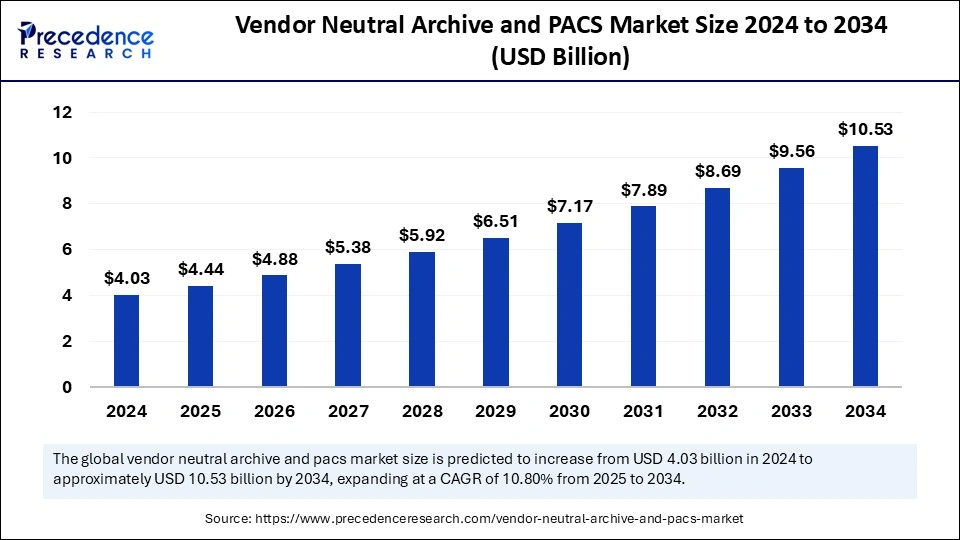

Vendor Neutral Archive and PACS Market Growth Forecast to Hit USD 10.53 Bn by 2034

Vendor neutral archive and PACS market forecast shows growth from USD 4.03 billion in 2024 to USD 10.53 billion by 2034, expanding at a CAGR of 10.80%.

Vendor Neutral Archive and PACS Market Key Takeaways

North America dominated the vendor neutral archive and PACS market in 2024.

Asia Pacific poised for rapid growth between 2025 and 2034.

The computed tomography segment led the market in 2024, while the magnetic resonance imaging segment is expected to grow the fastest during the forecast period.

Hospitals maintained the largest share by end-user in 2024, while diagnostic imaging centers are likely to expand at a strong CAGR in the coming years.

Vendor Neutral Archive and PACS Market Overview

The vendor neutral archive and PACS market is witnessing significant growth due to the rising need for efficient storage, retrieval, and management of medical imaging data. VNAs and PACS have become essential components of modern healthcare infrastructure, enabling healthcare providers to streamline workflows, enhance diagnostic accuracy, and ensure secure access to patient information.

VNAs store imaging data in a standard format, making it accessible across different healthcare systems, while PACS facilitate the storage and distribution of medical images. As healthcare organizations transition from traditional paper-based systems to digital platforms, the adoption of VNA and PACS solutions is increasing rapidly. The growing prevalence of chronic diseases, increasing demand for diagnostic imaging procedures, and the shift towards cloud-based solutions are driving market growth.

Vendor Neutral Archive and PACS Market Drivers

The increasing adoption of electronic health records and the need for seamless integration between various healthcare systems are primary drivers fueling the growth of the VNA and PACS market. As healthcare facilities generate vast amounts of imaging data, the need for efficient data management solutions has become imperative. VNAs and PACS enable healthcare providers to access and share patient information across multiple departments, improving collaboration and enhancing patient care.

The rising prevalence of chronic diseases, such as cancer and cardiovascular disorders, is driving the demand for diagnostic imaging procedures, further boosting the adoption of VNA and PACS solutions. Additionally, the growing emphasis on interoperability and data exchange between healthcare systems is encouraging the implementation of VNA and PACS solutions that ensure secure and standardized data storage.

Vendor Neutral Archive and PACS Market Opportunities

The VNA and PACS market presents significant growth opportunities in the adoption of cloud-based solutions and the integration of AI-powered technologies. Cloud-based VNAs and PACS offer scalability, cost-efficiency, and remote accessibility, making them an attractive option for healthcare providers seeking to enhance data security and streamline operations. AI-powered imaging solutions are transforming the healthcare landscape by enabling automated image analysis, early disease detection, and real-time decision support.

The increasing focus on telemedicine and remote diagnostics is also creating new opportunities for VNA and PACS vendors to offer innovative solutions that facilitate seamless access to medical images and patient records. Emerging markets in Asia Pacific, Latin America, and the Middle East are witnessing increased investments in healthcare infrastructure, creating additional opportunities for market expansion.

Vendor Neutral Archive and PACS Market Challenges

Despite the positive growth trajectory, the VNA and PACS market faces several challenges, including high implementation costs, technical complexities, and data security concerns. The transition from legacy systems to advanced VNA and PACS solutions requires significant investments in hardware, software, and training, making it a costly endeavor for smaller healthcare facilities. Ensuring seamless interoperability between VNA and PACS solutions and existing healthcare systems presents technical challenges that require ongoing innovation and expertise.

Additionally, concerns about data security and patient privacy pose significant challenges, particularly in the context of cloud-based solutions. The lack of standardized imaging formats and protocols further complicates the implementation of VNA and PACS systems, potentially hindering market growth.

Vendor Neutral Archive and PACS Market Regional Insights

The VNA and PACS market is geographically segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America leads the market, driven by the presence of well-established healthcare infrastructure, high adoption rates of advanced medical imaging technologies, and supportive government initiatives promoting digital healthcare solutions.

Europe follows closely, with countries such as Germany, the United Kingdom, and France investing in healthcare IT infrastructure and promoting the adoption of cloud-based VNA and PACS solutions.

Asia Pacific is expected to experience the highest growth rate, fueled by rapid urbanization, increasing healthcare spending, and growing awareness of digital imaging solutions.

Recent Developments

- In November 2023, Hyland Software, Inc. showcased its advanced diagnostic imaging and point-of-care technologies at this year’s RSNA conference. The company seeks to tackle healthcare challenges, such as workforce shortages and increasing demand, by providing solutions that enhance patient information and facilitate informed decision-making.

- In February 2023, Fujifilm Holdings Corporation declared its acquisition of Inspirata’s global digital pathology division, which includes the Dynamyx system. This acquisition bolsters Fujifilm’s healthcare capabilities, fostering collaboration among pathology, radiology, and oncology and enhancing integrated care delivery across the organization.

Vendor Neutral Archive and PACS Market Companies

- Merge Healthcare Inc.

- Visage Imaging

- Xerox Corporation

- GE Healthcare

- Caresyntax AG

- Canon Medical Systems

- Soft Imaging Systems

- Cerner Corporation

- Advanced Imaging Concepts

- Fujifilm Holdings Corporation

- McKesson Corporation

- Koninklijke Philips N.V.

- AGFA HealthCare N.V.

- Siemens AG

Segments Covered in the Report

By Imaging Modality

- X-Ray

- Computed Tomography

- Magnetic Resonance Imaging

- Ultrasound

- Nuclear Imaging

By End-user

- Hospitals

- Diagnostic Imaging Centers

- Ambulatory Surgical Centers

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Ready for more? Dive into the full experience on our website!