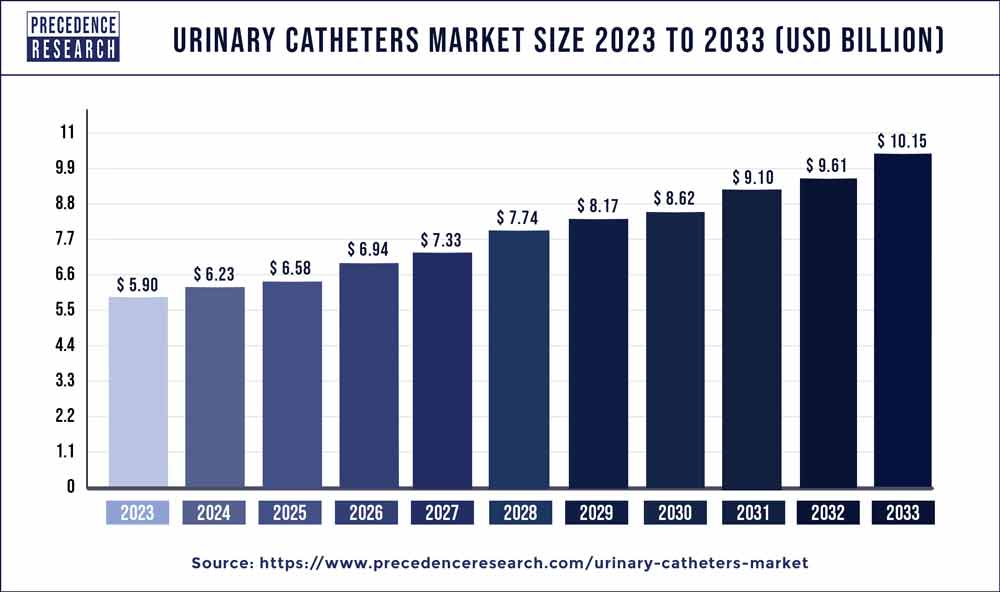

Urinary Catheters Market Size to Grow USD 10.15 Bn by 2033

The global urinary catheters market size was valued at USD 5.90 billion in 2023 and is expected to hit around USD 10.15 billion by 2033 with a CAGR of 5.57% from 2024 to 2033.

Key Points

- North America has accounted for more than 35% of the market share in 2023.

- By product, the intermittent catheters segment dominated the market with the largest market share of 58% in 2023.

- By application, the Urinary Incontinence (UI) segment dominated the market with the largest share of 38% in 2023.

- By type, the coated catheters segment led the market in 2023.

- By gender, the women segment led the market in 2023 and promises sustained growth during the forecast period.

- By end-user, the hospitals segment led the market with the largest share in 2023.

The urinary catheters market is witnessing significant growth globally due to several factors such as the rising prevalence of urinary incontinence, urinary retention, and other urinary disorders. Urinary catheters are medical devices used to drain urine from the bladder when normal urine flow is obstructed or when a patient is unable to urinate independently. These catheters are commonly used in hospitals, clinics, and home care settings, contributing to the expansion of the market.

The market for urinary catheters is driven by the increasing geriatric population worldwide, as elderly individuals are more prone to urinary problems due to age-related factors such as weakened bladder muscles and prostate enlargement. Moreover, the growing incidence of chronic diseases such as diabetes and neurological disorders also contributes to the rising demand for urinary catheters, as these conditions can lead to urinary dysfunction.

Get a Sample: https://www.precedenceresearch.com/sample/3908

Growth Factors

List of Contents

ToggleSeveral factors are driving the growth of the urinary catheters market. Technological advancements in catheter design and materials have led to the development of innovative products that offer improved comfort, reduced risk of infection, and enhanced ease of use. Additionally, the expanding awareness about the importance of urinary health and hygiene among both healthcare professionals and patients has increased the acceptance and adoption of urinary catheters.

Furthermore, the increasing healthcare expenditure in developing countries, coupled with the growing availability of healthcare facilities and infrastructure, is expected to drive market growth. Governments and healthcare organizations are also implementing initiatives to raise awareness about urinary disorders and promote early diagnosis and treatment, which is anticipated to further fuel market expansion.

Urinary Catheters Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 5.57% |

| Global Market Size in 2023 | USD 5.90 Billion |

| Global Market Size by 2033 | USD 10.15 Billion |

| U.S. Market Size in 2023 | USD 1.55 Billion |

| U.S. Market Size by 2033 | USD 2.66 Billion |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Product, By Application, By Type, By Gender, and By End-user |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Region Insight:

The urinary catheters market is geographically segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. North America currently dominates the market, attributed to the presence of well-established healthcare infrastructure, high healthcare expenditure, and a large patient population suffering from urinary conditions. Europe follows closely, with countries like Germany, the UK, and France contributing significantly to market growth.

Asia Pacific is expected to witness rapid growth in the urinary catheters market due to factors such as the increasing geriatric population, rising disposable income, and improving healthcare infrastructure in countries like China, India, and Japan. Latin America and the Middle East and Africa regions are also projected to experience growth, driven by improving healthcare facilities and rising awareness about urinary health issues.

Trends:

One notable trend in the urinary catheters market is the shift towards the use of intermittent catheters over indwelling catheters. Intermittent catheters are preferred for their lower risk of urinary tract infections and reduced discomfort compared to indwelling catheters, which are left in place for an extended period. Manufacturers are focusing on developing advanced intermittent catheters with features such as hydrophilic coatings and compact designs to meet patient needs and improve overall outcomes.

Another trend is the increasing adoption of minimally invasive techniques for urinary catheterization, such as the use of ultrasound guidance and robotic-assisted procedures. These techniques offer greater precision, reduced risk of complications, and faster recovery times compared to traditional catheter insertion methods, driving their popularity among healthcare providers and patients alike.

Read Also: Outboard Engines Market Size to Attain USD 18.12 Bn by 2033

Recent Developments

- In January 2023, after a thorough authorization procedure, Bactiguard announced the approval of its first MDR (Medical Device Regulations 2017/745) product. The latex BIP Foley Catheter, an indwelling urinary catheter using Bactiguard’s exclusive infection prevention technology, is the subject of the MDR approval. A thin coating of noble metal alloy affixed to the catheter’s surface serves as the foundation for Bactiguard’s unique technology. The metals have a galvanic effect when they come into contact with fluids, which lowers microbial adhesion—that is, fewer germs stick to the catheter surface. Healthcare-associated infections (HAI) impact one in ten patients globally, with catheter-associated urinary tract infections (CAUTI) accounting for a sizable portion of cases. The incidence of CAUTI is considerably decreased by urinary catheters equipped with Bactiguard technology.

- In December 2022, to minimize urinary tract infections (UTIs) and unintentional Foley catheter extractions, CATHETRIX, a creative creator of urinary (Foley) smart catheter fixation devices, commercially debuted their catheter stabilizer at the Arab Health 2023.

Competitive Landscape:

The urinary catheters market is highly competitive, with several key players competing for market share. Major companies operating in the market include B. Braun Melsungen AG, Coloplast A/S, Hollister Incorporated, Teleflex Incorporated, and Boston Scientific Corporation, among others. These companies focus on product innovation, strategic collaborations, mergers and acquisitions, and geographical expansion to strengthen their market position.

Moreover, the market also comprises numerous small and medium-sized enterprises (SMEs) that cater to niche segments or regional markets. These players often differentiate themselves through the development of specialized catheter products tailored to specific patient needs or preferences. Overall, the urinary catheters market is characterized by intense competition, rapid technological advancements, and a constant focus on improving patient outcomes and quality of life.

Urinary Catheters Market Companies

- Coloplast

- ConvaTec, Inc.

- Boston Scientific Corp.

- BD (C.R. Bard, Inc.)

- Cook Medical

- Medtronic PLC

- Teleflex, Inc.

- B. Braun Melsungen AG

- Hollister, Inc.

- Medline Industries, Inc.

- J and M Urinary Catheters LLC

Segments Covered in the Report

By Product

- Foley/ Indwelling Catheters

- Intermittent Catheters

- External Catheters

By Application

- Urinary Incontinence

- Benign Prostate Hyperplasia & Prostate Surgeries

- Spinal Cord Injury

- Others

By Type

- Coated Catheters

- Uncoated Catheters

By Gender

- Male

- Female

By End-user

- Clinics

- Hospitals

- Long-Term Care Facilities

- Others

`By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/