Market Trends

- Increasing Regulatory Scrutiny: There’s growing regulatory focus on payment integrity across sectors like healthcare and financial services. Regulations aim to improve transparency, accountability, and reduce fraud.

- Advanced Analytics and AI: Adoption of advanced analytics, machine learning, and AI is rising. These technologies help detect anomalies, predict fraud patterns, and enhance decision-making in real-time.

- Integration of Blockchain: Blockchain technology is being explored to improve payment security and transparency. It offers immutable transaction records, reducing the risk of fraud and ensuring integrity.

- Collaborative Approaches: Stakeholders are increasingly collaborating to combat fraud. Public-private partnerships, data sharing agreements, and collaborative tools are enhancing detection capabilities.

- Focus on Data Security: With increased digital transactions, there’s a heightened focus on data security and privacy. Encryption, secure data storage, and compliance with data protection regulations are critical.

U.S. Payment Integrity Market Scope

| Report Coverage | Details |

| Market Size in 2023 | USD 0.98 Billion |

| Market Size by 2033 | USD 10.27 Billion |

| Growth Rate from 2024 to 2033 | CAGR of 26% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Component, By Function, By Application, By Mode of Delivery, and By End Use |

Component Insights

The U.S. Payment Integrity Market is driven by essential components that ensure the accuracy and reliability of financial transactions. Software solutions form a critical part of this ecosystem, offering advanced analytics and real-time monitoring capabilities to detect anomalies and mitigate risks effectively. Complemented by robust hardware infrastructure including servers and data storage devices, these components support the seamless processing and secure handling of payment data. Additionally, services such as consulting and support play a crucial role in integrating and maintaining these systems, ensuring optimal performance and compliance with industry standards.

U.S. Payment Integrity Market, By Component, 2022-2032 (USD Million)

| By Component | 2022 | 2023 | 2027 | 2032 |

| Software | 486.52 | 618.38 | 1,626.54 | 5,545.27 |

| Services | 285.74 | 361.62 | 934.94 | 3,119.22 |

Function Insights

Within the U.S. Payment Integrity Market, key functions focus on enhancing operational efficiency and mitigating financial risks. Fraud detection and prevention are paramount, employing sophisticated algorithms and machine learning techniques to identify and mitigate fraudulent activities in real-time. Payment accuracy functions verify claims and transactions against established rules, minimizing errors and ensuring financial compliance. Compliance management functions further bolster regulatory adherence, helping organizations navigate complex legal frameworks and maintain ethical standards in financial operations.

U.S. Payment Integrity Market, By Function, 2022-2032 (USD Million)

| By Function | 2022 | 2023 | 2027 | 2032 |

| Query & Reporting | 270.29 | 342.51 | 890.11 | 2,989.25 |

| OLAP & Visualization | 308.9 | 392.98 | 1,037.4 | 3,552.44 |

| Performance Management | 193.07 | 244.51 | 633.97 | 2,122.8 |

Application Insights

Applications of payment integrity solutions span diverse sectors, each benefiting from tailored functionalities that address specific industry challenges. In healthcare, these solutions play a crucial role in verifying claims and detecting billing errors, thereby reducing fraud and optimizing revenue cycle management. Government agencies utilize payment integrity systems to manage public funds transparently and prevent misuse or misappropriation. In banking and financial services, these systems secure transactions, detect financial crimes, and ensure compliance with stringent regulatory requirements like AML regulations.

U.S. Payment Integrity Market, By Application, 2022-2032 (USD Million)

| By Application | 2022 | 2023 | 2027 | 2032 |

| Pre-payment | 193.07 | 247.94 | 678.79 | 2,426.06 |

| Post-payment | 386.13 | 488.04 | 1,255.12 | 4,158.95 |

| FWA | 154.45 | 195.51 | 505.89 | 1,689.58 |

| Others | 38.61 | 48.51 | 121.67 | 389.9 |

Mode of Delivery Insights

The mode of delivery for payment integrity solutions varies, offering organizations flexibility in deployment and accessibility. On-premises solutions provide greater control and customization, suitable for organizations prioritizing data security and compliance with internal protocols. In contrast, cloud-based solutions offer scalability and remote accessibility, reducing upfront costs and accelerating deployment timelines. This flexibility allows organizations to choose the deployment method that best aligns with their operational needs and strategic objectives.

U.S. Payment Integrity Market, By Mode of Delivery, 2022-2032 (USD Million)

| By Mode of Delivery | 2022 | 2023 | 2027 | 2032 |

| On-Premise | 432.47 | 548.31 | 1,428.02 | 4,808.79 |

| Cloud-Based | 108.12 | 139.16 | 384.22 | 1,386.32 |

| Hybrid | 231.68 | 292.53 | 749.23 | 2,469.38 |

End Use Insights

End users of payment integrity solutions include large enterprises, SMEs, and government agencies, each leveraging these technologies to optimize financial processes and enhance operational transparency. Large corporations benefit from comprehensive payment integrity systems that streamline complex financial operations and ensure regulatory compliance. SMEs find value in these solutions by reducing operational costs and safeguarding against financial fraud. Government agencies use payment integrity systems to enhance accountability in public spending and improve service delivery across various administrative levels.

Read Also: U.S. Supplemental Health Market Size, Trends, Report By 2033

U.S. Payment Integrity Market Dynamics

Drivers:

Several factors drive the growth of the U.S. Payment Integrity market. Firstly, increasing regulatory scrutiny and the need for transparency in financial transactions have propelled organizations to invest in robust payment integrity solutions. Moreover, the rising incidence of fraudulent activities, especially in healthcare and government sectors, has heightened the demand for advanced fraud detection and prevention technologies. Additionally, the adoption of digital payment methods and the proliferation of complex payment ecosystems have necessitated more sophisticated tools to ensure payment accuracy and security.

Opportunities:

The market presents significant opportunities for innovation and expansion. Advancements in artificial intelligence (AI) and machine learning (ML) technologies offer the potential to enhance the accuracy and efficiency of payment integrity solutions. There is also a growing trend towards integrated platforms that offer comprehensive payment integrity services across multiple sectors, providing opportunities for service providers to offer tailored solutions. Furthermore, the increasing collaboration between public and private sectors to combat financial fraud creates avenues for partnerships and new market entrants to capitalize on emerging opportunities.

Challenges:

Despite its growth prospects, the U.S. Payment Integrity market faces several challenges. One of the primary challenges is the complexity of detecting and preventing sophisticated fraudulent schemes, which requires continuous innovation in technology and analytics. Moreover, interoperability issues between different payment systems and legacy IT infrastructure pose integration challenges for organizations implementing payment integrity solutions. Additionally, concerns regarding data privacy and compliance with stringent regulatory requirements add complexity to the deployment of these solutions. Lastly, the high cost associated with implementing advanced payment integrity solutions may act as a barrier for small to medium-sized enterprises (SMEs), limiting market penetration in certain segments.

U.S. Payment Integrity Market Recent Developments

- In April 2023, NTT DATA was introduced by NTT DATA To Help Organizations Deliver Bold Digital Experiences.

- In April 2023, Conduent launched First-of-Their-Kind Digital Payment Solutions for Tolling and Other Transportation Uses

- In March 2023, NTT, NTT DATA, And INDYCAR Extended Entitlement Partnership with Multi-Year Agreement.

- In December 2022, Cognizant acquired Integration.

- In September 2022, CyberCube announced a partnership with EXL.

- In September 2022, Zelis Completed the Acquisition of Payer Compass

- In March 2022, Orono acquired CERIS Group to Develop Its Activities in the Healthcare, Pharmaceuticals, and Biotechnology Sectors

- In December 2021, EXL acquired Clairvoyant, adding scale in data, AI, and cloud engineering.

U.S. Payment Integrity Market Companies

- Cotiviti

- Optum / Change Healthcare

- Zelis

- Availity

- MultiPlan

- Ceris

- Cognizant

- EXL

- Performant

- Syrtis

- Varis

- ClarisHealth

- ClaimLogiq

- Rialtic

- HealthEdge