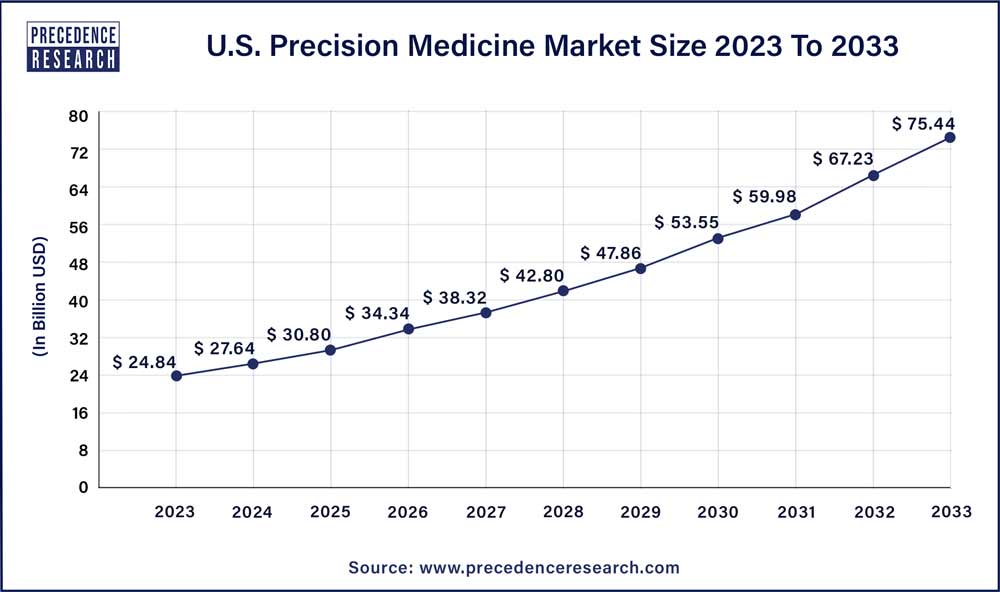

U.S. Precision Medicine Market Size to Attain USD 75.44 Bn by 2033

Key Takeaways

- By technology, the drug discovery segment held the dominating share of the market in 2023.

- By application, the oncology segment dominated the U.S. precision medicine market in 2023.

- By end-use, the pharmaceutical company segment held the largest share of the market in 2023.

- By sequencing technology, the single molecule real-time sequencing segment is expected to dominate the market over the forecast period.

- By product, the consumables segment held the largest share of the market in 2023.

- By route of administration, the oral segment held the largest share of the market in 2023.

- By drugs, the Mepolizumab segment is observed to witness significant growth during the forecast period

Introduction

The United States is at the forefront of the precision medicine revolution, leveraging advanced technologies and interdisciplinary collaborations to tailor medical treatments and interventions to individual patients. Precision medicine, also known as personalized medicine, represents a paradigm shift in healthcare, moving away from the traditional one-size-fits-all approach towards more targeted and effective therapies. This analysis delves into the dynamic landscape of precision medicine in the U.S., exploring the key factors driving its growth, the challenges it faces, the opportunities it presents, and regional dynamics shaping its implementation.

Get a Sample: https://www.precedenceresearch.com/sample/3722

Growth Factors

Several factors have contributed to the rapid growth of the precision medicine market in the United States. Advances in genomics, molecular biology, and data analytics have revolutionized our understanding of disease mechanisms and patient variability, paving the way for personalized treatment approaches. The decreasing costs of genomic sequencing and other molecular profiling technologies have made precision medicine more accessible and affordable, driving adoption among healthcare providers and patients alike. Moreover, the increasing availability of electronic health records (EHRs) and health data interoperability initiatives have facilitated the integration of genomic and clinical data, enabling more precise diagnosis, prognosis, and treatment selection.

U.S. Precision Medicine Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 11.80% |

| U.S. Market Size in 2023 | USD 24.84 Billion |

| U.S. Market Size by 2033 | USD 75.44 Billion |

| Base Year | 2024 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Technology, By Application, By End-Use, By Sequencing Technology, By Product, By Route of Administration, and By Drugs |

U.S. Precision Medicine Market Dynamics

Drivers

The adoption of precision medicine in the United States is driven by various factors, including the growing burden of chronic diseases, rising healthcare costs, and the need to improve patient outcomes. Precision medicine offers the promise of more effective therapies with fewer adverse effects, reducing the trial-and-error approach often associated with conventional treatments. Additionally, the shift towards value-based care and reimbursement models incentivizes healthcare providers to adopt precision medicine practices that deliver better outcomes at lower costs. Furthermore, patient demand for personalized healthcare experiences, coupled with increasing awareness of precision medicine advancements through media and patient advocacy groups, fuels the uptake of these innovative approaches.

Restraints

Despite its potential, precision medicine faces several challenges and restraints in the United States. One significant barrier is the complexity of translating genomic and molecular data into actionable clinical insights. Healthcare professionals require specialized training and resources to interpret and apply genetic information effectively, leading to gaps in implementation and adoption. Moreover, regulatory and reimbursement hurdles, including uncertainty around coverage and reimbursement for genomic testing and targeted therapies, pose barriers to widespread adoption. Additionally, concerns related to data privacy, security, and ethical implications of genetic testing and personalized treatments raise questions about patient acceptance and trust in precision medicine practices.

Opportunity

The precision medicine market in the United States presents significant opportunities for innovation, collaboration, and improved patient outcomes. Investments in research and development are driving the discovery of new biomarkers, therapeutic targets, and personalized treatment strategies across a wide range of diseases, including cancer, cardiovascular disorders, and rare genetic conditions. Collaborative initiatives between academia, industry, and government entities are accelerating the translation of scientific discoveries into clinical applications, fostering the development of precision medicine technologies and therapies. Moreover, the integration of artificial intelligence (AI) and machine learning algorithms into precision medicine workflows holds promise for enhancing diagnostic accuracy, treatment selection, and patient stratification, leading to more personalized and effective healthcare interventions.

Region Insights

The implementation of precision medicine varies across regions within the United States, influenced by factors such as healthcare infrastructure, access to resources, and regional disparities in health outcomes. Academic medical centers and research institutions, particularly those clustered in regions such as the Boston-Cambridge area, the San Francisco Bay Area, and the Research Triangle in North Carolina, play a central role in driving innovation and adoption of precision medicine practices. However, access to precision medicine services may be limited in rural and underserved areas due to challenges related to healthcare access, provider shortages, and disparities in healthcare delivery. Efforts to address these disparities, including telemedicine initiatives, mobile health interventions, and community-based research collaborations, aim to expand access to precision medicine and improve health equity across diverse populations.

Read Also: Solar Carport Market Size, Share, Growth Report By 2033

Recent Developments

- In March 2023, the global biotechnology company Seagen, which finds, develops, and markets revolutionary cancer medicines, was acquired by Pfizer for $229 in cash per Seagen share, amounting to a $43 billion enterprise value. Pfizer and Seagen Inc. announced that they have entered into a definitive merger agreement.

- In January 2024, the US state of California will see the establishment of a precision medicine center due to cooperation established by BIOS Health, the Kern Venture Group, and the city of Bakersfield. The facility will function as a central location for brain clinical trials and research and development (R&D) that makes use of the adaptive dosage technology from BIOS.

U.S. Precision Medicine Market Players

- Biocrates Life Sciences

- Quest Diagnostics

- NanoString Technologies

- Pfizer

- AbbVie Inc.

- AstraZeneca

- Johnson & Johnson Services, Inc

- Thermo Fisher Scientific, Inc.

- Illumina, Inc.

- ARIEL Precision Medicine, Inc.

Segments Covered in the Report

By Technology

- Bioinformatics

- Big Data Analytics

- Drug Discovery

- Gene Sequencing

- Companion Diagnostics

- Others

By Application

- CNS

- Immunology

- Oncology

- Respiratory

- Others

By End-Use

- Diagnostic Companies

- Pharmaceutical Companies

- Healthcare IT companies

- Others

By Sequencing Technology

- Sequencing by Synthesis

- Ion Semiconductor Sequencing

- Sequencing by Ligation

- Pyrosequencing

- Single Molecule Real Time Sequencing

- Chain Termination Sequencing

- Nanopore Sequencing

By Product

- Consumables

- Instruments

- Services

By Route of Administration

- Oral

- Injectable

By Drugs

- Alectinib

- Osimertinib

- Mepolizumab

- Aripiprazole Lauroxil

- Others

TABLE OF CONTENT

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology (Premium Insights)

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. Market Dynamics Analysis and Trends

5.1. Market Dynamics

5.1.1. Market Drivers

5.1.2. Market Restraints

5.1.3. Market Opportunities

5.2. Porter’s Five Forces Analysis

5.2.1. Bargaining power of suppliers

5.2.2. Bargaining power of buyers

5.2.3. Threat of substitute

5.2.4. Threat of new entrants

5.2.5. Degree of competition

Chapter 6. Competitive Landscape

6.1.1. Company Market Share/Positioning Analysis

6.1.2. Key Strategies Adopted by Players

6.1.3. Vendor Landscape

6.1.3.1. List of Suppliers

6.1.3.2. List of Buyers

Chapter 7. Global U.S. Precision Medicine Market, By Technology

7.1. U.S. Precision Medicine Market Revenue and Volume, by Technology, 2024-2033

7.1.1. Bioinformatics

7.1.1.1. Market Revenue and Volume Forecast (2021-2033)

7.1.2. Big Data Analytics

7.1.2.1. Market Revenue and Volume Forecast (2021-2033)

7.1.3. Drug Discovery

7.1.3.1. Market Revenue and Volume Forecast (2021-2033)

7.1.4. Gene Sequencing

7.1.4.1. Market Revenue and Volume Forecast (2021-2033)

7.1.5. Companion Diagnostics

7.1.6.1. Market Revenue and Volume Forecast (2021-2033)

7.1.6. Others

7.1.5.1. Market Revenue and Volume Forecast (2021-2033)

Chapter 8. Global U.S. Precision Medicine Market, By Application

8.1. U.S. Precision Medicine Market Revenue and Volume, by Application, 2024-2033

8.1.1. CNS

8.1.1.1. Market Revenue and Volume Forecast (2021-2033)

8.1.2. Immunology

8.1.2.1. Market Revenue and Volume Forecast (2021-2033)

8.1.3. Oncology

8.1.3.1. Market Revenue and Volume Forecast (2021-2033)

8.1.4. Respiratory

8.1.4.1. Market Revenue and Volume Forecast (2021-2033)

8.1.5. Others

8.1.5.1. Market Revenue and Volume Forecast (2021-2033)

Chapter 9. Global U.S. Precision Medicine Market, By End-Use

9.1. U.S. Precision Medicine Market Revenue and Volume, by End-Use, 2024-2033

9.1.1. Diagnostic Companies

9.1.1.1. Market Revenue and Volume Forecast (2021-2033)

9.1.2. Pharmaceutical Companies

9.1.2.1. Market Revenue and Volume Forecast (2021-2033)

9.1.3. Healthcare IT companies

9.1.3.1. Market Revenue and Volume Forecast (2021-2033)

9.1.4. Others

9.1.4.1. Market Revenue and Volume Forecast (2021-2033)

Chapter 10. Global U.S. Precision Medicine Market, By Sequencing Technology

10.1. U.S. Precision Medicine Market Revenue and Volume, by Sequencing Technology, 2024-2033

10.1.1. Sequencing by Synthesis

10.1.1.1. Market Revenue and Volume Forecast (2021-2033)

10.1.2. Ion Semiconductor Sequencing

10.1.2.1. Market Revenue and Volume Forecast (2021-2033)

10.1.3. Sequencing by Ligation

10.1.3.1. Market Revenue and Volume Forecast (2021-2033)

10.1.4. Pyrosequencing

10.1.4.1. Market Revenue and Volume Forecast (2021-2033)

10.1.5. Single Molecule Real Time Sequencing

10.1.5.1. Market Revenue and Volume Forecast (2021-2033)

10.1.6. Chain Termination Sequencing

10.1.6.1. Market Revenue and Volume Forecast (2021-2033)

10.1.7. Nanopore Sequencing

10.1.7.1. Market Revenue and Volume Forecast (2021-2033)

Chapter 11. Global U.S. Precision Medicine Market, By Product

11.1. U.S. Precision Medicine Market Revenue and Volume, by Product, 2024-2033

11.1.1. Consumables

11.1.1.1. Market Revenue and Volume Forecast (2021-2033)

11.1.2. Instruments

11.1.2.1. Market Revenue and Volume Forecast (2021-2033)

11.1.3. Services

11.1.3.1. Market Revenue and Volume Forecast (2021-2033)

Chapter 12. Global U.S. Precision Medicine Market, By Route of Administration

12.1. U.S. Precision Medicine Market Revenue and Volume, by Route of Administration, 2024-2033

12.1.1. Oral

12.1.1.1. Market Revenue and Volume Forecast (2021-2033)

12.1.2. Injectable

12.1.2.1. Market Revenue and Volume Forecast (2021-2033)

Chapter 13. Global U.S. Precision Medicine Market, By Drugs

13.1. U.S. Precision Medicine Market Revenue and Volume, by Drugs, 2024-2033

13.1.1. Alectinib

13.1.1.1. Market Revenue and Volume Forecast (2021-2033)

13.1.2. Osimertinib

13.1.2.1. Market Revenue and Volume Forecast (2021-2033)

13.1.3. Mepolizumab

13.1.3.1. Market Revenue and Volume Forecast (2021-2033)

13.1.4. Aripiprazole Lauroxil

13.1.4.1. Market Revenue and Volume Forecast (2021-2033)

13.1.5. Others

13.1.5.1. Market Revenue and Volume Forecast (2021-2033)

Chapter 14. Global U.S. Precision Medicine Market, Regional Estimates and Trend Forecast

14.1. U.S.

14.1.1. Market Revenue and Volume Forecast, by Technology (2021-2033)

14.1.2. Market Revenue and Volume Forecast, by Application (2021-2033)

14.1.3. Market Revenue and Volume Forecast, by End-Use (2021-2033)

14.1.4. Market Revenue and Volume Forecast, by Sequencing Technology (2021-2033)

14.1.5. Market Revenue and Volume Forecast, by Product (2021-2033)

14.1.6. Market Revenue and Volume Forecast, by Drugs (2021-2033)

14.1.7. Market Revenue and Volume Forecast, by Route of Administration (2021-2033)

Chapter 15. Company Profiles

15.1. Biocrates Life Sciences

15.1.1. Company Overview

15.1.2. Product Offerings

15.1.3. Financial Performance

15.1.4. Recent Initiatives

15.2. Quest Diagnostics

15.2.1. Company Overview

15.2.2. Product Offerings

15.2.3. Financial Performance

15.2.4. Recent Initiatives

15.3. NanoString Technologies

15.3.1. Company Overview

15.3.2. Product Offerings

15.3.3. Financial Performance

15.3.4. Recent Initiatives

15.4. Pfizer

15.4.1. Company Overview

15.4.2. Product Offerings

15.4.3. Financial Performance

15.4.4. Recent Initiatives

15.5. AbbVie Inc.

15.5.1. Company Overview

15.5.2. Product Offerings

15.5.3. Financial Performance

15.5.4. Recent Initiatives

15.6. AstraZeneca

15.6.1. Company Overview

15.6.2. Product Offerings

15.6.3. Financial Performance

15.6.4. Recent Initiatives

15.7. Johnson & Johnson Services, Inc

15.7.1. Company Overview

15.7.2. Product Offerings

15.7.3. Financial Performance

15.7.4. Recent Initiatives

15.8. Thermo Fisher Scientific, Inc.

15.8.1. Company Overview

15.8.2. Product Offerings

15.8.3. Financial Performance

15.8.4. Recent Initiatives

15.9. Illumina, Inc.

15.9.1. Company Overview

15.9.2. Product Offerings

15.9.3. Financial Performance

15.9.4. Recent Initiatives

15.10. ARIEL Precision Medicine, Inc.

15.10.1. Company Overview

15.10.2. Product Offerings

15.10.3. Financial Performance

15.10.4. Recent Initiatives

Chapter 16. Research Methodology

16.1. Primary Research

16.2. Secondary Research

16.3. Assumptions

Chapter 17. Appendix

17.1. About Us

17.2. Glossary of Terms

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/