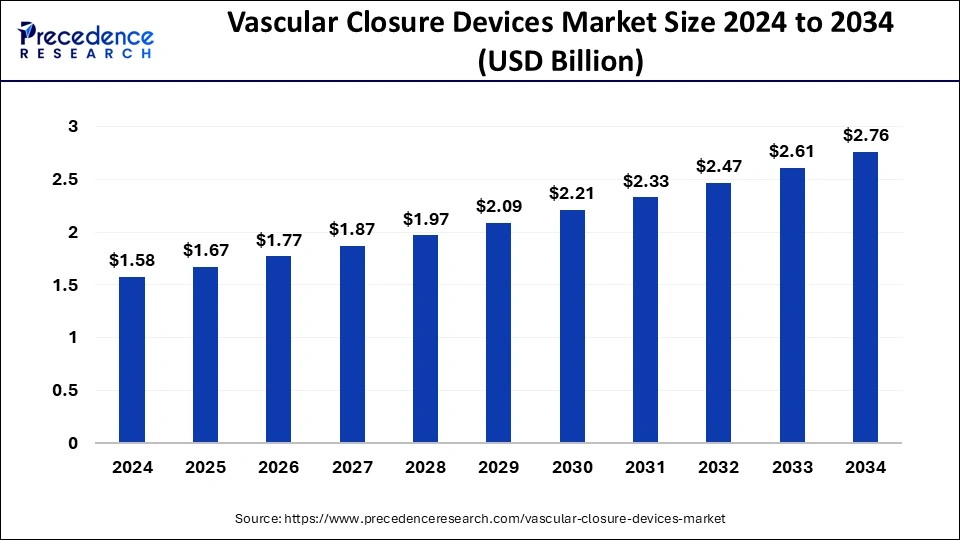

The global vascular closure devices market size surpassed USD 1.75 billion in 2023 and is projected to attain around USD 3.30 billion by 2033, growing at a CAGR of 6.55% from 2024 to 2033.

Key Points

- North America led the market with the biggest market share of 43% in 2023.

- Asia Pacific is observed to witness the fastest rate of expansion during the forecast period.

- By type, the active vascular closure devices segment held the largest share of the market in 2023.

- By access, the femoral segment is expected to capture a prominent market share during the forecast period while sustaining dominance.

- By end-use, the ambulatory surgical centers segment dominated the market with the largest share of 61% in 2023.

The vascular closure devices market is witnessing significant growth globally, driven by the rising prevalence of cardiovascular diseases and the increasing adoption of minimally invasive procedures. Vascular closure devices are medical devices used to achieve hemostasis after the puncture of a blood vessel during diagnostic or interventional procedures such as catheterization. These devices offer several advantages over traditional manual compression, including reduced time to achieve hemostasis, improved patient comfort, and lower complication rates.

The market for vascular closure devices is segmented based on product type, including passive closure devices and active closure devices. Passive closure devices, such as collagen plugs and sealants, work by promoting the body’s natural clotting mechanisms. Active closure devices, such as suture-based and clip-based devices, use mechanical mechanisms to achieve hemostasis. Both types of devices have gained traction among healthcare providers due to their effectiveness and ease of use.

Get a Sample: https://www.precedenceresearch.com/sample/3945

Growth Factors:

Several factors are driving the growth of the vascular closure devices market. One key factor is the increasing prevalence of cardiovascular diseases worldwide. According to the World Health Organization (WHO), cardiovascular diseases are the leading cause of death globally, accounting for an estimated 17.9 million deaths annually. The growing burden of cardiovascular diseases has led to a rise in the number of diagnostic and interventional procedures, thereby fueling the demand for vascular closure devices.

Furthermore, technological advancements in vascular closure devices have led to the development of innovative products with enhanced efficacy and safety profiles. Manufacturers are investing in research and development activities to introduce novel materials and designs that improve hemostasis and reduce the risk of complications. Additionally, the shift towards minimally invasive procedures is driving the adoption of vascular closure devices, as these devices facilitate faster recovery times and shorter hospital stays for patients.

Moreover, increasing healthcare expenditure and improving healthcare infrastructure in emerging economies are contributing to market growth. Governments and healthcare organizations are focusing on expanding access to cardiovascular care and investing in medical technologies to address the growing burden of cardiovascular diseases. This trend is expected to create lucrative opportunities for market players in emerging markets.

Vascular Closure Devices Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 6.55% |

| Global Market Size in 2023 | USD 1.75 Billion |

| Global Market Size by 2033 | USD 3.30 Billion |

| U.S. Market Size in 2023 | USD 530 Million |

| U.S. Market Size by 2033 | USD 990 Million |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Type, By Access, and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Vascular Closure Devices Market Dynamics

Driver:

One of the primary drivers of the vascular closure devices market is the growing demand for minimally invasive procedures. Minimally invasive techniques offer several advantages over traditional open surgeries, including reduced post-operative pain, shorter recovery times, and lower risk of complications. Vascular closure devices play a crucial role in facilitating minimally invasive procedures by enabling efficient and reliable hemostasis following vascular access.

Additionally, the aging population is driving the demand for vascular closure devices. Elderly individuals are more susceptible to cardiovascular diseases and often require diagnostic and interventional procedures such as cardiac catheterization. As the elderly population continues to grow globally, there is a corresponding increase in the number of procedures performed, thereby boosting the demand for vascular closure devices.

Furthermore, advancements in medical technology have led to the development of next-generation vascular closure devices with improved performance and safety features. These devices offer healthcare providers greater confidence in achieving hemostasis and reducing the risk of access site complications such as bleeding and hematoma. As a result, there is growing adoption of advanced vascular closure devices in clinical practice, driving market growth.

Restraint:

Despite the numerous growth drivers, the vascular closure devices market faces certain challenges that may hinder its expansion. One of the primary restraints is the high cost associated with vascular closure devices, especially advanced active closure devices. These devices often come with a higher price tag compared to traditional manual compression, making them less accessible, particularly in emerging economies with limited healthcare budgets.

Another restraint is the risk of complications associated with vascular closure devices. While these devices are designed to achieve hemostasis and minimize bleeding complications, there is still a possibility of adverse events such as vessel occlusion, infection, and pseudoaneurysm formation. Healthcare providers must carefully weigh the benefits and risks of using vascular closure devices and ensure proper patient selection and technique to mitigate the risk of complications.

Additionally, regulatory challenges and the need for stringent approval processes pose barriers to market entry for new players. The vascular closure devices market is subject to rigorous regulatory scrutiny to ensure patient safety and device effectiveness. Obtaining regulatory approvals can be a time-consuming and expensive process, particularly for novel devices with innovative technologies. This regulatory burden may discourage smaller companies from entering the market and limit competition.

Opportunity:

Despite the challenges, the vascular closure devices market presents several opportunities for growth and innovation. One key opportunity lies in expanding market penetration in emerging economies. As healthcare infrastructure improves and access to cardiovascular care expands in these regions, there is a growing demand for advanced medical technologies, including vascular closure devices. Market players can capitalize on this opportunity by partnering with local distributors and healthcare providers to introduce their products to new markets.

Moreover, there is a growing trend towards outpatient and ambulatory care settings for cardiovascular procedures. Outpatient catheterization labs and ambulatory surgery centers offer convenience and cost savings for patients, driving the demand for vascular closure devices that enable same-day discharge. Manufacturers can develop specialized closure devices tailored to the needs of outpatient settings, such as devices with shorter time to hemostasis and simpler deployment mechanisms.

Furthermore, ongoing research and development activities are creating opportunities for the introduction of innovative vascular closure devices with advanced features. For example, bioresorbable closure devices that are gradually absorbed by the body after achieving hemostasis offer the potential to eliminate the need for device removal and reduce long-term complications. Similarly, devices incorporating advanced imaging technologies such as ultrasound and fluoroscopy guidance enhance the precision and safety of vascular closure procedures.

Read Also: Tubeless Insulin Pump Market Size to Cross USD 11.93 Bn by 2033

Region Insights:

The vascular closure devices market is segmented into several key regions, including North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. North America dominates the market, driven by the high prevalence of cardiovascular diseases, well-established healthcare infrastructure, and strong adoption of advanced medical technologies. The presence of major market players and ongoing research and development activities contribute to the region’s market leadership.

Europe is also a significant market for vascular closure devices, supported by favorable healthcare policies, increasing healthcare expenditure, and a growing elderly population. Countries such as Germany, France, and the United Kingdom are key contributors to market growth in the region. Additionally, the Asia Pacific region is experiencing rapid market expansion due to improving healthcare infrastructure, rising disposable income levels, and increasing awareness of cardiovascular diseases.

In Latin America and the Middle East and Africa, the vascular closure devices market is witnessing steady growth driven by efforts to improve access to healthcare services and address the unmet medical needs of underserved populations. However, market penetration in these regions is still relatively low compared to developed markets, presenting opportunities for market players to expand their presence through strategic partnerships and investments in local distribution networks.

Recent Developments

- In February 2023, the LockeT product was introduced to the market by Catheter Precision, Inc., a wholly-owned subsidiary of Ra Medical Systems, Inc. The first shipments of the product to its distributors will start right away. When a catheter is inserted through the skin into a blood artery and subsequently removed after an operation, LockeT can be utilized in combination with the closure of the percutaneous wound site. LockeT is used to keep the sutures in place after the doctor has sutured the vessel and the location. The lockeT can be utilized in place of or in addition to closing devices. These devices are Angioseal, marketed by Terumo, Vascade, marketed by Cardiva, a division of Haemonetics, and Perclose, marketed by Abbott.

Vascular Closure Devices Market Companies

- Medtronic

- Abbott Vascular

- Biotronik GMBH & CO. KG

- COOK

- Merit Medical Systems, Inc.

- C. R. Bard, Inc.

- Boston Scientific Corporation

- ESSENTIAL MEDICAL, Inc.

- Cardinal Health

- W L. Gore & Associates

Segments Covered in the Report

By Type

- Active Vascular Closure Device

- Passive Vascular Closure Device

By Access

- Radial

- Femoral

By End-use

- Ambulatory Surgical Centers

- Hospitals

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/