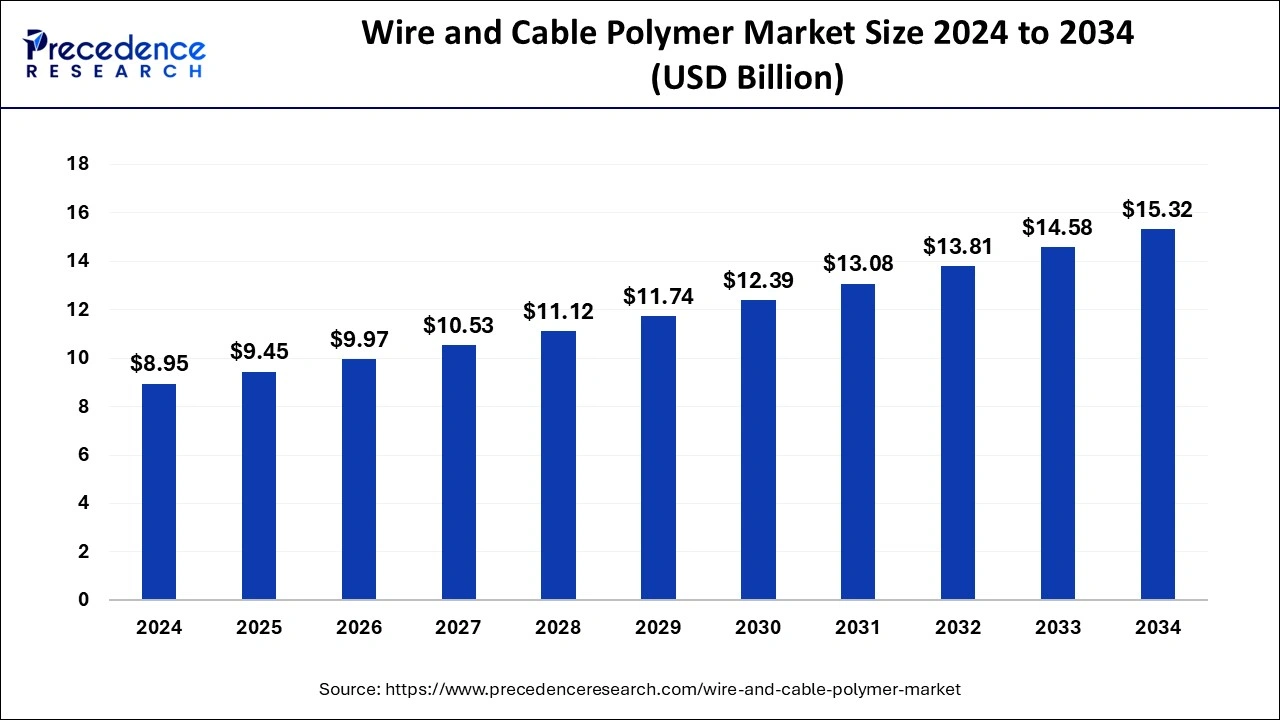

The global wire and cable polymer market size surpassed USD 8.48 billion in 2023 and is anticipated to rake around USD 14.58 billion by 2033, growing at a CAGR of 5.57% from 2024 to 2033.

Key Points

- North America led the market with the largest share in 2023.

- By type, the Polyethylene segment held the largest share in the market and is expected to sustain the position throughout the forecast period.

- By voltage, the low voltage segment held the largest share in the wire and cable polymer market in 2023.

- By application, the building wire segment held the largest share in the market in 2023.

The wire and cable polymer market plays a crucial role in supporting the infrastructure and connectivity needs of various industries, including telecommunications, automotive, construction, and energy. Polymers are widely used in the production of wires and cables due to their excellent electrical insulation properties, mechanical strength, and resistance to environmental factors such as moisture, heat, and chemicals. As the demand for efficient and reliable transmission of electricity, data, and signals continues to grow, the wire and cable polymer market is experiencing steady expansion and innovation.

Get a Sample: https://www.precedenceresearch.com/sample/3990

Growth Factors

Several factors are driving the growth of the wire and cable polymer market. Firstly, rapid urbanization and industrialization in emerging economies are increasing the demand for infrastructure development, including power transmission and telecommunications networks, which require high-quality wires and cables. Additionally, the growing adoption of renewable energy sources such as solar and wind power necessitates the installation of new transmission lines, boosting the demand for polymer-insulated cables. Moreover, technological advancements, such as the development of lightweight and high-performance polymers, are enhancing the efficiency and reliability of wires and cables, further driving market growth.

Region Insights

The wire and cable polymer market exhibit regional variations influenced by factors such as economic development, infrastructure investment, and regulatory frameworks. In Asia-Pacific, rapid industrialization and urbanization in countries like China and India are driving significant demand for wires and cables across various sectors, including construction, automotive, and telecommunications. North America and Europe, with their mature infrastructure and stringent quality standards, are key markets for high-performance polymer-insulated cables used in industries such as aerospace, automotive, and telecommunications.

Wire and Cable Polymer Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 5.57% |

| Global Market Size in 2023 | USD 8.48 Billion |

| Global Market Size by 2033 | USD 14.58 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Type, By Voltage, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Wire and Cable Polymer Market Dynamics

Drivers

Several drivers are propelling the growth of the wire and cable polymer market. The expansion of smart grid infrastructure and the deployment of advanced communication networks are driving the demand for high-quality cables capable of transmitting data and power efficiently. Additionally, the increasing emphasis on energy efficiency and sustainability is prompting the adoption of polymer-insulated cables with reduced environmental impact and improved performance. Furthermore, government initiatives aimed at upgrading and modernizing infrastructure, coupled with investments in renewable energy projects, are driving demand for wires and cables in various applications.

Opportunities

The wire and cable polymer market presents numerous opportunities for manufacturers, suppliers, and stakeholders. The rising demand for electric vehicles (EVs) and the development of charging infrastructure create a significant opportunity for polymer-insulated cables used in EV charging stations and battery systems. Moreover, the expansion of telecommunications networks, including 5G deployment, presents opportunities for high-speed data transmission cables capable of meeting the stringent performance requirements of next-generation networks. Additionally, the increasing focus on renewable energy generation and grid modernization projects offers opportunities for the development of innovative polymer-based cables designed to withstand harsh environmental conditions and improve energy efficiency.

Challenges

Despite its growth prospects, the wire and cable polymer market faces several challenges. Intense competition among manufacturers and fluctuating raw material prices can impact profit margins and hinder market growth. Additionally, regulatory requirements and compliance standards for safety, performance, and environmental sustainability pose challenges for manufacturers, requiring investments in research and development to meet evolving industry standards. Moreover, the ongoing COVID-19 pandemic has disrupted supply chains and dampened demand in some end-user industries, creating short-term challenges for market players.

Read Also: Term Insurance Market Size to Surpass USD 4 Trillion by 2033

Recent Developments

- In Feburary 2024, At its new 168-acre facility in Fitzgerald, Georgia, Modern Dispersions, a worldwide producer of thermoplastic compounds and concentrates, has finished and put into service the first stage of a multifaceted production expansion. The company’s new 400 million lb/yr plant is located across the street from its current one, and it will increase masterbatch capacity by 100 million lbs a year. The business will talk about its expanded production capabilities during the NPE 2024 show, which takes place in Orlando, Florida, from May 6–10.

Wire and Cable Polymer Market Companies

- Dow Inc.

- BASF SE

- Solvay SA

- Arkema SA

- Mitsui chemicals, Inc.

- Borealis AG

- LG chem Ltd

Segment Covered in the Report

By Type

- Polyethylene

- Polypropylene

- Polyvinyl chloride

- Polybutylene Terephthalate

- Halogen Free fire Retardant

- HFFR_XLPE

- LDPE

- HDPE

- LLDPE

- Photovoltaic Compound

- Nylon

- EVA

By Voltage

- Low Voltage

- Medium voltage

- High voltage

By Application

- Building wire

- Medium voltage distribution lines

- Industrial cable

- Special Cables

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/