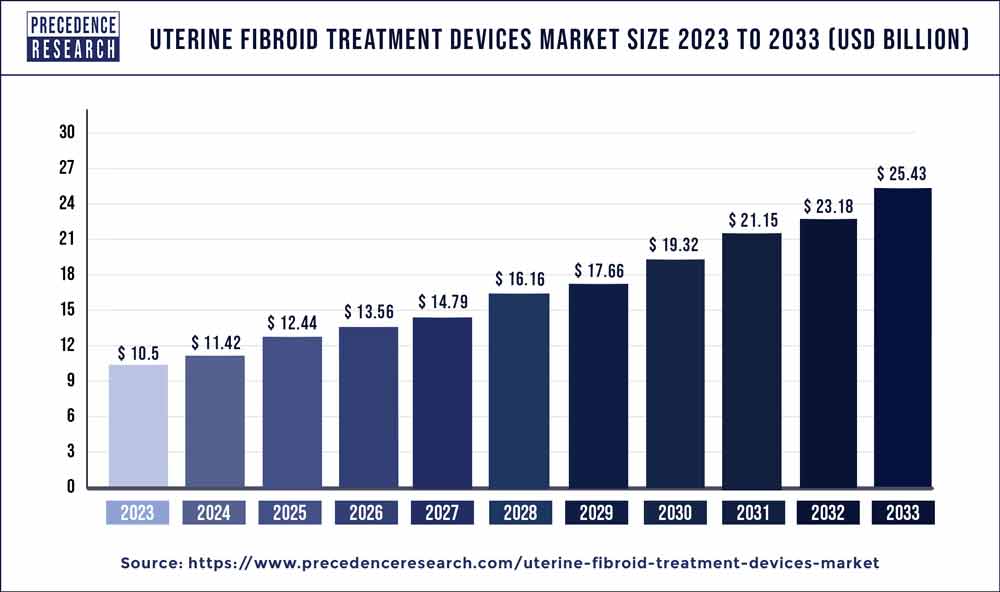

Uterine Fibroid Treatment Devices Market Size To Hit USD 25.43 Bn by 2033

The global uterine fibroid treatment devices market size surpassed USD 10.5 billion in 2023 and is expected to reach around USD 25.43 billion by 2033, notable at a CAGR of 9.30% from 2024 to 2033.

Key Takeaways

- North America held the largest market share of 62% in 2023.

- Asia Pacific is observed to witness a growth rate at a CAGR of 10.8% during the forecast period.

- By technology, the surgical techniques segment held the largest market share of 34% in 2023.

- By technology, the ablation techniques segment is observed to grow at a CAGR of 10.4% during the forecast period.

- By mode of treatment, the invasive treatment segment held the largest market share of 46% in 2023.

Uterine Fibroid Treatment Devices Market Overview:

The global uterine fibroid treatment devices market is witnessing significant growth due to the rising prevalence of uterine fibroids among women worldwide. Uterine fibroids, also known as leiomyomas, are non-cancerous growths that develop in the uterus. They can cause symptoms such as heavy menstrual bleeding, pelvic pain, and pressure on the bladder or bowel, impacting women’s quality of life. As a result, the demand for effective treatment options has fueled the growth of the uterine fibroid treatment devices market.

Get a Sample: https://www.precedenceresearch.com/sample/3755

Growth Factors

Several factors contribute to the growth of the uterine fibroid treatment devices market. Firstly, the increasing awareness among women about uterine fibroids and the availability of minimally invasive treatment options have led to a rise in the number of patients seeking medical intervention. Additionally, technological advancements in uterine fibroid treatment devices, such as the development of radiofrequency ablation, high-intensity focused ultrasound (HIFU), and minimally invasive surgical techniques, have improved treatment outcomes and reduced patient recovery time.

Moreover, the growing preference for outpatient procedures and the availability of uterine fibroid treatment devices in ambulatory surgical centers have expanded access to care, especially for women who prefer less invasive treatment options. Furthermore, the aging female population and the increasing prevalence of obesity contribute to the rising incidence of uterine fibroids, driving market growth.

Uterine Fibroid Treatment Devices Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 9.30% |

| Global Market Size in 2023 | USD 10.5 Billion |

| Global Market Size by 2033 | USD 25.43 Billion |

| U.S. Market Size in 2023 | USD 5.56 Billion |

| U.S. Market Size by 2033 | USD 11.14 Billion |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Technology and By Mode of Treatment |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Uterine Fibroid Treatment Devices Market Dynamics

Drivers:

Several drivers propel the growth of the uterine fibroid treatment devices market. Firstly, the growing demand for minimally invasive procedures due to their advantages, such as shorter hospital stays, faster recovery, and reduced risk of complications, has increased the adoption of uterine fibroid treatment devices. Additionally, the rise in healthcare expenditure and the increasing availability of healthcare facilities, particularly in developing countries, have facilitated access to uterine fibroid treatment options.

Furthermore, favorable reimbursement policies for uterine fibroid treatments in many countries have encouraged patients to seek medical intervention, thereby boosting market growth. Moreover, collaborations and partnerships between medical device manufacturers and healthcare providers have led to the development of innovative uterine fibroid treatment devices, driving market expansion.

Restraints:

Despite the growth opportunities, the uterine fibroid treatment devices market faces certain restraints. Limited awareness about uterine fibroids and their treatment options among women in some regions may hinder market growth. Additionally, the high cost of uterine fibroid treatment devices and procedures, particularly for advanced technologies such as HIFU and robotic-assisted surgery, may limit their adoption, especially in developing countries with constrained healthcare budgets.

Moreover, concerns regarding the long-term efficacy and safety of uterine fibroid treatment devices, particularly for newer technologies, may affect patient and physician acceptance. Regulatory challenges and the need for clinical evidence to support the effectiveness of these devices could also pose barriers to market growth.

Opportunities:

Despite the challenges, the uterine fibroid treatment devices market presents several opportunities for growth. Expanding healthcare infrastructure and increasing healthcare expenditure in emerging economies offer a promising market landscape for uterine fibroid treatment device manufacturers. Additionally, ongoing research and development efforts to improve the efficacy and safety of existing devices and develop novel treatment modalities hold the potential to expand the market further.

Furthermore, initiatives aimed at raising awareness about uterine fibroids and educating women about available treatment options could drive market growth. Collaboration between healthcare providers, patient advocacy groups, and government agencies to develop screening programs and improve access to care for women with uterine fibroids could also create opportunities for market expansion.

Read Also: Autonomic Systems Market Size to Attain USD 13.53 Bn by 2033

Recent Developments

- In November 2023, to increase the commercialization of its sonata treatment, which targets uterine fibroids, Gynesonics announced an investment of $67 million.

- In June 2022, The Healthcare Products Regulatory Agency (MHRA) and UK Medicines have authorized the marketing of Yselty, an oral GnRH antagonist, to treat mild to severe signs and symptoms of uterine fibroids (UF) in adult women of reproductive years. ObsEva SA is a biopharmaceutical company developing and commercializing novel health therapies for women.

Uterine Fibroid Treatment Devices Market Companies

- Medtronic

- Stryker Corporation

- Boston Scientific Corporation

- INSIGHTEC

- CooperSurgical Inc.

- Hologic, Inc.

- Lumenis

Segments Covered in the Report

By Technology

- Surgical Techniques

- Hysterectomy

- Myomectomy

- Laparoscopic Techniques

- Laparoscopic Myomectomy

- Myolysis

- Ablation Techniques

- Microwave Ablation

- Hydrothermal Ablation

- Cryoablation

- Ultrasound Ablation

- High Intensity Focused Ultrasound (HIFU)

- MRI-guided Focused Ultrasound (MRgFUS)

- Other Ablation Techniques

- Embolization Techniques

By Mode of Treatment

- Invasive Treatment

- Minimally Invasive Treatment

- Non-invasive Treatment

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/