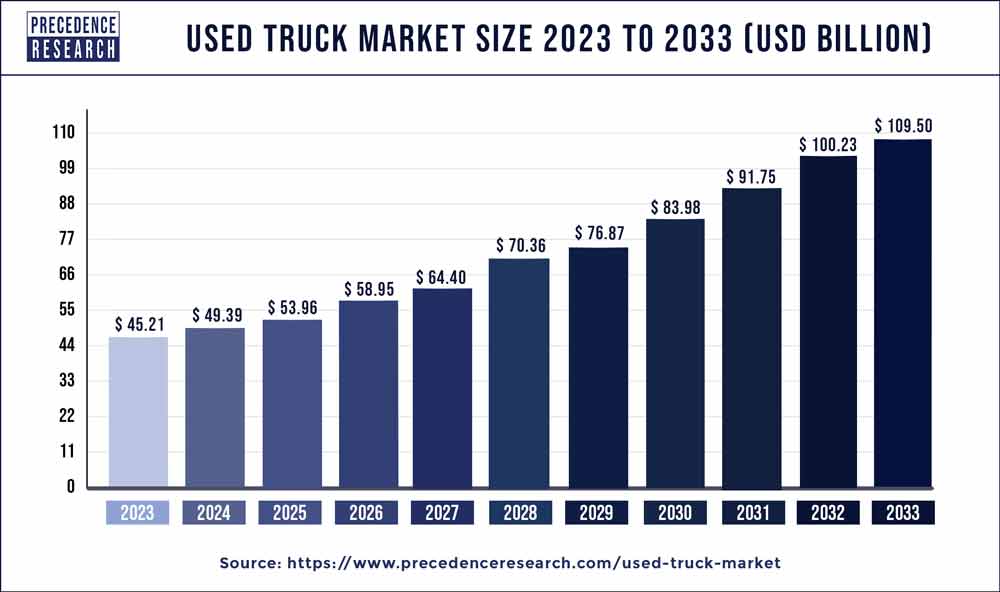

Used Truck Market Size to Rise USD 109.50 Billion by 2033

The global used truck market size reached USD 45.21 billion in 2023 and is estimated to hit around USD 109.50 billion by 2033 with a CAGR of 9.25% from 2024 to 2033.

Key Points

- Asia Pacific dominated the used truck market in 2023.

- North America is observed to witness a significant rate of expansion during the forecast period.

- By vehicle, the medium-duty truck segment dominated the market in 2023.

- By vehicle, the heavy-duty truck segment is observed to grow at a significant rate during the forecast period.

- By sales channel, the independent dealer sales segment dominated the market with a CAGR of 58% in 2023.

- By end user, the construction segment dominated the market with the highest market share in 2023.

- By end user, the transportation and logistics segment is expected to grow at the fastest rate during the forecast period.

The used truck market has experienced significant growth and transformation in recent years, becoming a crucial sector within the broader automotive industry. As the demand for transportation and logistics services continues to rise globally, the market for used trucks has witnessed a parallel surge. This growth can be attributed to various factors, including economic trends, technological advancements, and shifting consumer preferences.

Get a Sample: https://www.precedenceresearch.com/sample/3878

Growth Factors:

Several factors contribute to the growth of the used truck market. One key driver is the cost-effectiveness offered by used trucks compared to their new counterparts. Businesses and individual buyers often find used trucks to be a more affordable option, enabling them to acquire reliable vehicles without the hefty price tag associated with new purchases. Additionally, the increasing awareness of environmental sustainability has led to a growing interest in recycling and reusing vehicles, further boosting the demand for used trucks.

Used Truck Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 9.25% |

| Global Market Size in 2023 | USD 45.21 Billion |

| Global Market Size by 2033 | USD 109.50 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Vehicle, By Sales Channel, and By End-user |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Used Truck Market Dynamics

Drivers:

The used truck market is driven by several key factors that influence its dynamics. Economic conditions play a crucial role, as businesses tend to opt for used trucks during periods of economic uncertainty to manage costs effectively. Moreover, advancements in vehicle technology have contributed to the increased longevity and durability of trucks, making them more appealing in the used market. Government regulations on emissions and fuel efficiency have also prompted fleet operators to explore the used truck market for compliant and cost-efficient options.

Opportunities

Opportunities in the used truck market are abundant, presenting potential growth avenues for businesses and stakeholders. The emergence of online platforms and digital marketplaces has streamlined the buying and selling process, creating a convenient and efficient environment for participants. Moreover, the demand for specialized trucks, such as those equipped for e-commerce logistics or last-mile delivery, presents a unique opportunity for the used truck market to cater to specific industry needs.

Challenges:

Despite the positive trajectory, the used truck market faces certain challenges that warrant attention. One significant challenge is the potential risk associated with the condition and history of used trucks. Buyers often express concerns about hidden defects, maintenance issues, or the accuracy of vehicle history reports. Building trust and transparency in the used truck transaction process is crucial to overcoming this challenge. Additionally, the market must adapt to evolving emission standards and technological updates, posing challenges for older models.

Region:

The dynamics of the used truck market vary across regions due to diverse economic, regulatory, and cultural factors. In developed economies, the market is driven by the need for fleet renewal and adherence to strict emission standards. Conversely, in emerging economies, the demand for used trucks is fueled by rapid industrialization and infrastructure development. The Asia-Pacific region, in particular, has emerged as a key player in the used truck market, with a growing number of businesses and individuals opting for cost-effective and reliable transportation solutions.

Read Also: Healthcare Fraud Detection Market Size to Worth USD 6.64 Bn by 2033

Recent Developments

- In January 2024, VE Commercial Vehicles Ltd., another business unit Eicher Trucks and Buses announced to launch the LNG variant of heavy-duty trucks in the same year, as per the Vinod Aggarwal Managing Director & CEO of the company.

- In January 2024, Volvo, a leading automobile player launched a new heavy-duty truck platform for the market of America simultaneously with a range of heavy-duty truck ranges in the Asia, Europe, Africa, and Australian markets.

Used Trucks Market Companies

- AB Volvo

- KENWORTH (PACCAR Inc.)

- Freightliner Northwest

- Scania

- Daimler Truck AG.

- RENAULT TRUCKS

- Mascus

- MAN

- ASHOK LEYLAND

- Gordon Truck Centers, Inc.

Segments Covered in the Report

By Vehicle

- Medium Duty Truck

- Heavy Duty Truck

- Off-road Truck

By Sales Channel

- Independent Dealer

- Franchise Dealer

- Peer-to-peer Dealer

By End-user

- Construction

- Logistic & Transportation

- Mining

- Oil & Gas

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/