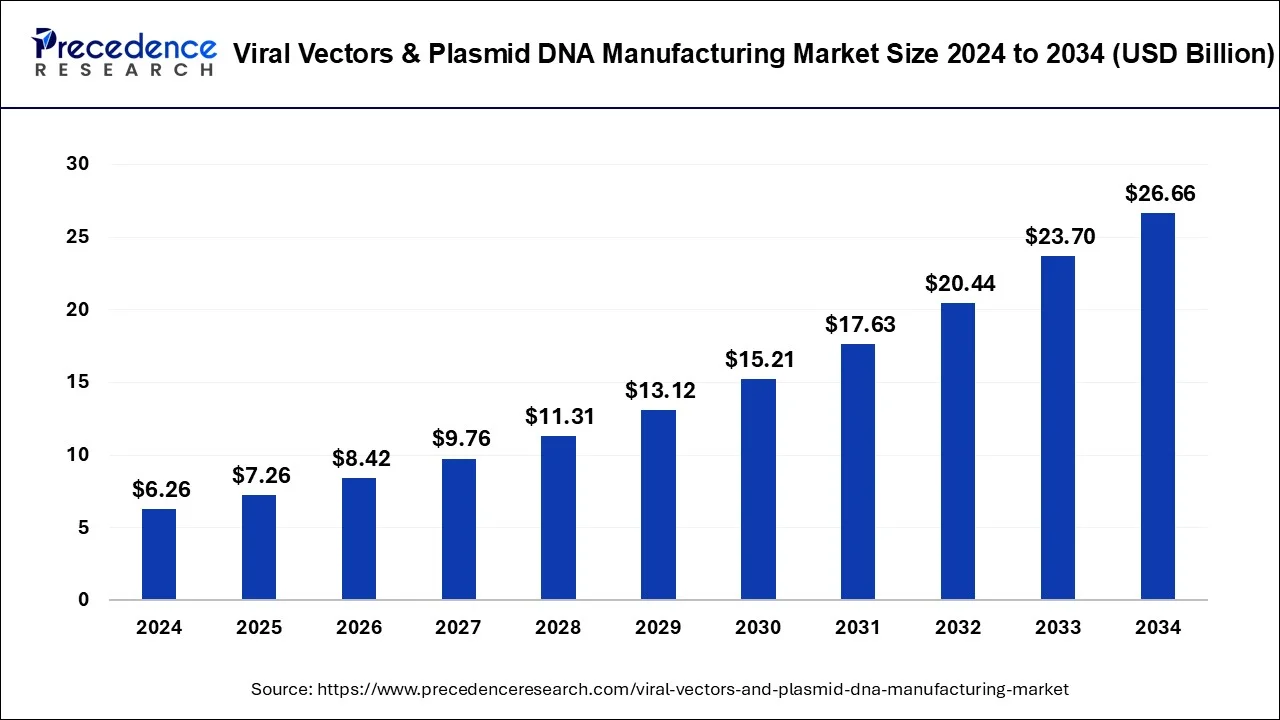

Viral Vectors & Plasmid DNA Market to Reach USD 26.66 Bn by 2034.

The global viral vectors & plasmid DNA market reached USD 6.26 Bn in 2024 and is projected to grow at a 15.59% CAGR, reaching USD 26.66 Bn by 2034.

Viral Vectors & Plasmid DNA Market Key Insights

- North America led the market with a 49% revenue share in 2024.

- AAV segment emerged as the leading vector type, accounting for 21% revenue share in 2024.

- Downstream processing dominated the workflow segment with a 54% revenue share in 2023.

- Vaccinology held the largest application share, contributing 22.5% of revenue in 2024.

- Cancer segment led the market by disease type, capturing 38% revenue share in 2024.

- Research institutes accounted for the largest end-use share, with 58.4% revenue in 2024.

The viral vectors and plasmid DNA market is experiencing robust growth, driven by advancements in gene therapy and vaccine development. In 2023, the global market was valued at approximately USD 5.33 billion and is projected to reach around USD 36.5 billion by 2033, with a compound annual growth rate (CAGR) of 21.3%. This expansion is primarily attributed to the increasing adoption of gene therapies for rare and genetic diseases, necessitating high-quality viral vectors and plasmid DNA for therapeutic development.

Sample Link: https://www.precedenceresearch.com/sample/1012

Market Drivers

Key drivers of this market include the rising prevalence of genetic disorders and cancers, which demand innovative treatment approaches. The shift towards personalized medicine has further propelled research in gene therapies, increasing the need for efficient vector production. Additionally, significant investments in healthcare infrastructure and research and development, especially in regions like Asia-Pacific, are fostering market growth. Governments and private entities are allocating substantial funds to enhance healthcare facilities and promote scientific advancements in viral vector and plasmid DNA manufacturing technologies.

Opportunities

Opportunities within the market are vast. The ongoing development of innovative therapies for rare and complex diseases presents a significant potential for market expansion. Emerging economies, particularly in the Asia-Pacific region, are investing heavily in healthcare infrastructure and biotechnology, offering lucrative prospects for market players. Collaborations between academic institutions and biopharmaceutical companies are also fostering the development of novel therapies, further enhancing market growth.

Challenges

However, the market faces challenges, including high manufacturing costs and complex regulatory frameworks governing gene therapies. Ensuring the scalability and consistency of viral vector and plasmid DNA production remains a critical hurdle. Moreover, ethical concerns surrounding genetic modifications necessitate stringent oversight, potentially slowing down the approval and commercialization processes.

Regional Insights

Regionally, North America dominated the market in 2023, accounting for approximately 49.11% of the global share. This leadership is attributed to a robust biopharmaceutical industry, advanced healthcare infrastructure, and favorable regulatory environments. The Asia-Pacific region is anticipated to experience the fastest growth, driven by increasing healthcare investments, a rising burden of genetic disorders, and supportive governmental policies promoting biotechnology research.

Read Also: Autoinjectors Market