Unmanned Aerial Vehicle Drones Market to Record 18.2% CAGR

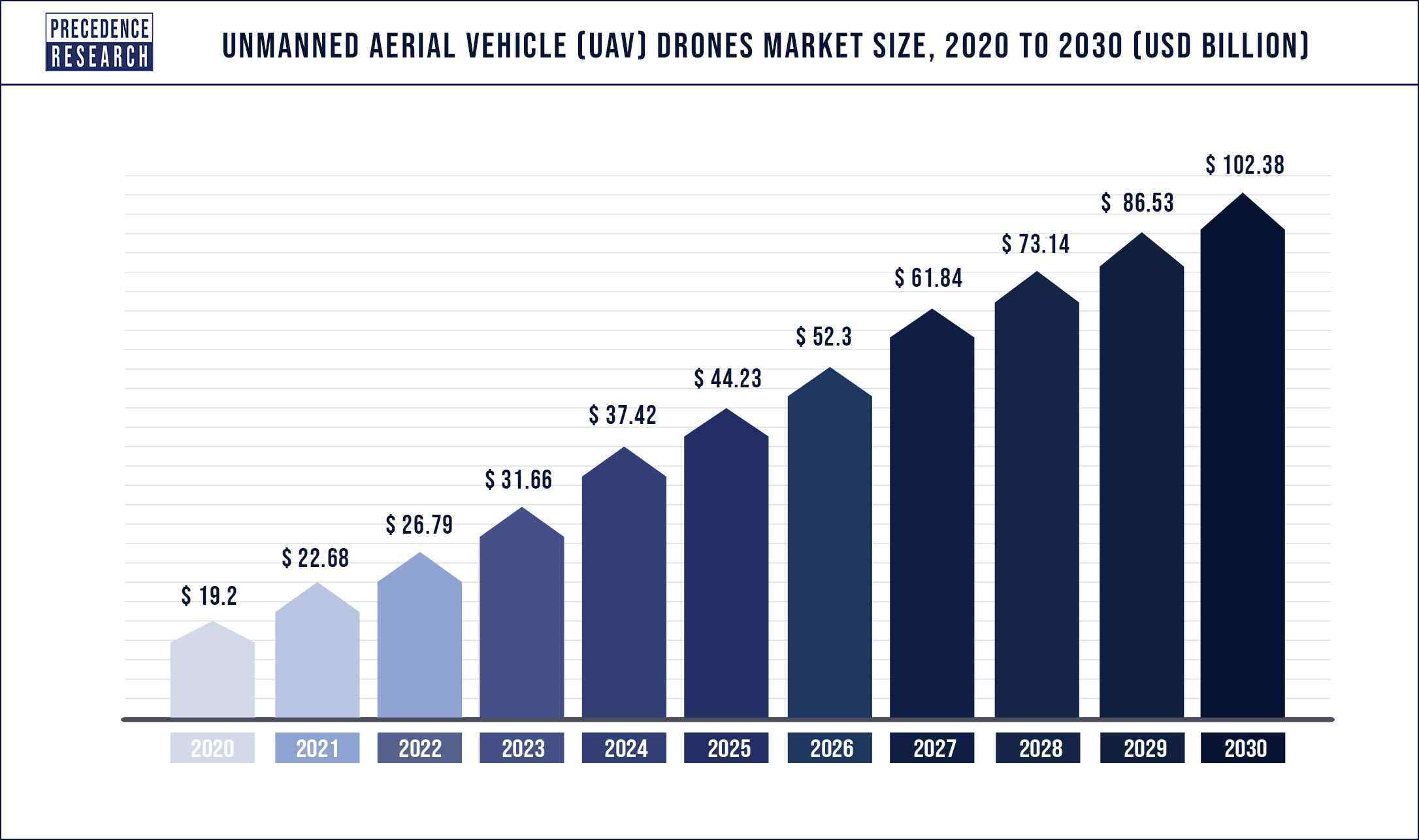

The global unmanned aerial vehicle drones market is anticipated to garner notable gains, registering a CAGR of 18.2% every year, according to a 2022 study by Precedence Research, the Canada-based market Insight Company.

The global unmanned aerial vehicle drones market is surging, with an overall revenue growth expectation of hundreds of billions of dollars within the next ten years. The market is expected to grow to US$ 102.38 billion by 2030 from US$ 22.68 billion in 2021. The report contains 150+ pages with detailed analysis.

The growing use of unmanned aerial vehicle (UAV) drones in various end use industries, such as the military and event industries are expected to be the primary driver of the growth of the unmanned aerial vehicle drones market over the forecast period. The regulations and restrictions imposed by government organizations in their different countries for flying drones in public places, on the other hand, are limiting the growth of the unmanned aerial vehicle drones market.

The unmanned aerial vehicle drones are aircrafts that do not require a human pilot to control their flight. The unmanned aircraft system comprises of the unmanned aerial vehicle , the controller, which is usually located on the ground, and a means of communication between the two. The market for unmanned aerial vehicle drones has been expanding in combination with greater data processing capabilities, superior design, and significant operational ranges and security.

Our Free Sample Reports Includes:

- In-depth Industry Analysis, Introduction, Overview, and COVID-19 Pandemic Outbreak.

- Impact Analysis 180+ Pages Research Report (Including latest research).

- Provide chapter-wise guidance on request 2021 Updated Regional Analysis with Graphical Representation of Trends, Size, & Share, Includes Updated List of figures and tables.

Updated Report Includes Major Market Players with their Sales Volume, Business Strategy and Revenue Analysis by using Precedence Research methodology.

Download a FREE Sample Copy (Including TOC, List of Tables & Figures, and Chart) @ https://www.precedenceresearch.com/sample/1551

Unmanned Aerial Vehicle Drones Market Scope

| Report Coverage | Details |

| Market Size | US$ 102.38 Billion by 2030 |

| Growth Rate | CAGR of 18.2% from 2022 to 2030 |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segments Covered | Type, Application, Component, Payload, Region |

Unmanned Aerial Vehicle Drones Market Report Highlights

- Camera accounted for the biggest revenue share by component in 2020 for the unmanned aerial vehicle drones market. The camera systems are used in applications such as remote surveillance, video monitoring, and border security, thermographic examination of inaccessible buildings, and important infrastructure protection and security.

- Media and entertainment dominated the global unmanned aerial vehicle drones market in terms of application in 2020, and it is expected to continue to do so throughout the forecast period. The unmanned aerial vehicle drones offer a lot of benefits over traditional image capture methods, including reduced costs and higher film and photo quality.

- North America is the largest segment for unmanned aerial vehicle drones market in terms of region. The increasing usage of drones in the commercial sector for various operational uses such as delivering products to consumers in their respective countries is expected to propel the growth of the unmanned aerial vehicle drones market in the North America region.

- Asia-Pacific region is the fastest growing region in the unmanned aerial vehicle drones market. An increase in the use of drones in agriculture to monitor the cultivation process and produce better outcomes is expected to enhance the unmanned aerial vehicle drones market in Asia-Pacific region.

Read Also: Digital Patient Monitoring Devices Market Size, Share, Growth and Forecasts 2022-2030

Unmanned Aerial Vehicle Drones Market Dynamics

Drivers

Flexibility for quick inspections

The unmanned aerial vehicle drones exist in variety of configurations, so some can perform high or low altitude inspections. These qualities’ adaptability allows clients to easily modify the tools for their tasks. The unmanned aerial vehicle drones are appropriate for both routine and emergency situations, and the construction industry, particularly building developers, recognizes these benefits. The unmanned aerial vehicle drones can do a variety of tasks, including taking high quality films and photos. As a result, the flexibility of quick inspections is propelling the growth of the unmanned aerial vehicle drones market during the forecast period.

Restraints

Lack of data privacy

The weakness of unmanned aerial vehicle drones technology is a significant drawback to its development. The hackers can swiftly get access to a drone’s central control system and assume control of the drone. Hackers can get access to personal information, corrupt or damage files, and expose data to untrusted third parties. Thus, the lack of data privacy is hindering the growth of the unmanned aerial vehicle (UAV) drones market.

Opportunities

Rising use of the unmanned aerial vehicle (UAV) drones in defense sector

Due to the increased use of drones in the defense and military and defense industries, the global unmanned aerial vehicle (UAV) drones market has grown significantly. The surveillance, target acquisition, intelligence, and transporting aircraft ammunition such as bombs and missiles in targeted points are all actions carried out by unmanned aerial vehicle (UAV) drones in the military and defense sectors.

The main advantage of deploying drones in the defense and military sectors is that they can be controlled remotely, reducing the possibilities of being caught by rivals or being injured during the mission. Thus, the rising use of unmanned aerial vehicle (UAV) drones in defense sector is creating lucrative opportunities for the growth of the unmanned aerial vehicle (UAV) drones market.

Challenges

Stringent government regulations and laws

The unmanned aerial vehicle (UAV) drones are controlled by remote ground control systems, often known as ground aviation systems. According to air traffic management, several laws and regulations apply when flying any object. No one can fly a drone unless they adhere to the laws of country in which they are being utilized. In many countries, rules related to unmanned aerial vehicle (UAV) drones are extremely rigid, which is a major challenge for the growth of the unmanned aerial vehicle (UAV) drones market.

Some of the prominent players in the global unmanned aerial vehicle (UAV) drones market include:

- General Atomics Aeronautical Systems

- Israel Aerospace Industries

- ALCORE Technologies

- BAE Systems

- Nimbus

- VTOL Technologies

- Xiaomi

- ING Robotic Aviation

- PrecisionHawk

- Lockheed Martin

Unmanned Aerial Vehicle Drones Market Segmentations

By Type

- Fixed Wing

- Vertical Take-off & Landing (VTOL)

- Small Tactical Unmanned Air System (STUAS)

- Medium Altitude Long Endurance (MALE)

- High Altitude Long Endurance (HALE)

By Payload

- Up to 150 kg

- Up to 600 kg

By Component

- Camera

- Sensor

By Application

- Media & Entertainment

- Precision Agriculture

- Energy

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

TABLE OF CONTENT

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Unmanned Aerial Vehicle (UAV) Drones Market

5.1. COVID-19 Landscape: Unmanned Aerial Vehicle (UAV) Drones Industry Impact

5.2. COVID 19 – Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Unmanned Aerial Vehicle (UAV) Drones Market, By Type

8.1. Unmanned Aerial Vehicle (UAV) Drones Market, by Type, 2022-2030

8.1.1. Fixed Wing

8.1.1.1. Market Revenue and Forecast (2019-2030)

8.1.2. Vertical Take-off & Landing (VTOL)

8.1.2.1. Market Revenue and Forecast (2019-2030)

8.1.3. Small Tactical Unmanned Air System (STUAS)

8.1.3.1. Market Revenue and Forecast (2019-2030)

8.1.4. Medium Altitude Long Endurance (MALE)

8.1.4.1. Market Revenue and Forecast (2019-2030)

8.1.5. High Altitude Long Endurance (HALE)

8.1.5.1. Market Revenue and Forecast (2019-2030)

Chapter 9. Global Unmanned Aerial Vehicle (UAV) Drones Market, By Payload

9.1. Unmanned Aerial Vehicle (UAV) Drones Market, by Payload, 2022-2030

9.1.1. Up to 150 kg

9.1.1.1. Market Revenue and Forecast (2019-2030)

9.1.2. Up to 600 kg

9.1.2.1. Market Revenue and Forecast (2019-2030)

Chapter 10. Global Unmanned Aerial Vehicle (UAV) Drones Market, By Component

10.1. Unmanned Aerial Vehicle (UAV) Drones Market, by Component, 2022-2030

10.1.1. Camera

10.1.1.1. Market Revenue and Forecast (2019-2030)

10.1.2. Sensors

10.1.2.1. Market Revenue and Forecast (2019-2030)

Chapter 11. Global Unmanned Aerial Vehicle (UAV) Drones Market, By Application Type

11.1. Unmanned Aerial Vehicle (UAV) Drones Market, by Application Type, 2022-2030

11.1.1. Media & Entertainment

11.1.1.1. Market Revenue and Forecast (2019-2030)

11.1.2. Precision Agriculture

11.1.2.1. Market Revenue and Forecast (2019-2030)

11.1.3. Energy

11.1.3.1. Market Revenue and Forecast (2019-2030)

Chapter 12. Global Unmanned Aerial Vehicle (UAV) Drones Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Type (2019-2030)

12.1.2. Market Revenue and Forecast, by Payload (2019-2030)

12.1.3. Market Revenue and Forecast, by Component (2019-2030)

12.1.4. Market Revenue and Forecast, by Application Type (2019-2030)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Type (2019-2030)

12.1.5.2. Market Revenue and Forecast, by Payload (2019-2030)

12.1.5.3. Market Revenue and Forecast, by Component (2019-2030)

12.1.5.4. Market Revenue and Forecast, by Application Type (2019-2030)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Type (2019-2030)

12.1.6.2. Market Revenue and Forecast, by Payload (2019-2030)

12.1.6.3. Market Revenue and Forecast, by Component (2019-2030)

12.1.6.4. Market Revenue and Forecast, by Application Type (2019-2030)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Type (2019-2030)

12.2.2. Market Revenue and Forecast, by Payload (2019-2030)

12.2.3. Market Revenue and Forecast, by Component (2019-2030)

12.2.4. Market Revenue and Forecast, by Application Type (2019-2030)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Type (2019-2030)

12.2.5.2. Market Revenue and Forecast, by Payload (2019-2030)

12.2.5.3. Market Revenue and Forecast, by Component (2019-2030)

12.2.5.4. Market Revenue and Forecast, by Application Type (2019-2030)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Type (2019-2030)

12.2.6.2. Market Revenue and Forecast, by Payload (2019-2030)

12.2.6.3. Market Revenue and Forecast, by Component (2019-2030)

12.2.6.4. Market Revenue and Forecast, by Application Type (2019-2030)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Type (2019-2030)

12.2.7.2. Market Revenue and Forecast, by Payload (2019-2030)

12.2.7.3. Market Revenue and Forecast, by Component (2019-2030)

12.2.7.4. Market Revenue and Forecast, by Application Type (2019-2030)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Type (2019-2030)

12.2.8.2. Market Revenue and Forecast, by Payload (2019-2030)

12.2.8.3. Market Revenue and Forecast, by Component (2019-2030)

12.2.8.4. Market Revenue and Forecast, by Application Type (2019-2030)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Type (2019-2030)

12.3.2. Market Revenue and Forecast, by Payload (2019-2030)

12.3.3. Market Revenue and Forecast, by Component (2019-2030)

12.3.4. Market Revenue and Forecast, by Application Type (2019-2030)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Type (2019-2030)

12.3.5.2. Market Revenue and Forecast, by Payload (2019-2030)

12.3.5.3. Market Revenue and Forecast, by Component (2019-2030)

12.3.5.4. Market Revenue and Forecast, by Application Type (2019-2030)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Type (2019-2030)

12.3.6.2. Market Revenue and Forecast, by Payload (2019-2030)

12.3.6.3. Market Revenue and Forecast, by Component (2019-2030)

12.3.6.4. Market Revenue and Forecast, by Application Type (2019-2030)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Type (2019-2030)

12.3.7.2. Market Revenue and Forecast, by Payload (2019-2030)

12.3.7.3. Market Revenue and Forecast, by Component (2019-2030)

12.3.7.4. Market Revenue and Forecast, by Application Type (2019-2030)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Type (2019-2030)

12.3.8.2. Market Revenue and Forecast, by Payload (2019-2030)

12.3.8.3. Market Revenue and Forecast, by Component (2019-2030)

12.3.8.4. Market Revenue and Forecast, by Application Type (2019-2030)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Type (2019-2030)

12.4.2. Market Revenue and Forecast, by Payload (2019-2030)

12.4.3. Market Revenue and Forecast, by Component (2019-2030)

12.4.4. Market Revenue and Forecast, by Application Type (2019-2030)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Type (2019-2030)

12.4.5.2. Market Revenue and Forecast, by Payload (2019-2030)

12.4.5.3. Market Revenue and Forecast, by Component (2019-2030)

12.4.5.4. Market Revenue and Forecast, by Application Type (2019-2030)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Type (2019-2030)

12.4.6.2. Market Revenue and Forecast, by Payload (2019-2030)

12.4.6.3. Market Revenue and Forecast, by Component (2019-2030)

12.4.6.4. Market Revenue and Forecast, by Application Type (2019-2030)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Type (2019-2030)

12.4.7.2. Market Revenue and Forecast, by Payload (2019-2030)

12.4.7.3. Market Revenue and Forecast, by Component (2019-2030)

12.4.7.4. Market Revenue and Forecast, by Application Type (2019-2030)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Type (2019-2030)

12.4.8.2. Market Revenue and Forecast, by Payload (2019-2030)

12.4.8.3. Market Revenue and Forecast, by Component (2019-2030)

12.4.8.4. Market Revenue and Forecast, by Application Type (2019-2030)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Type (2019-2030)

12.5.2. Market Revenue and Forecast, by Payload (2019-2030)

12.5.3. Market Revenue and Forecast, by Component (2019-2030)

12.5.4. Market Revenue and Forecast, by Application Type (2019-2030)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Type (2019-2030)

12.5.5.2. Market Revenue and Forecast, by Payload (2019-2030)

12.5.5.3. Market Revenue and Forecast, by Component (2019-2030)

12.5.5.4. Market Revenue and Forecast, by Application Type (2019-2030)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Type (2019-2030)

12.5.6.2. Market Revenue and Forecast, by Payload (2019-2030)

12.5.6.3. Market Revenue and Forecast, by Component (2019-2030)

12.5.6.4. Market Revenue and Forecast, by Application Type (2019-2030)

Chapter 13. Company Profiles

13.1. General Atomics Aeronautical Systems

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Israel Aerospace Industries

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. ALCORE Technologies

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. BAE Systems

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Nimbus

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. VTOL Technologies

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Xiaomi

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. ING Robotic Aviation

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. PrecisionHawk

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Lockheed Martin

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Thanks for reading you can also get individual chapter-wise sections or region-wise report versions such as North America, Europe, or the Asia Pacific.

Buy this Premium Research Report@ https://www.precedenceresearch.com/checkout/1551

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 9197 992 333

Frequently Asked Questions:

[sc_fs_multi_faq headline-0=”h6″ question-0=”How much is the CAGR of unmanned aerial vehicle (UAV) drones market?” answer-0=”The global unmanned aerial vehicle (UAV) drones market is expected to grow at a CAGR of 18.2% over the forecast period 2022 to 2030. ” image-0=”” headline-1=”h6″ question-1=”What is the current size of unmanned aerial vehicle (UAV) drones market?” answer-1=”According to Precedence Research, the global unmanned aerial vehicle (UAV) drones market size was reached at US$ 22.68 billion in 2021 and is anticipated to surpass over US$ 102.38 billion by 2030. ” image-1=”” headline-2=”h6″ question-2=”Who are the major players operating in the unmanned aerial vehicle (UAV) drones market?” answer-2=”The major players operating in the unmanned aerial vehicle (UAV) drones market are General Atomics Aeronautical Systems, Israel Aerospace Industries, ALCORE Technologies, BAE Systems, Nimbus, VTOL Technologies, Xiaomi, ING Robotic Aviation, PrecisionHawk, Lockheed Martin. ” image-2=”” headline-3=”h6″ question-3=”Which are the driving factors of the unmanned aerial vehicle (UAV) drones market?” answer-3=”The growing use of unmanned aerial vehicle (UAV) drones in various end use industries, such as the military and event industries, is expected to be the primary driver of the growth of the unmanned aerial vehicle (UAV) drones market over the forecast period. ” image-3=”” headline-4=”h6″ question-4=”Which region will lead the global unmanned aerial vehicle (UAV) drones market?” answer-4=”North America is the largest segment for unmanned aerial vehicle (UAV) drones market and will lead the market in near future. ” image-4=”” count=”5″ html=”true” css_class=””]