U.S. Supplemental Health Market Size, Trends, Report By 2033

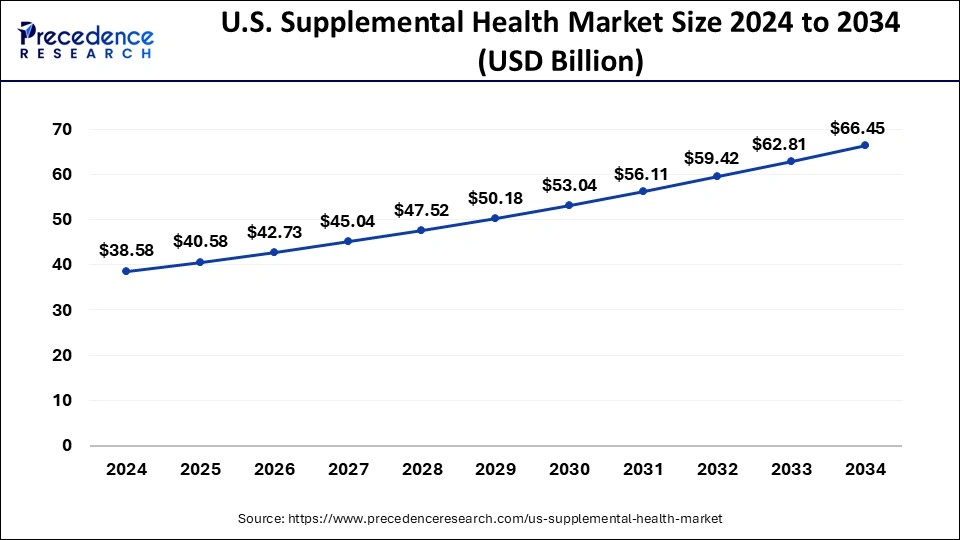

The U.S. supplemental health market size is calculated at USD 38.657 billion in 2024 and is predicted to be worth around USD 62.57 billion by 2033, growing at a CAGR of 6% from 2024 to 2033.

U.S. Supplemental Health Market Key Points

- By Product, the hospital indemnity insurance segment generated more than 21.95% of revenue share in 2023.

- By Distribution Channel, the brokers segment contributed more than 60.55% of revenue share in 2023.

- By Demography, the individuals aged 65 and above segment dominated the market and accounted more than 96.95% of revenue share in 2023.

The U.S. supplemental health market encompasses a range of insurance products designed to complement traditional health coverage by providing additional financial support for out-of-pocket expenses not covered by standard health plans. This includes expenses like deductibles, co-payments, and other healthcare-related costs that may not be fully covered by primary insurance. The market has seen significant growth in recent years due to rising healthcare costs and increasing consumer awareness about the need for additional financial protection against medical expenses.

Get a Sample: https://www.precedenceresearch.com/sample/3063

U.S. Supplemental Health Market Trends

- Increasing Demand for Critical Illness Coverage: There’s a growing interest in supplemental plans that cover critical illnesses such as cancer, heart attacks, and strokes. These plans provide lump-sum payments upon diagnosis, helping cover expenses like deductibles, copayments, and non-medical costs.

- Rise in Hospital Indemnity Plans: Hospital indemnity plans are gaining popularity due to their ability to pay fixed amounts for covered hospital stays. They supplement traditional health insurance by covering daily hospital expenses and other costs associated with inpatient care.

- Expanded Dental and Vision Coverage: Many supplemental health plans now offer comprehensive dental and vision coverage, appealing to individuals seeking additional benefits beyond basic medical insurance.

- Integration with High-Deductible Health Plans (HDHPs): Supplemental health products are often designed to complement HDHPs by covering out-of-pocket costs like deductibles and coinsurance, thereby reducing financial burdens for policyholders.

- Focus on Wellness Programs: Some supplemental plans include wellness benefits such as gym memberships, telehealth services, and preventive screenings. These additions aim to promote overall health and reduce long-term healthcare costs.

U.S. Supplemental Health Market Scope

| Report Coverage | Details |

| Market Size in 2023 | USD 36.8 Billion |

| Market Size by 2033 | USD 62.57 Billion |

| Growth Rate from 2024 to 2033 | CAGR of 6% |

| Base Year | 2023 |

| Forecast Period | 2024 To 2033 |

| Segments Covered | By Product, By Distribution Channel, and By Demography |

Product Insights

The U.S. supplemental health market encompasses a variety of products designed to complement traditional health insurance coverage. Key products include critical illness insurance, hospital indemnity plans, accident insurance, and dental and vision plans. Critical illness insurance provides lump-sum payments upon diagnosis of specified serious illnesses, offering financial support beyond medical expenses. Hospital indemnity plans cover hospitalization costs not fully paid by primary insurance, mitigating out-of-pocket expenses. Accident insurance provides benefits for medical costs resulting from accidental injuries, while dental and vision plans offer coverage for routine and specialized care not typically included in basic health insurance policies.

U.S. Supplemental Health Market, By Product, 2022-2032 (USD Million)

| By Product | 2022 | 2023 | 2027 | 2032 |

| Critical Illness Insurance | 5,218.04 | 5,484.44 | 6,891.02 | 9,389.07 |

| Accident Insurance | 3,843.02 | 4,023.15 | 4,976.85 | 6,655.54 |

| Hospital Indemnity Insurance | 7,756.55 | 8,079.43 | 9,796.06 | 12,776.26 |

| Worksite Life | 6,452.04 | 6,772.74 | 8,467.40 | 11,468.92 |

| Dental | 11,987.39 | 12,448.58 | 14,908.03 | 19,134.68 |

Distribution Channel Insights

Supplemental health products in the U.S. are distributed through various channels to reach consumers effectively. Direct sales channels involve insurance carriers selling directly to consumers through their websites, call centers, or agents. Group benefits are often distributed through employers, who offer supplemental health plans as part of employee benefit packages. Additionally, brokers and agents play a crucial role in distributing these products by providing personalized advice and assisting consumers in selecting plans tailored to their needs. Online platforms and digital marketplaces are increasingly utilized to facilitate direct-to-consumer sales, offering convenience and transparency in plan comparison and selection.

U.S. Supplemental Health Market, By Distribution Channel, 2022-2032 (USD Million)

| By Distribution Channel | 2022 | 2023 | 2027 | 2032 |

| Direct-to-Consumer (DTC) | 669.88 | 702.67 | 876.02 | 1,182.55 |

| Agents | 13,186.13 | 13,781.78 | 16,939.31 | 22,474.34 |

| Brokers | 21,365.77 | 22,287.46 | 27,181.26 | 35,714.11 |

| Others | 35.26 | 36.44 | 42.79 | 53.48 |

Demography Insights

Demographic factors significantly influence the uptake and design of supplemental health products in the U.S. Different age groups, income levels, and health statuses shape consumer preferences and product offerings. Young adults often seek accident insurance for coverage against unforeseen medical costs, while older adults may prioritize critical illness insurance to safeguard against major health crises. Income levels impact affordability and coverage limits, influencing the choice between comprehensive plans and more targeted coverage options. Employers often tailor group benefits based on workforce demographics, offering plans that meet diverse employee needs across different life stages and health conditions.

U.S. Supplemental Health Market, By Demography, 2022-2032 (USD Million)

| By Demography | 2022 | 2023 | 2027 | 2032 |

| Individuals Aged 65 and Above | 34,199.33 | 35,685.70 | 43,575.59 | 57,344.62 |

| Individuals Aged Below 65 with an Eligible Disability | 1,057.71 | 1,122.65 | 1,463.78 | 2,079.86 |

U.S. Supplemental Health Market Dynamics

Drivers:

Several factors drive growth in the U.S. supplemental health market. One primary driver is the increasing prevalence of high-deductible health plans (HDHPs), which require individuals to pay higher out-of-pocket costs before insurance coverage kicks in. As more employers and individuals opt for HDHPs to control premium costs, the demand for supplemental health plans rises to mitigate financial risks associated with these high deductibles. Additionally, an aging population and the corresponding increase in chronic diseases contribute to higher healthcare utilization, boosting demand for supplemental coverage that can help manage these expenses.

Opportunities:

The evolving regulatory landscape presents opportunities for expansion within the supplemental health market. Regulatory changes that promote consumer choice and flexibility in healthcare coverage options can encourage innovation and product development among insurers. Moreover, the growing trend of consumer-driven healthcare decisions, coupled with increasing awareness of financial risk exposure, creates opportunities for insurers to tailor products that meet specific needs and preferences of consumers. Advances in digital technology also offer opportunities to enhance customer engagement, streamline operations, and improve the overall consumer experience in purchasing and managing supplemental health plans.

Challenges:

Despite growth opportunities, the U.S. supplemental health market faces several challenges. One significant challenge is the regulatory environment, which can be complex and subject to frequent changes. Compliance with varying state regulations and federal mandates adds operational complexity for insurers operating across different jurisdictions. Moreover, consumer education remains a challenge as many individuals may not fully understand the benefits and limitations of supplemental health plans, leading to misconceptions or hesitancy in purchasing these products. Additionally, pricing transparency and affordability concerns can deter some consumers from investing in supplemental coverage, especially when faced with competing financial priorities.

Read Also: Ophthalmic Packaging Market Size, Share, Report By 2032

U.S. Supplemental Health Market Recent Developments

- In October 2022, Allianz announced the acquisition of Jubilee Holdings Limited in East Africa for a controlling interest in the general insurance business.

- In April 2023, AIG announced the agreement with Stone Point Capital LLC (Stone Point).

- In February 2022, Assurant and Tekion came into a partnership to enhance Digital F&I experiences in Automotive Retail.

- In January 2023, Humana acquired Doctors on Demand, a telemedicine provider.

U.S. Supplemental Health Market Companies

- Aetna Inc.

- Allianz S.E.

- American International Group, Inc.

- Anthem, Inc.

- Assurant, Inc.

- AXA Group

- Cigna Corporation

- Humana Inc.

- MetLife, Inc.

- Zurich Insurance Group AG