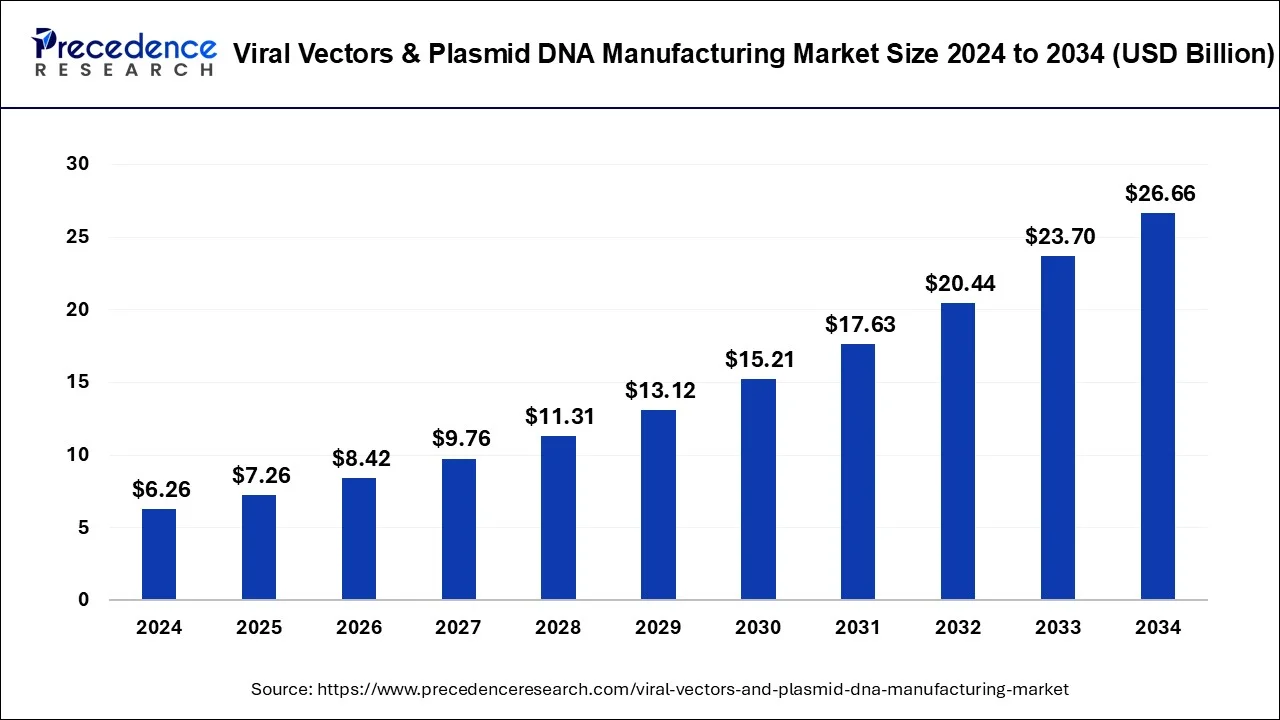

Viral Vectors & Plasmid DNA Manufacturing Market to Reach USD 26.66 Bn by 2034

The global viral vectors & plasmid DNA manufacturing market was valued at USD 6.26 billion in 2024 and is projected to reach USD 26.66 billion by 2034, growing at a CAGR of 15.59%.

The global viral vectors and plasmid DNA manufacturing market is experiencing significant growth, driven by the increasing demand for gene therapies, vaccines, and biopharmaceuticals. Viral vectors are widely used in gene therapy for delivering genetic material into cells, while plasmid DNA plays a crucial role in vaccine development and gene editing. The market, valued at USD 6.26 billion in 2024, is expected to reach USD 26.66 billion by 2034, with a robust CAGR of 15.59%. This growth is fueled by advancements in genetic research, increased funding for biotech innovations, and the growing need for effective therapies to treat genetic diseases. Additionally, the increasing adoption of viral vector-based vaccines and the rise in personalized medicine further contribute to the market’s expansion.

Viral Vectors & Plasmid DNA Manufacturing Market Key Insights

- North America led the market with a 49% revenue share in 2024.

- The AAV segment showed the highest growth in the viral vectors & plasmid DNA manufacturing market, accounting for 21% revenue share in 2024.

- The downstream processing segment held a dominant position, with 54% revenue share in 2023.

- The vaccinology application accounted for the largest revenue share of approximately 22.5% in 2024.

- The cancer disease segment dominated the market, holding 38% revenue share in 2024.

- The research institutes segment captured around 58.4% revenue share in 2024.

Viral Vectors & Plasmid DNA Manufacturing Market Scope

| Report Highlights | Details |

| Market Size by 2034 | USD 26.66 billion |

| Market Size in 2024 | USD 6.26 billion |

| Growth Rate | CAGR of 15.59% From 2025 to 2034 |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Vector Type, Application, Workflow, End-User, Disease |

| Regional Scope | Asia Pacific, North America, Europe, Latin America, Middle East and Africa |

Market Drivers

The growth of the viral vectors and plasmid DNA manufacturing market is primarily driven by the increasing demand for gene therapies, vaccines, and biologics. Advancements in gene therapy and precision medicine have created a need for more efficient viral vectors to deliver genetic material into cells. The surge in cancer and genetic disorder treatments, where gene therapies are becoming pivotal, is contributing to the market’s expansion. The growing emphasis on personalized medicine, which involves tailored treatments based on genetic profiles, is also fueling demand for viral vectors and plasmid DNA. Additionally, the rise of mRNA vaccines and their use in infectious disease prevention, including COVID-19, has further boosted the need for robust manufacturing capabilities. The market is also benefiting from increased investments in biotechnological research, government funding, and collaborations among research institutions, pharmaceutical companies, and biotech firms, which are accelerating the development and commercialization of innovative therapies.

Opportunities

- Growing demand for gene therapies and personalized medicine.

- Increased adoption of viral vectors in vaccine production, especially in mRNA-based vaccines.

- Rising prevalence of genetic diseases and cancer, driving the need for gene-based treatments.

- Advancements in CRISPR and gene-editing technologies, opening new markets for viral vectors and plasmid DNA.

- Expansion of research and development activities in biotechnology and pharmaceuticals.

- Potential for increased collaboration between biotech firms, research institutes, and pharmaceutical companies.

Challenges

- High manufacturing costs and complexities associated with viral vector production.

- Regulatory hurdles and long approval processes for gene therapies and vaccines.

- Limited scalability of viral vector production to meet growing demand.

- Concerns about the safety and long-term effects of gene therapies, particularly in clinical trials.

- Lack of standardized production processes, leading to variability in quality and yields.

- Intellectual property concerns and competition within the biotechnology sector.

Regional Insights

The viral vectors and plasmid DNA manufacturing market is experiencing strong growth across various regions, with North America dominating the market. The U.S., in particular, has a significant share due to its advanced biotechnology infrastructure, high levels of research and development, and strong demand for gene therapies and vaccines. The presence of leading pharmaceutical companies and biotechnology firms in North America further contributes to this dominance. Europe follows closely behind, with countries such as Germany, the U.K., and Switzerland playing crucial roles in the market.

The European region benefits from robust healthcare systems, significant funding for biotechnological research, and a strong emphasis on personalized medicine and gene therapy advancements. In Asia Pacific, the market is growing rapidly, driven by increasing investments in biotechnology, rising healthcare needs, and expanding research in gene therapies. China and Japan are at the forefront of this regional growth, with significant improvements in manufacturing capabilities. The market in Latin America and the Middle East and Africa is still emerging but is expected to grow as the adoption of gene therapies and biopharmaceuticals increases, along with greater healthcare investments.

Read Also: Dental Support Organizations Market Size Analysis 2022 To 2030

Market Companies

- Creative Biogene

- The Cell and Gene Therapy Catapult

- Cobra Biologics

- uniQure N.V.

- Addgene

- FUJIFILM Holdings Corporation

- Oxford Biomedicaplc

- Takara Bio Inc.

Recent Developments

Recent developments in the viral vectors and plasmid DNA manufacturing market include significant advancements in production technologies aimed at improving the efficiency and scalability of manufacturing processes. Companies are investing heavily in the development of more robust and cost-effective viral vector production platforms, such as HEK293 cells, to meet the rising demand for gene therapies and vaccines.

Additionally, the market has seen increased partnerships and collaborations between biotechnology firms, academic research institutions, and pharmaceutical companies to advance the development of novel gene therapies. One notable development is the growing use of viral vectors in the production of mRNA vaccines, such as those used for COVID-19, which has highlighted the need for enhanced manufacturing capabilities. Moreover, advancements in CRISPR and gene-editing technologies are driving the need for high-quality plasmid DNA for research and clinical applications. The rise of personalized medicine and the shift toward more targeted treatments have led to an increasing focus on plasmid DNA manufacturing as a key component of gene therapy development.

This research report estimates revenue growth at global, regional, and country levels and offers an analysis of present industry trends in everysub-segment from 2025 to 2034. This research study analyzes market thoroughly by classifying global viral vectors & plasmid DNA manufacturing market report on the basis of different parameters including type of vector, application, workflow, end users, disease, and region:

Segments Covered in the Report

By Vector Type

- Adenovirus

- Plasmid DNA

- Lentivirus

- Retrovirus

- AAV

- Others

By Application

- Gene Therapy

- Antisense &RNAi

- Cell Therapy

- Vaccinology

By Workflow

- Upstream Processing

- Vector Recovery/Harvesting

- Vector Amplification & Expansion

- Downstream Processing

- Fill-finish

- Purification

By End-User

- Biopharmaceutical and Pharmaceutical Companies

- Research Institutes

By Disease

- Genetic Disorders

- Cancer

- Infectious Diseases

- Others

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of the World